Longtime readers may remember that, in the fall / winter of 2021, after the Rogers family got in a public spat over control of their family conglomerate, threatened to air each other’s dirty laundry if they didn’t get their way, and never followed through, we wrote about the dual-class share structure that makes them the ultimate shot callers at Rogers Communications, despite owning only 22% of the outstanding equity.

The idea of doing away with the structure was being discussed at the time by Andrew Coyne, who would prefer there be less drama in the business pages (because he hates fun), and by Catherine McCall, some suit who advanced the questionable notion that voting stock distributed more evenly among shareholders would create some kind of pseudo-democracy that would somehow be better for the tens of millions of non-shareholders that Rogers impacts daily.

The only interesting aspect of the Rogers family’s control block is the fact that it exists in the first place. How did Ted Rogers manage to leave his bratty kids with a hammer-lock on a network so important that, when it glitches out, everyone’s world stops? The answer, as usual, is money.

Rogers Communications (TSX: RCI.B) is a telecom and media company that owns and operates wireless and wireline (internet, phone and television) networks, various television channels and radio stations, the Toronto Blue Jays, and a major stake (37.5%, while “competitor” BCE Inc also owns a similar stake) in Maple Leaf Sports and Entertainment, whom owns the Toronto Raptors, the Toronto Maple Leafs, Toronto FC, and a host of other sports teams as well as the Scotiabank Arena in Toronto.

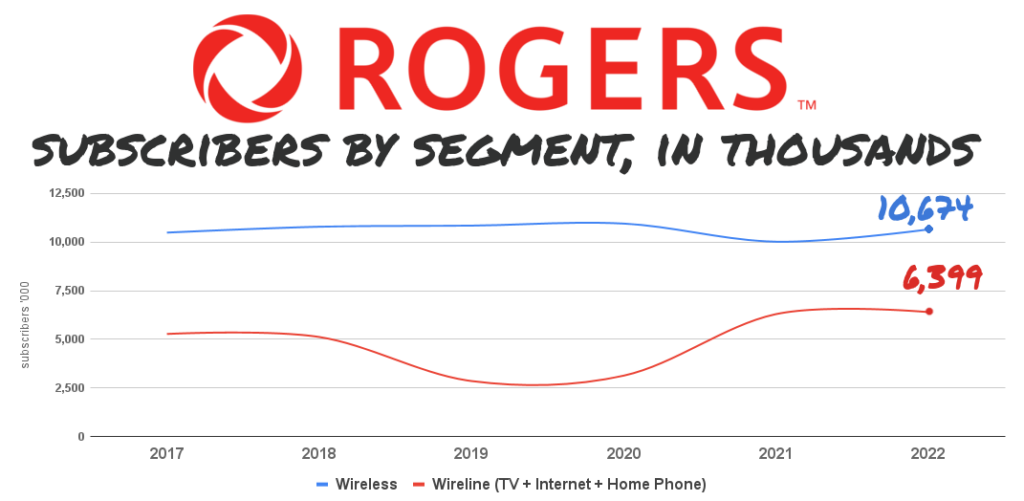

It earns most of its money selling access to its networks to around 10 million Canadian subscribers.

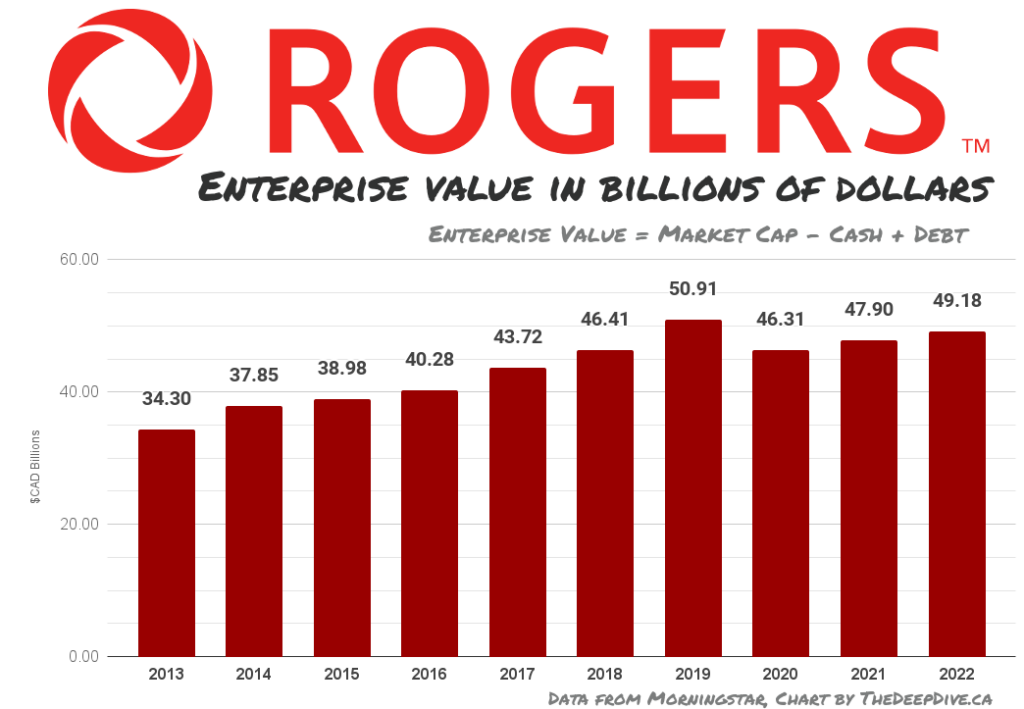

Following its recently approved purchase of “rival” telco Shaw Communications from The Rogers family’s Western Canadian A-stock-holding rich-kid counterparts in the Shaw family, the new Rogers represents about $49 billion worth of at-risk investor capital.

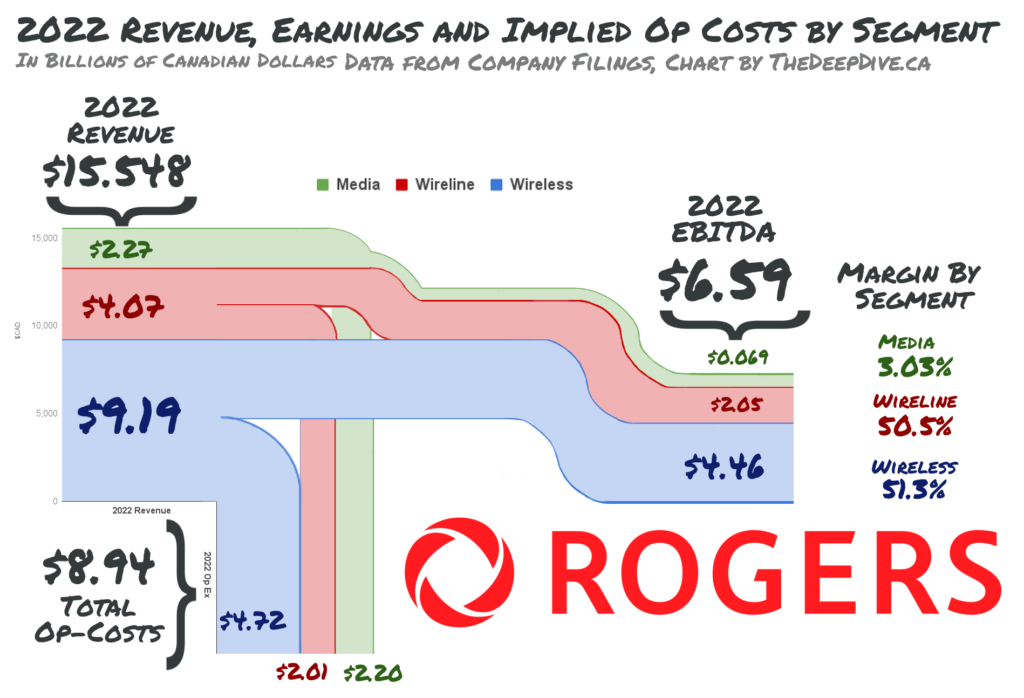

The invested capital generates around $15 billion per year in revenue….

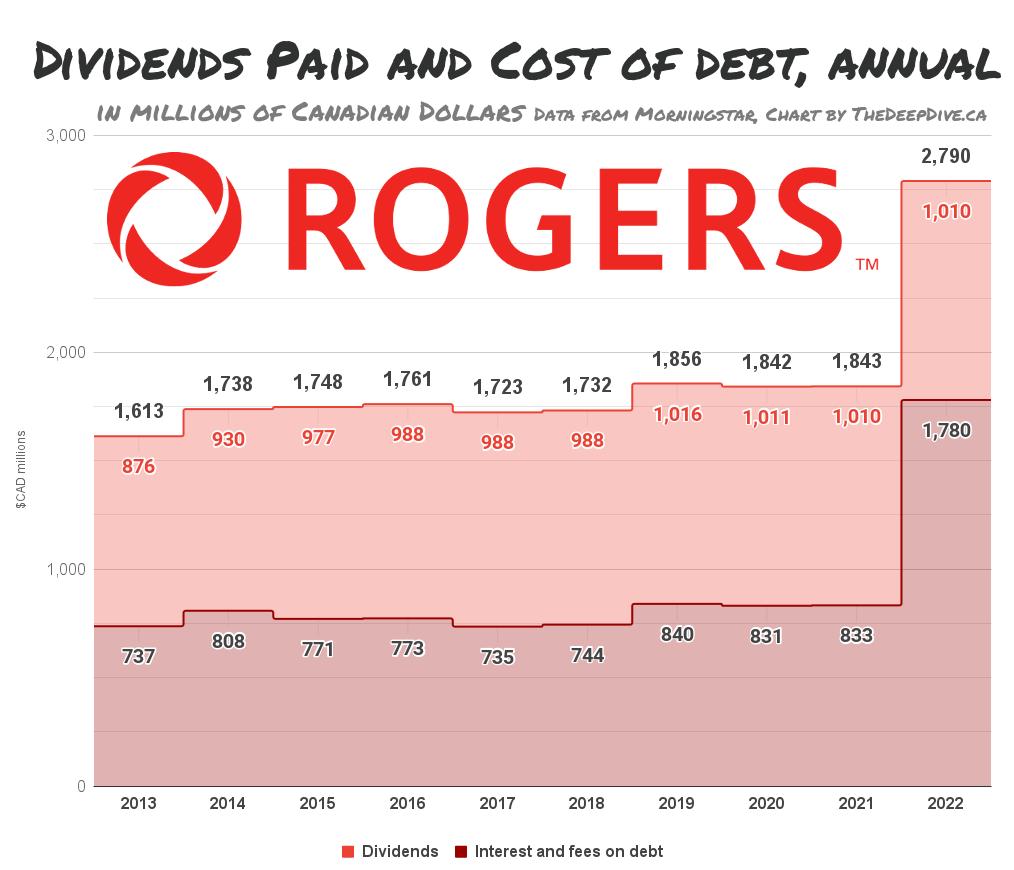

…from which the investors draw $1 billion per year in dividends, and another $1.89 billion per year in interest and fees on Rogers’ debt.

Those dividend and interest payments are as close to a sure thing as there ever has been in yield investing because, in the modern social and monetary economies, cell and internet service is effectively the difference between a person and a non-person.

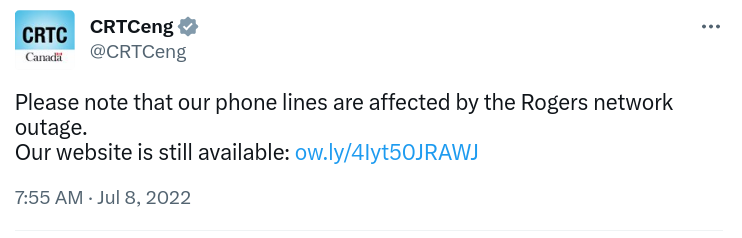

Outages of Rogers’ wireless and phone network in the spring of 2021 and the fall of 2022 affected pretty much everyone, knocking down payment systems, 911 services, and phones everywhere, including at the Canadian Radio and Telecommunications Commission…

…the company’s nominal regulator who, as near as we can tell, hasn’t yet addressed the outage by making Rogers pay a fine or suspending their licenses or anything like that.

The Competition Bureau, the arm of the Canadian government in charge of maintaining a competitive landscape in the Canadian economy, put up a convincing fight against the merger, but was ultimately over-ruled by the federal court of appeal, who didn’t see how a teensy bit less competition was such a big deal compared to all that MONEY!

Of the record $15.3 billion in revenue generated by Rogers in 2022, $9 billion of it came from the wireless division, at a 63% margin, $4 billion of it came from cable, at a 51% margin, and $2 billion came from media, at a 3% margin.

FIRE THE COACH!

Pro ball teams and TV stations are fun things for rich people to own. It gives them something to meddle with, helps them feel like a big-shot, and makes their “job” as a “businessman” something that holds their attention, because it’s full of fun and interesting things to do.

There are games to go to, of course. All sorts of management to hire and fire… but mostly, people tend to listen intently while a second generation tycoon patters on about “vertically integrating” the Jays and Raptors with regional sports network properties, and it makes them feel like intelligent, important titans of industry.

You can read about how Ed Rogers tried to get rid of the beloved executive over at the Toronto Star.

The larger, more integral parts of the business that make money every year, without fail, because they can’t help it, are far less interesting, and make for terrible conversation. Wireline and wireless networks are an exercise in growing the number of subscribers, and bleeding them for as much as possible. Stay out of the way of anyone big enough to matter, and they’ll stay out of yours. If smaller competitors threaten to grow, buy them. If they threaten to undercut the obscene rates held up by an unspoken agreement of non-competition, crush them. After that, all that’s left to do is pump out the gravy.

The non-voting shareholders, who own the stock because of their interest in the aforementioned money, would surely prefer Ed Rogers indulged his ego on his own dime, and put all that ballclub and TV capital into generating more high-margin telco dollars. But they quite literally don’t get a vote. They signed up not to have one, because it was the only way to get a piece of that money!

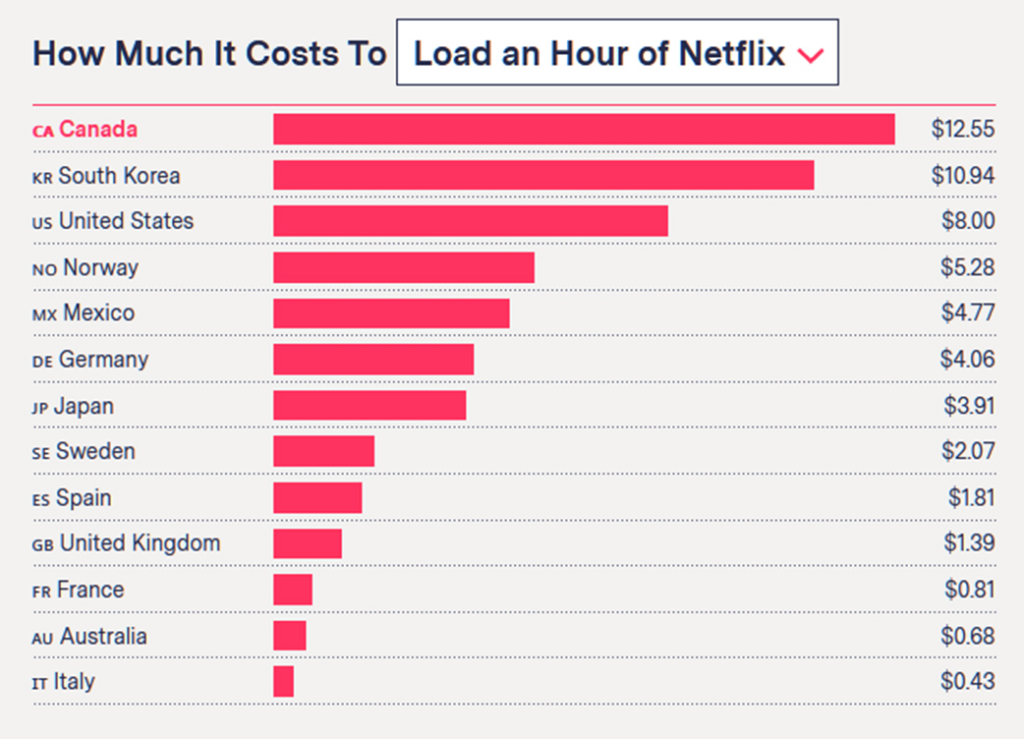

And that’s what they’re going to do, every time. Rogers is a business that controls critical infrastructure, suffers no consequence for screwing it up, and had no trouble at all orchestrating a merger that sews up the right to charge rent on about a third of the country’s communications traffic at the highest yield in the world.

It can’t lose. And the $50 billion or so in capital parked in the enterprise is pretty comfortable with its level of risk. Thanks to no small amount of help from the government, that capital’s contribution to the economy is effectively the bleeding of the company’s subscribers.

The ministry of innovation, fresh off of approving this merger, does not appear to consider this a poor use of $50 billion in capital, from the standpoint of the economy. Minister François-Philippe Champagne’s office mandated conditions on Rogers’ payroll as a condition of the merger’s approval because it knows that, left to its own devices, the company will only expand its labour force when it suits its interests.

Mature businesses have no reason to innovate. For its part, Rogers doesn’t really pretend to be an innovator the way its peers do. We’re going to have a closer look at the innovation lampshades that Bell and Telus put up in future episodes, but Rogers apparently doesn’t see the point. It books no research and development costs, and doesn’t pretend to be creating any sort of new or vital technology. And why should it? The ministry of industry and innovation has just blessed this racket as an integral component of the Canadian economy.

If the government cared about the Canadian economy, it wouldn’t be aiding and abeting Rogers, it would nationalize it. Some coarse math indicates that the average Rogers subscriber got bled for $862 in 2022. $65 of that went to the shareholders as a divvy.

A government-owned Telco network might be able to give Canadians the same type of low-cost stability that they have come to expect from the provincially-owned power utilities. The dividend alone would save each subscriber an average of 7.6%, but the real boom would be to the economy.

Faced with the prospect of no longer being able to squeeze cash out of people for their phone and internet bill. The $50 billion or so in capital that is tied up in this enterprise would be available to be re-invested in the economy, possibly in companies that make things or develop things.

Stay tuned to The Dive as we make cases to nationalize the essential services at Bell, Telus and Bass Pro Shops.

Information for this briefing was found via Sedar, the Government of Canada, and the sources mentioned or linked. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.