Aside from potentially Bitcoin (if that is a commodity), perhaps no other commodity has displayed a greater change in near-term fundamentals and trading patterns than natural gas, both in North America and in Europe. Prices were soaring in both regions as recently as three months ago on strong demand for liquefied natural gas (LNG) — demand for molecules to be loaded on ships in the U.S. for shipment to Europe and Asia and for its end use in Europe to replace natural gas which used to be supplied by Russia.

However, prices have plummeted over the last three months. Prices in Europe are now about 115 euros per megawatt-hour (Mwh), equivalent to US$34 per thousand cubic feet (Mcf), down 66% from about 340 euros per Mwh in late August.

Benchmark Henry Hub prices in the U.S. have likewise fallen, although not as dramatically, from more than US$9 per Mcf in late August to approximately US$6.37 per Mcf today. The Henry Hub is a distribution point in Louisiana that interconnects with nine interstate and four intrastate pipelines. Note the still enormous differential between Europe and U.S. prices.

What happened? Europe was an aggressive purchaser of LNG this summer from the U.S., Qatar, and even (remarkably) Russian sources, so much so that Europe’s natural gas storage is now 90% full. At this time in 2021, pre-Ukraine invasion, storage levels were 80% full. This summer there was a genuine fear that Europe could run out of gas this winter. Few express those same concerns now.

Add to this mild weather so far in Europe, fairly weak competing demand from China for LNG, and a reported glut of LNG on vessels off the European coast. The energy analytics firm Vortexa reported that in early November thirty LNG vessels carrying somewhere in the vicinity of US$2 billion worth of LNG were waiting to offload their cargoes.

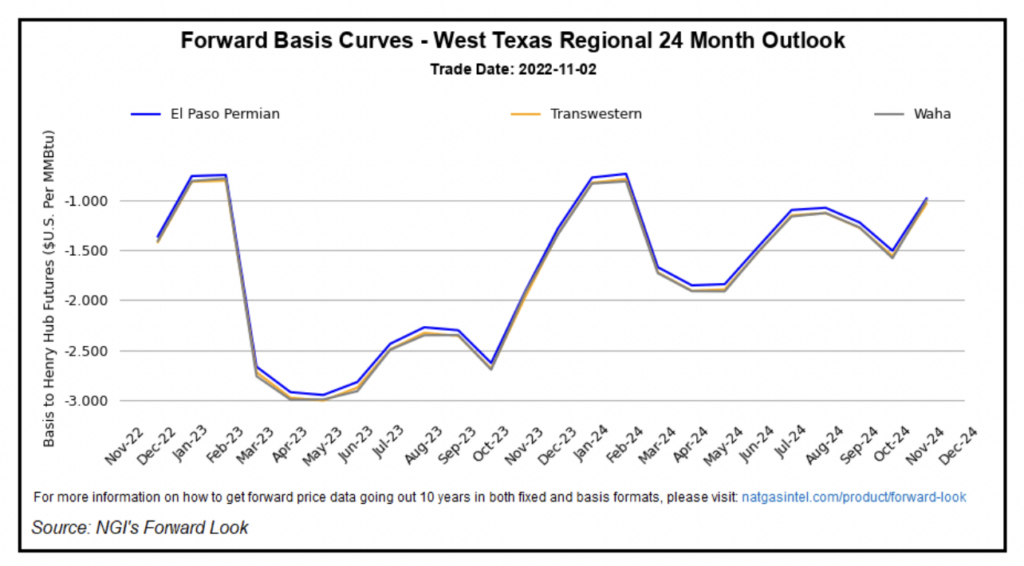

U.S. gas prices have collapsed recently due to temperate late November weather forecasts in key gas-consuming regions. An interesting phenomenon has been the giant discounts to Henry Hub pricing that many gas trading hubs in the giant Permian Basin producing region are commanding. The Permian Basin is located in western Texas and southwestern New Mexico. For example, gas delivered by E&P companies under forward contracts through year-end 2024 at the popular Waha Hub in West Texas are trading at discounts of US$1/Mcf or more to benchmark Henry Hub pricing.

Gas production has grown dramatically in the Permian Basin this year, and there is simply not enough takeaway pipeline capacity in place to transport the gas to LNG liquefaction terminals along the Gulf Coast. Some capacity expansion projects are planned, but new pipeline capacity is not expected to commence service until about a year from now. Until then, Waha gas prices may continue to trade at a sharp discount to Henry Hub prices.

Information for this briefing was found via Trading Economics and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.