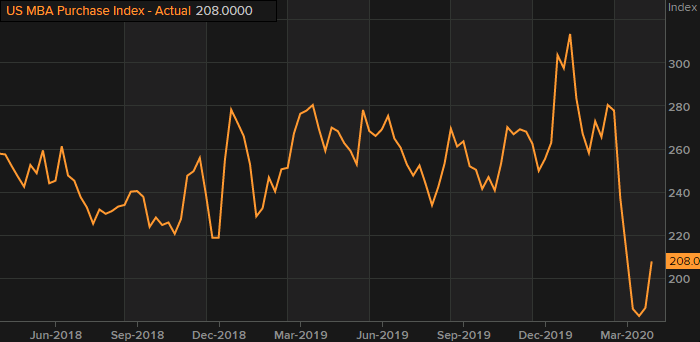

Last month, the demand for buying homes decreased dramatically amid the coronavirus chaos, but now incoming data is suggesting the market is beginning to rebound as the demand for new mortgages is starting to see an increase.

Just last week, potential homebuyers caused mortgage demand to increase by 12%, indicating that buyer confidence may be on the rise. Conversely, volume is still lower by 20% when compared to just the year prior, meaning the market still has a ways to go before it is back to pre-pandemic levels.

Typically, spring is when homebuying becomes most active; however this year has been like no other amid the ongoing pandemic. But as they say, April showers bring May’s flowers, thus the dreariness of strict quarantine measures may soon begin to pass as some states are slowly beginning to reopen the economy. According to Joel Kan, who is the associate vice president of economic and industry forecasting for the Mortgage Banker’s Association, states like Washington and California are starting to show signs of an increase in home purchasing activity.

Another implication of the pandemic has been lower mortgage rates, thus providing an incentive for buyers amid all the chaos. Fixed mortgage interest rates for a 30-year term dropped from 3.45% to 3.43% for loans under $510,400. However, down payments on a home have increased to 20% as lenders are reminiscent of the 2008 mortgage crisis.

Furthermore, many homeowners have opted to refinance their mortgages given the current economic situation in the US. In fact, loan refinancing has increased by 218% since the same time last year but this time around, lenders have been erring on the side of caution. Some lenders are no longer offering certain products, given the emerging volatility in the housing market stemming from new government mortgage bailouts. Currently the rates for refinancing have been higher than the interest rates attached to a new home.

Information for this briefing was found via CNBC and Mortgage Banker’s Association. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

Most of America still hasn’t come to grips with this virus.

You sound like Florida Grim Reeper!

Record day of reported cases. Beaches are packed.

V Shaped recovery?

You’re not buying it either Debbie?