Montage Gold (TSXV: MAU) this morning filed its final results with respect to its Phase 1 resource expansion drill program at its flagship Morondo Gold Project, located in Cote d’Ivoire. The key highlight released from program is the extension of known mineralization to depths of 450 metres, while strike has been expanded to over two kilometres.

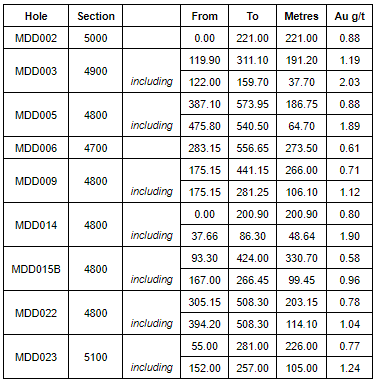

Mineralization was found to exceed average true widths in excess of 200 metres across a total of 800 metres of strike at the Kone deposit, signifying the potential size of the deposit. This was confirmed via a total of 22,193 metres of drilling.

The company currently expects an inferred mineral resource update to be made public by the end of the month, while a preliminary economic assessment is expected by the end of the quarter. The previous resource estimate was completed in 2018, with the property determined to have an inferred resource of 1,536,000 ounces of gold at a cut off of 0.50 g/t, and an average grade of 0.91 g/t.

Phase two of the drill program has begun, with a planned 35,000 metres of infill drilling to take place. The program will look to upgrade the resource estimate at the property from the inferred category to that of indicated, while also spending time exploring the nearby Petit Yao deposit. The company is currently targeting the end of Q2 for such an upgrade, while a feasibility is planned to be completed by the end of the year.

The company reportedly has a cash balance of $35 million, enabling the firm to be fully funded for its 2021 business plan.

Montage Gold last traded at $0.86 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned above. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.