Turkish President Tayyip Erdogan announced on Wednesday that he and Russian President Vladimir Putin had agreed to establish a natural gas hub in Turkey. Speaking to members of his AK Party in parliament, the Turkish leader stated that his Russian counterpart has stated that Europe can acquire its gas supplies from the hub that will be built in Ankara.

During a face-to-face encounter in Kazakhstan’s capital Astana last week, the two presidents discussed the establishment of the gas hub.

“Turkey has turned out to be the most reliable route for deliveries today, even to Europe,” Putin said last week.

Smart move?

The “gas hub” plan comes amid Russia facing Ukraine-related sanctions and leaks at the Nord Stream twin pipelines, interrupting deliveries of energy exports to one of its largest markets in Europe.

Speaking at the Russian Energy Week forum in Moscow, Putin tried to court the European market by saying the country is ready to supply natural gas to the continent again. This comes after state-run Gazprom closed down the Nord Stream 1 pipeline indefinitely–itself a move after a series of export cuts–even before leaks appeared on the gas conduits.

The Russian leader said that gas could still be sent to Europe via one of the Nord Stream 2 pipeline’s remaining intact lines, but the decision is now in the hands of the European Union.

Putin’s speech at the forum seems to be aimed at courting the EU and sowing further distance from the United States. The Nord Stream 2 pipeline, although ultimately suspended by German Chancellor Olaf Scholz on the pretext of Russia’s invasion of Ukraine, was a target of sanctions by the US–claiming that Moscow will potentially use the pipeline to gain geopolitical advantage.

But the Turkish gas hub could potentially be a reincarnation of the geopolitical repercussions brought by the second pipeline before. Albeit, the former might be a more attractive option: it opens the gas exports to all European states as opposed to the pipelines that chiefly deliver the supplies to Germany.

Cry for help?

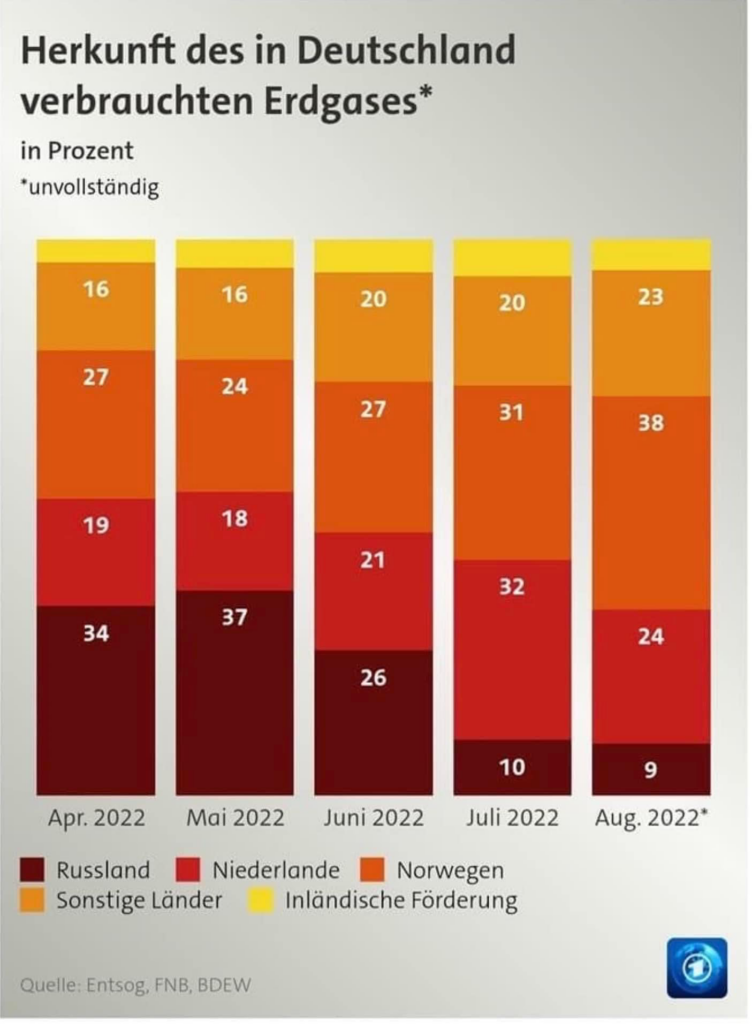

Since Russia started curtailing gas deliveries–and eventually shut off–through the Nord Stream 1 pipeline, Europe looked for another way to sustain its energy needs. Berlin was able to approach its winter target gas storage despite the significant cutbacks–trying to dispel the characterization that the country is dependent on Moscow to keep the lights on. Norway has taken over most of the country’s import needs.

The sanctions Russia is suffering and the energy war it is waging might have been taking a toll already on the government’s coffers. The country’s energy income fell to their lowest level in more than a year in August, as Western sanctions over Ukraine drove the Kremlin to sell cheap oil and restrict gas deliveries to Europe.

According to Finance Ministry figures published Monday, Russia’s oil and gas income, which account for more than a third of the country’s budget, decreased to 671.9 billion rubles ($11.1 billion) last month, the lowest since June 2021. This represents an almost 13% decrease from July. It’s also a 3.4% drop from a year earlier, despite Urals crude prices rising over 10%.

The Finance Ministry is saying that the monthly reduction in Russia’s August oil and gas income is due to tax payment rules.

Despite the sanctions and the EU’s reduction in imports, Moscow has cleverly adjusted for lower export volume by raising pricing, particularly on European markets. As a result, “gas imports may have fallen by 70%, but Russia’s export revenues have remained virtually unchanged.”

But this might change once the European leaders were to follow through capping the price on gas imports from Russia. The falling trend on the Dutch TTF futures also provide a potential huge cut to Moscow’s gas revenues.

For Turkey, the move might be an attempt to bolster trade relations with Moscow. A couple of Turkish bank have stopped using Russia’s Mir payment system in their respective networks. The move was said to be due to the warning of second-hand sanctions the US issued on parties that help Moscow circumvent the penalties.

Ankara has been on the receiving end of building pressure from both the US and European Union, pushing the country to prevent helping Russia to “bypass the sanctions”.

On top of that, Turkey is still facing soaring inflation–rising for the 16th month to end at 83.5% in September. In what seems to be a reverse psychology strategy, the Turkish Central Bank cut its key rate by 100 basis points from 13% to 12% following the price inflation bump.

Information for this briefing was found via Reuters, The Moscow Times, Le Monde, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.