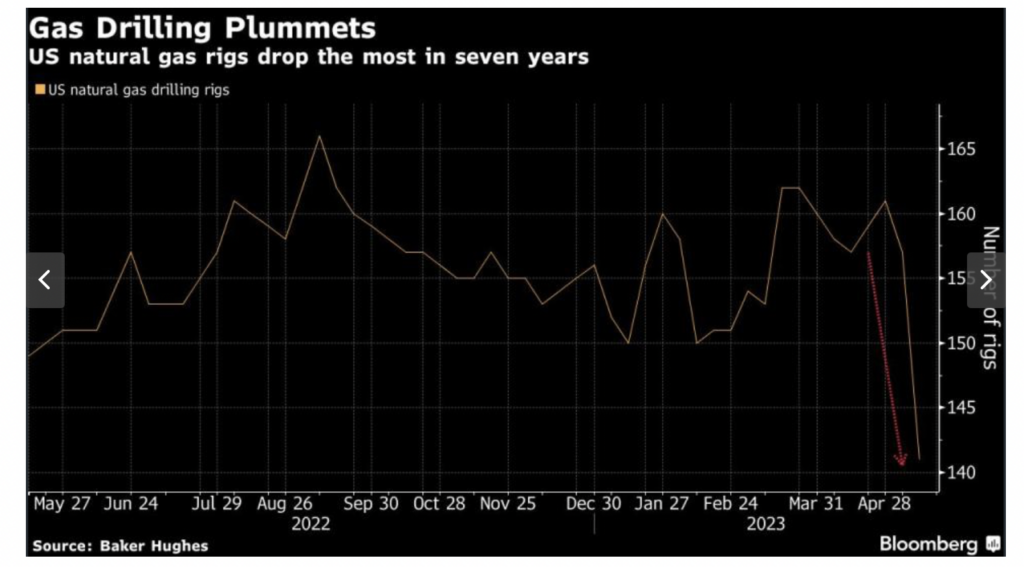

In its weekly rundown of oil and natural gas drilling rigs operating in North America, Baker Hughes Company (NASDAQ: BKR) announced that the number of natural gas rigs running on May 12 declined to 141, down 10% from 157 on May 5. The 16-rig week-over-week decline was sharper than any week during the dark days of the COVID pandemic; indeed, it was the biggest weekly decline since February 2016.

Of course, the reason for the decision by E&P companies to pull back on drilling is quite understandable: a collapse in natural gas prices over the last nine months. In September 2022, natural gas prices were at about four times current levels (US$9 per MMBtu versus the current level of about US$2.25 per MMBtu). Interestingly, the number of gas rigs deployed on May 5, 2023, when low natural gas prices prevailed, was not far below the mid-September 2022 peak for this cycle of 166 rigs.

Given all this, the big surprise is not the sharp reduction in rigs deployed this past week; the surprise really is: what took so long to start slashing production?

Another eye-opening aspect of the nearly unprecedented weekly cut in natural gas rigs deployed: natural gas traders essentially yawned; prices barely budged. Wall Street stock and commodity traders frequently react to sharp reductions in the operating costs of a company (linked to, say, wide-spread employee layoffs), or to the diminished supply of a commodity (for example, a Gulf of Mexico hurricane knocking out offshore oil wells) with exuberance.

Consequently, the lack of reaction by natural gas traders to this Baker Hughes news could suggest that many more gas rigs must be taken offline before natural gas supply and demand conditions become more balanced.

A piece of anecdotal evidence which illustrates the degree of oversupply of natural gas in the U.S., and particularly in the key Permian Basin producing region in west Texas and southeastern New Mexico, is the price action this week at the Waha trading hub in west Texas. On May 9, the next day natural gas spot price at Waha closed at negative US$0.35 per MMBtu, according to Refinitiv pricing data.

Before May 9, 2023, the last time Waha prices settled below zero was in October 2020, a time when the pandemic was raging and when demand was very low as many businesses were shut down.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.