It appears that it is not just Toronto that is witnessing a mass exodus from its downtown core. A slew of new condo listings in Montreal have hit the market over the past several months, suggesting that what was once the city’s prominent housing boom is coming to an end.

According to data released by the Quebec Professional Association of Real Estate Brokers (QPAREB), new condo listings on the Island of Montreal have risen by a staggering 72% in the third quarter, which is the largest annual spike in over 17 years. Meanwhile, the greater Montreal region was subject to a 61% increase in listings in that duration as well.

Thus far, condo prices are remaining relatively stable in Montreal, climbing by 10% on a year-over-year basis in September. August and July prices also held steady with price increases of 11% and 14% respectively, compared to the same time a year prior. Much like Toronto however, the oversupply of condos coupled with reduced demand will likely cause prices to fall in the coming months. Moreover, QPAREB director of market analysis Charles Brant notes that condo inventory is now taking significantly longer to deplete compared to the previous three years.

Prior to the pandemic, Montreal’s strong economy and affordable home prices made the city’s real estate market attractive to immigrants and students. However, with the steady flow of immigration into Canada was suddenly interrupted as a result of the pandemic, as well as many Canadians reverting to working from home, the housing market in both Toronto and Montreal have begun to show signs of weakness.

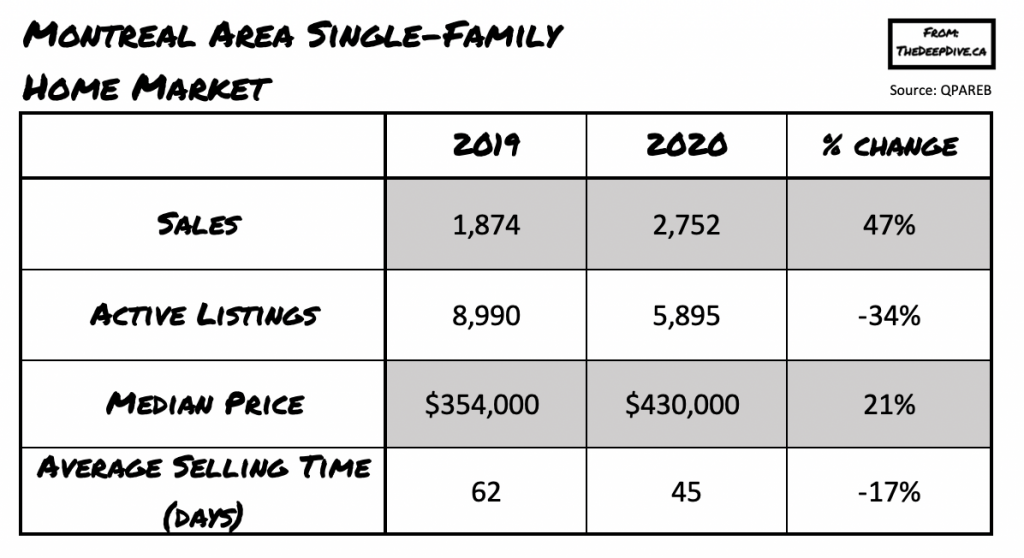

In the meantime, the real estate market in Montreal’s suburbs has been booming, with the sale of single family homes soaring by 47% in September. This in turn has caused the average price of a single-family home to rise to $430,000, which amounts to a 21% increase compared to September 2019.

Information for this briefing was found via the Quebec Professional Association of Real Estate Brokers. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.