As the US government is beginning to urge Americans to begin returning to work in lieu of unemployment benefits, the continued downward pressure from the coronavirus pandemic on the economy is making it increasingly difficult to stage a labour market recovery much like the one being envisioned. As a result, the alarming duration of unemployment in the country is beginning to worry some economists.

When joblessness persists longer than a period of 26 weeks, it is considered long-term unemployment, and it comes with its own set of deep problems that are much more difficult to eradicate. When people have been employed for a significantly longer period of time, there is a good chance that they have been dipping into their savings – or what is left of their savings to finance their everyday living. Some are even forced to take on additional debt to meet their basic necessities.

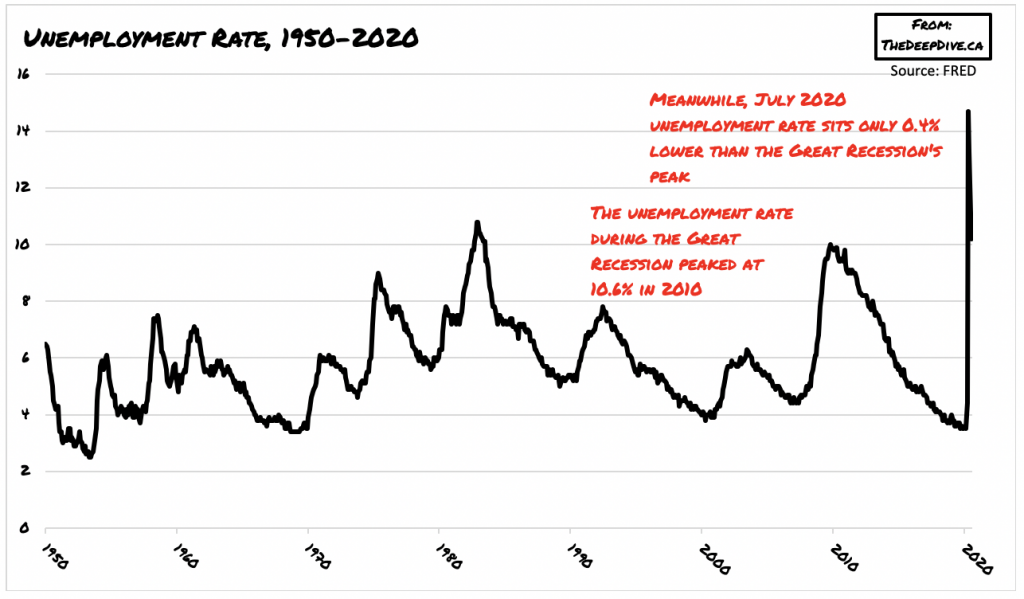

Then, in the event that these unemployed individuals are able to find a job, there is a low likelihood that the new place of employment will be one that will offer similar wages compared to prior work. Although jobless levels in the US have declined since their peak in April, the current unemployment rate of 10.2% is only slightly lower than the peak of the Great Recession. As a result, what may seem as an improvement in the labour market is not necessary an improvement in the financial situations of many.

The total number of individuals that have been unemployed anywhere between 15 and 26 weeks increased by 4.6 million in July; this depicts a startling increase of approximately 240%, to a total of 6.5 million Americans nearing long-term unemployment. Although government unemployment benefits have been able to soften the financial burden, they too, come affixed with expiration dates and only cover a portion of the worker’s lost wages.

In the meantime, many states have been relaxing their restrictions and urging Americans to return to work. In fact, the latest stimulus bill is contesting a reduction of the $600 employment benefits top-up in order to discourage some from staying home. However, as economic theory dictates, those that are willing to return to work and take on a lower wage relative to their pre-pandemic employment are going to have increasing difficulty doing so.

Reason being is, many of the lower skilled jobs that would be present in a typical recession actually happen to be the ones most impacted by the current pandemic. Such jobs in retail, hospitality, leisure, and restaurants have been the first to cease operations during the onset of the pandemic, and have been the last to restart when restrictions were lifted. So, jobs that were once considered safety nets in times of increased economic volatility are no longer there, thus suggesting that the oncoming labour market crisis may be dragged out for significantly longer than government stimulus spending anticipates.

Information for this briefing was found via US Department of Labour. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.