On Friday, Canaccord Genuity initiated coverage on MicroStrategy (NASDAQ: MSTR) with a $920 price target and buy rating. Joseph Vafi, their analyst, headlines, “Blazing new trails in driving shareholder value: exploiting Bitcoin scarcity + a steady core business.” Vafi commends MicroStrategy on their two “attractively priced” convertible notes in order to purchase and hold 91.6 thousand Bitcoins at an average cost of roughly $24 thousand.

MicroStrategy currently has four analysts covering the company with a weighted 12-month price target of $698.75. The street high comes from Canaccord with a $920 12-month price target and the lowest is C$325. Currently, two analysts have strong buy ratings, one analyst has a hold, and another analyst has a strong sell rating.

Vafi lists a number of drivers to hit their $920 price target such as Bitcoin going higher, “investor sentiment around the digital asset, market beta and performance in the core business,” and adds, “we remain keenly aware that the price of BTC is likely the main driver of MSTR share price direction, which presents potentially material downside risk that is beyond the control of management.”

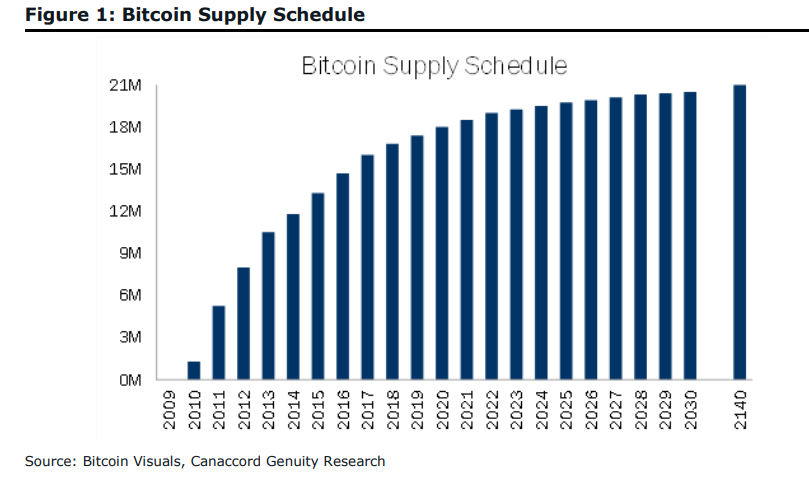

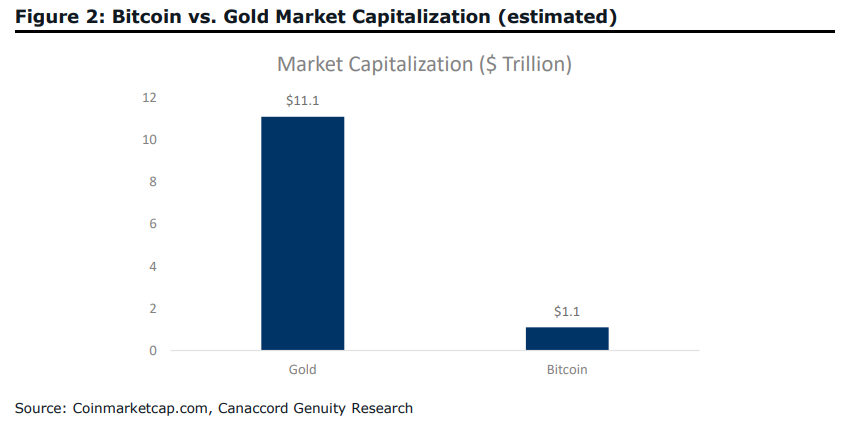

Although they do understand that Bitcoin is the biggest factor in the companies share price, Canaccord remains bullish on Bitcoin for various reasons such as Bitcoin being a supply-constrained asset, multiple reasons/drivers as for more demand to emerge, a comparative valuation versus other stores of value, and increasing acceptance by financial regulators. Vafi does give a list of headwinds such as high energy costs, fraud, and dilution via multiple other digital assets as well.

Vafi calls Microstrategy’s core business a “best-in-class business intelligence company” that has established itself as an industry leader in web, mobile, and cloud-based analytics. He adds, “The company boasts an attractive financial profile with 66% recurring revenue and 80%+ gross margin along with strong cash flows.”

Vafi defends his price target by saying a combination of positive catalysts are ahead, which include the reemergence of a more scarcity premium to MSTR’s BTC holdings, steady but not heroic upward price movement in BTC spot prices, and improving EBITDA in the core business. He writes, “A combination of a 15% increase in all three of these factors results in the attainment of our price target. We see this as a reasonable scenario from here.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.