Energy costs are skyrocketing out of control amid the ongoing Russia-Ukraine conflict, as the price of natural gas soars to the most on record, while crude prices top the highest since 2008.

If you think Europe’s energy crisis was bad before, think again! Natural gas prices exploded nearly 50% on Monday to around €283 per megawatt hour, which translates to approximately the equivalent of $522 per barrel of oil.

Similarly, the price of oil also soared on Monday, trading at nearly $130 per barrel— the most since 2008. The sudden increase in energy costs comes as Western nations mull imposing punishing sanctions on Russian oil and gas in response to the conflict in Ukraine. House Speaker Nancy Pelosi penned a letter on Sunday announcing that the chamber is “exploring” new legislation to ban imports of Russian oil, while US Secretary of State Antony Blinken is currently in Europe to coordinate a response to Russia’s Ukraine invasion.

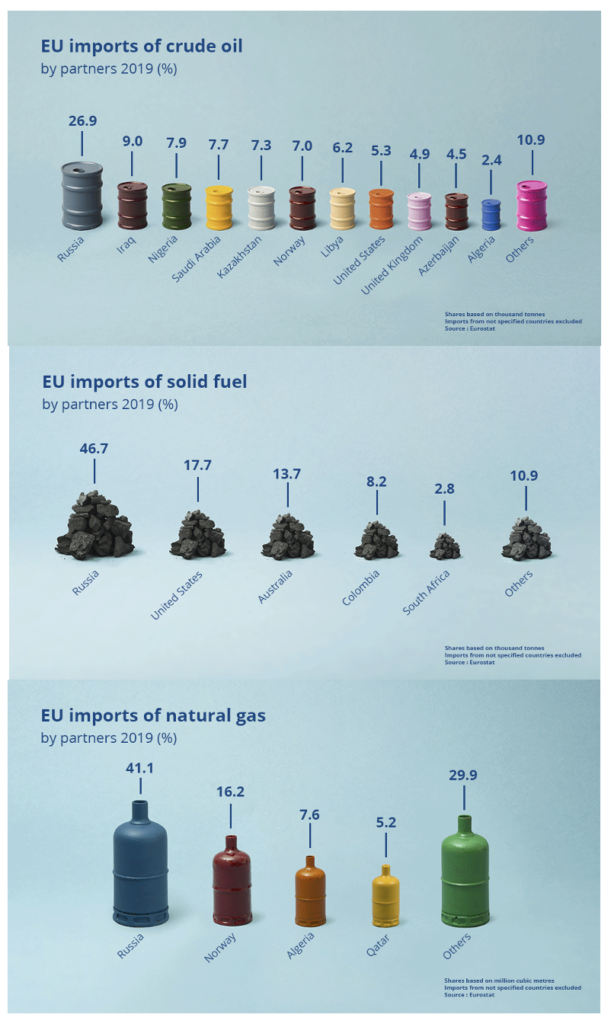

But, given that Europe imports over half of its energy supplies— with Russia accounting for 41%, 46%, and 27% of gas, coal, and oil supplies, respectively, the bloc may be shooting itself in the foot if it bans commodity shipments from the east.

Luckily, German Chancellor Olaf Scholz may have experienced some cognitive dissonance over the weekend, because come Monday, he rationalized that banning Russian energy imports would, indeed, be detrimental to the European Union. “At the moment, Europe’s supply of energy for heat generation, mobility, power supply, and industry cannot be secured in any other way” than via Russian supplies. “It is therefore of essential importance for the provision of public services and the daily lives of our citizens,” he said in a statement.

Olaf Scholz says no sanctions on energy from Russia, for now: "Europe has deliberately exempted energy supplies from Russia from sanctions. At the moment, Europe's supply of energy for heat generation, mobility, power supply and industry cannot be secured in any other way…" 1/3

— Hans von der Burchard (@vonderburchard) March 7, 2022

The EU has so far imposed various other unprecedented restrictions on Moscow, including banning Russian flights from its airspace and prohibiting Russian media, as well as sending military equipment to Ukraine. However, given that Germany’s renewable energy investments have, for the most part, failed to heed any meaningful results in terms of energy independence, coupled with the upcoming closures of three nuclear power plants later this year, the central European country is a lot more vulnerable to the implications of Western-encouraged commodity sanctions.

Although Europe still has enough natural gas supplies to get through the summer months, Germany’s decision to indefinitely halt the certification process of Russian-owned Nord Stream 2 means the prospect of cheap natural gas comes to an abrupt halt. Not to mention, Europe will even have to slash demand by at least 15% to make it through the next winter season if all Russian gas shipments get axed, calculated Evercore analyst Peter Williams.

In an effort to avert a full-blown energy crisis and save-face if such a scenario were to transpire, Germany’s economy minister Robert Habeck announced over the weekend that the country will build two LNG terminals to receive imports from other natural gas suppliers, such as the US. “It is necessary to reduce our dependence on Russian imports as soon as possible,” Habeck said, adding that “Russia’s war of aggression against Ukraine makes this mandatory.”

But, as Scholz reluctantly acknowledged, such a transition “cannot be done overnight,” and therefore it is imperative to “continue the activities of business enterprises with the area of energy supply with Russia.” So much for energy independence, hey?

Information for this briefing was found via Reuters, the WSJ, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.