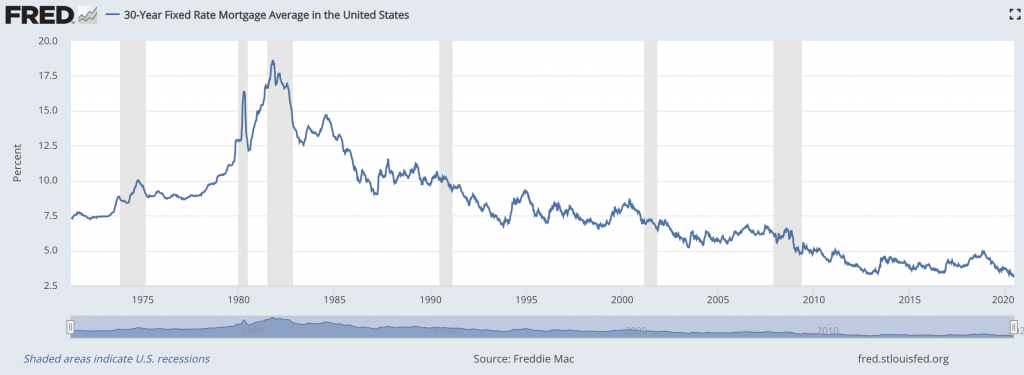

Just last week mortgage rates in the US appeared to show a slight increase as prospects of an economic recovery and an optimistic May employment report. However, the positivity soon subsided, as a potential second wave of COVID-19 is becoming increasingly inevitable.

According to Mortgage News Daily, the 30-year fixed mortgage, fell to 2.97% on Thursday, signalling a new record low. The sudden decline is the result of the stock market selling off, and investors rushed to purchase bonds instead. Given that interest rates are positively correlated with economic recovery, if the US economy does fare well in terms of a relatively quick recovery following the reopening of states, then the interest rate will increase; conversely, a sluggish economic recovery will result in low interest rates.

However, when interest rates are low, then the housing market tends to recover quite sharply and rapidly. According to the Mortgage Bankers Association, new mortgage applications increase by an annual 13% just last week. On the other hand however, mortgage credit availability has declined in May to the lowest on record in nearly six years, according to a Mortgage Banker’s Association survey. Thus, the low interest rates are not significantly impacting the housing market because although on one hand mortgages are relatively more affordable, the lack of mortgage availability and decrease in personal savings is mitigating the flood of potential home buyers.

Information for this briefing was found via CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.