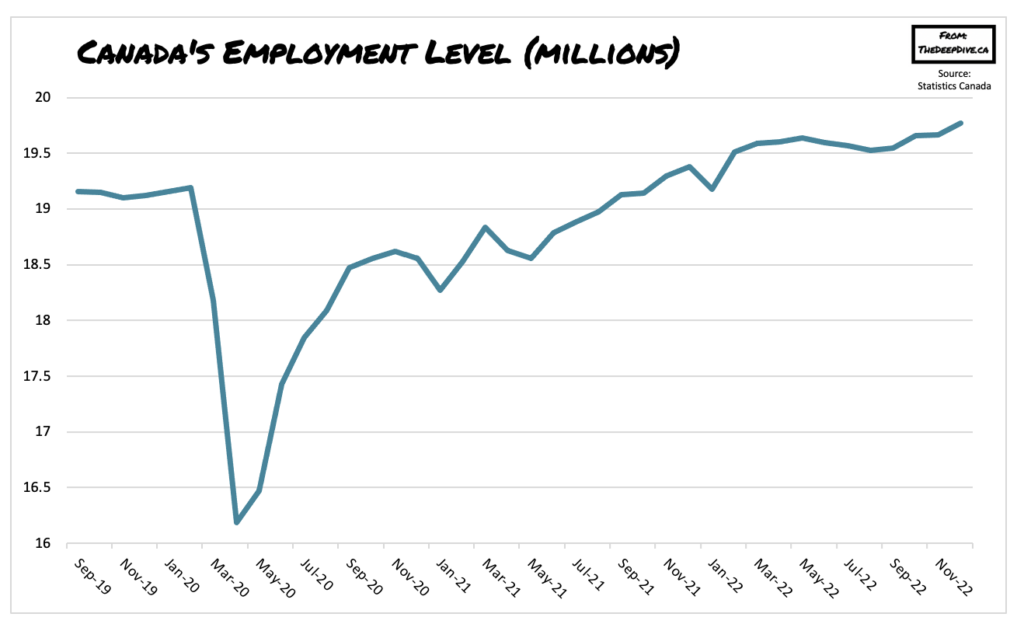

Canada’s labour market remained resilient last month, blowing past economists’ expectations and cementing the case for further intervention from the Bank of Canada.

Against forecasts calling for an increase of only 5,000 jobs, the labour market surprisingly added a whooping 104,000 positions in December, with broad-based gains across several main industries, including construction, transportation and warehousing, and accommodation and food services. Despite a surge in job openings across the healthcare and social assistance industry, employment levels fell in this category by 17,000, with declines concentrated primarily in Ontario and Quebec.

Interestingly, the employment rate for core-aged woman remains at historically high levels— in fact, over the past 12 months, a staggering 81% of women in Canada were at a job, marking the highest such annual rate since 1976. The increase was mainly focused among women with children; according to Statistics Canada, 75.2% of core-aged women with a child less than six years old were employed, an increase of 3.3% from 2019.

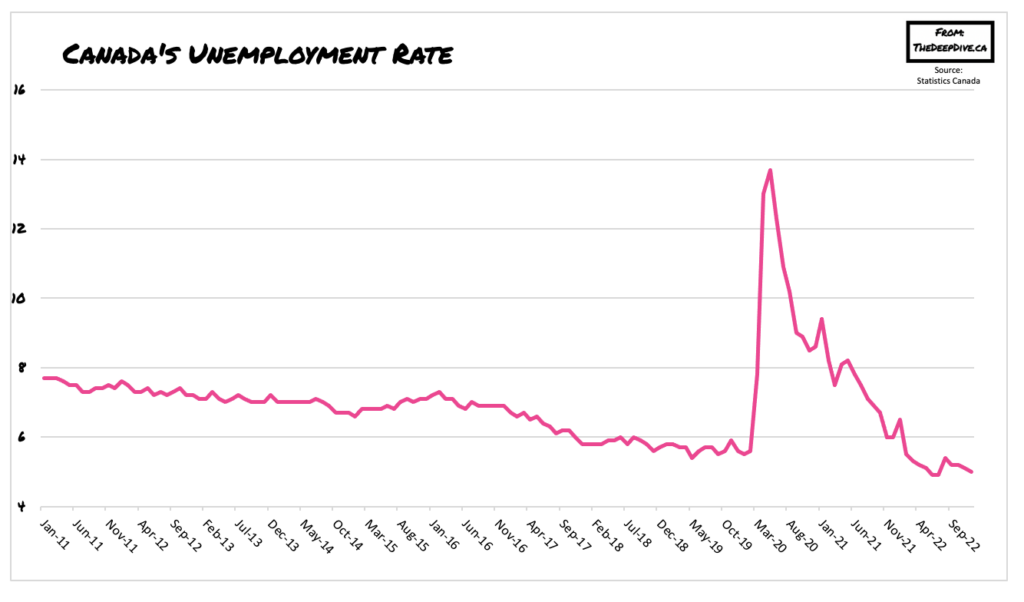

The unemployment rate dropped 0.1 percentage points to 5%, marking the third such decline in four months, sitting just above the record-low of 4.9% reported in June and July. Employment levels increased across six of the 10 provinces, including British Columbia, Ontario, Newfoundland and Labrador, as well as the prairie provinces.

Total hours worked remained relatively unchanged last month, rising 1.4% from December 2021. Average hourly wages, meanwhile, rose 5.1% year-over-year, sitting above 5% for the seventh straight month.

The latest figures likely cement the Bank of Canada’s resolve to cool the country’s labour market, opening speculation regarding another potential rate hike in January. “Today’s robust results support the view that the Bank of Canada will hike rates again later this month,” said BMO economist Douglas Porter, as quoted by Bloomberg.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.