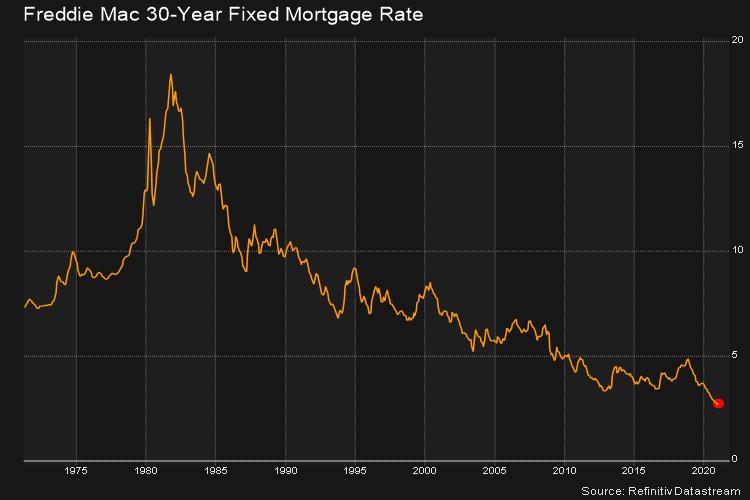

The pandemic sparked a real estate boom that was fuelled by record-low mortgage rates, work-from-home flexibility, and a cascade of city-dwellers looking to find refuge in rural areas from soaring Covid-19 infections. The mismatch between the low supply of homes and strong demand for housing caused prices to surge at the fastest pace since 2014, with no sign of tapering off anytime soon.

However, the perfect storm that has been pushing the real estate market to new highs is beginning to show signs of a cool-down, as bond traders have started to take impending inflation into account following the ongoing vaccine rollout and the $1.9 trillion stimulus bill. The increasingly optimistic economic recovery could force the Federal Reserve to raise interest rates a lot earlier than previously expected, and thus send the real estate rally into a tailspin.

Following January’s record low 2.65%, the 30-year fixed mortgage rate spiked to 2.97% on the week ending February 25 — the highest since August, according to Freddie Mac data. The acceleration in borrowing costs is threatening to derail the US housing market rally, and spells bad news for the mortgage business, which was basking in record profits throughout 2020.

With interest rates increasing, mortgage applications across the US have fallen to a nine-month low, while pending home sales dropped to six-month lows. Combining the declining housing inventory, and the demand-fuelled rising home prices with the spike in interest rates, puts the potential homebuyer at a significant bargaining disadvantage.

In the meantime, the 10-year Treasury yield rose to 1.45%— the highest level in nearly a year. as Americans no longer have the desire to refinance their mortgages, mortgage-bond investors face longer wait times to collect payments on their investments. The longer they are left waiting, the more financial strain they experience as they watch market rates spike higher without being able to take advantage of them. As a result, those investors holding mortgage-backed securities begin demanding higher rates in order to compensate for the increased risk levels.

Information for this briefing was found via Freddie Mac and FRED. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.