Monterey Minerals (CSE: MREY) announced this morning that it has signed a definitive agreement to acquire Greater Arc Pty Ltd, the subsidiary of Greater Arc Resources that owns the Alicia high-grade gold property located in Alicia Municipality, Philippines. Previous samples from shallow drilling on the mine site include 1.2 metres of 116 g/t gold, 1,263 g/t silver, 6.3% copper, 6.5% zinc, and 47.9% lead.

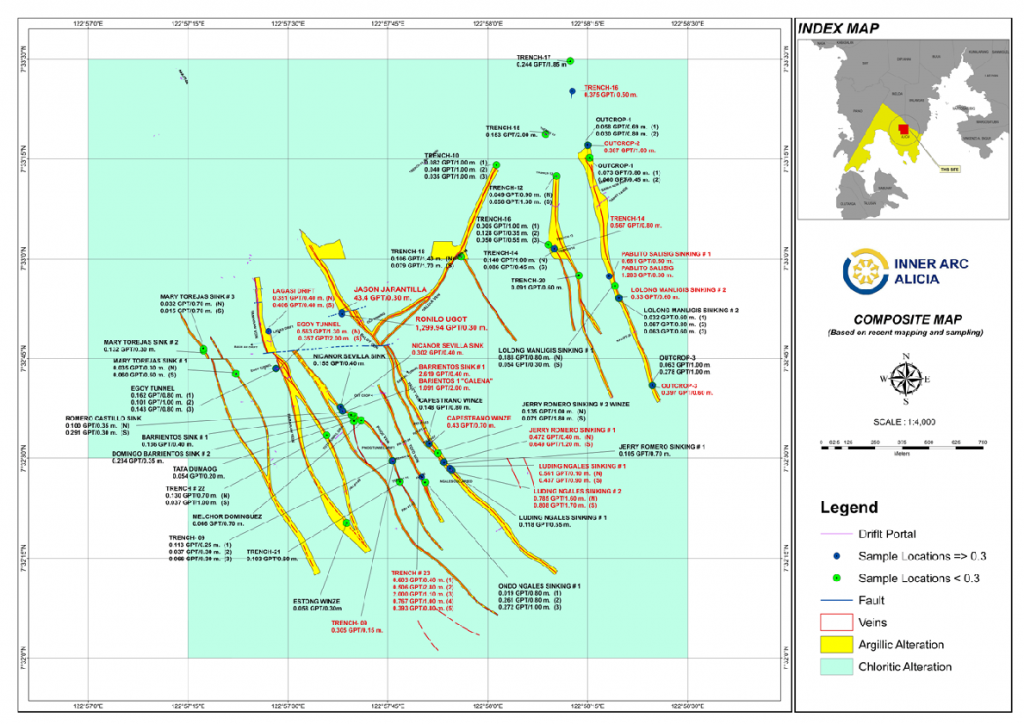

The property itself has been identified by Greater Arc as having a system of twelve veins that host high grade hold and base metal mineralization, with the veins being up to 3.8 metres wide and up to 1.7 kilometres in length, with a combined strike of approximately 11 kilometres. Previous fieldwork conducted on the property includes mapping, sampling, and limited drilling.

The veins themselves are grouped into three main structures, being the Sandi Vein to the east, the Baloy Vein in the central portion, and Pamaraw-Sumihig to the west. High grade samples from shallow drilling of the Baloy Vein have resulted in highlight samples of 1.2 metres of 116 g/t gold, 1,263 g/t silver, 6.3% copper, 6.5% zinc, and 47.9% lead, as well as 1.5 metres of 40.9 g/t gold, 437 g/t silver, 1.1% copper, 3.6% zinc, and 62.9% lead.

Comparatively, field work conducted on the Pamaraw-Sumihig structure has resulted in shallow drilling results of 1.5 metres of 13.86 g/t gold, 181 g/t silver and 4.8% copper, as well as grab samples of 7.51 g/t gold, 55.2 g/t silver and 1.76% copper.

The Alicia Project is accessible via sealed roads, has nearby power as well as towns, and is located 10 kilometres from the port city of Malangas and 60 kilometres from an airport, located in Pagadian City. The property itself is also located within a declared mineral reservation, and currently has an active exploration permit. The municipality also has a stable government authority, whom is supportive of the projects development.

The property is being acquired by Monterey Minerals in exchange for 54 million shares of the issuer.

Monterey Minerals last traded at $0.045 on the CSE.

FULL DISCLOSURE: Monterey Minerals is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Monterey Minerals on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.