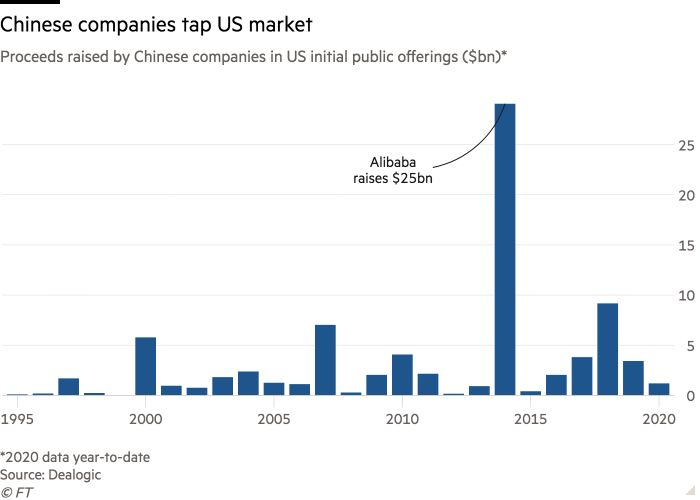

The tensions between the US and China continue to escalate, with a significant concentration on investing into Chinese companies. Previously, Donald Trump had ordered the federal employee pension fund from investing in Chineses equities, followed by a Senate vote to prevent certain non-audit-compliant Chinese companies from listing on US exchanges. It also appears that the US government’s discontent with China has been noticed, and now NASDAQ has updated its listing rules in order to call for more thorough audit practices. ‘

Last month, NASDAQ re-structured its listing requirements as a means of addressing the discrepancy between US audit practices and Chinese audit practices. Previously, some Chinese companies were not required to disclose certain information if their local laws do not permit to do so. Now however, that is about to change, as NASDAQ is making it mandatory that all companies on the exchange abide by international reporting and inspection standards. According to a Reuter’s report on Thursday, NASDAQ received recognition from Secretary Mike Pompeo, who called on NASDAQ’s decision to be mimicked by other security exchanges – domestic and abroad.

Furthermore, last week US President Donald Trump declared that his administration would no longer offer special economic treatment to Hong Kong as a move to punish China for its enactment of the controversial national security law. Nonetheless, it has been previously discovered that some Chinese companies listed on US exchanges had discrepancies in their financial statements, thus putting American investors at risk.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.