The price of natural gas has soared to a 13-year high, as fears over scarcity ahead of the winter months intensifies.

October futures for natural gas jumped by more than 10% on Monday to close at US$5.86 per million Btu, marking the sharpest increase since February. November futures were also up on Monday, hitting a fresh high of nearly US$6 per million Btu— the highest since November 2008. Energy prices have been on a steep rise over the past several weeks, particularly as low reserves in Europe and China ignite fears over widespread shortages ahead of the cold season.

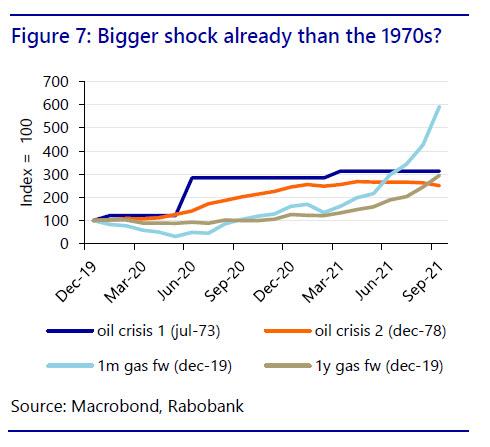

The steep rise in natural gas prices has been unprecedented across Europe, and is expected to be even worse than the US oil price shock of the 1970s, according to estimates from Rabobank. European natural gas prices have soared to above $25 per million Btu, which is a staggering 400% more than the average of the past decade, and significantly higher than the commodity’s price in the US.

To make matters worse, data from the Bureau of Safety and Environmental Enforcement showed that natural gas output has significantly declined in the US, as Hurricane Ida shuttered nearly 25% of gas production across the US Gulf of Mexico, with a full recovery not expected until well into 2022. This has caused US gas stockpiles to fall 6.9% below their historical average over the past five years, as the country prepares to send additional cargo supplies overseas amid renewed export capacities.

With strong demand from Europe and Asia, coupled with no upcoming boosts in output across the US Gulf of Mexico, a detrimental natural gas shortage could materialize in the event that North America succumbs to a cold December. However, if temperatures remain above seasonal during the winter, then the market could face a significant correction.

Information for this briefing was found via Bloomberg and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.