Last night Netflix (NASDAQ: NFLX) reported their quarterly earnings, which financially, came generally in line with analysts’ estimates. The company reported $7.16 billion in top-line revenue, an almost $2 billion operating income, and earnings per share of $3.75. The Board of Directors also announced a $5 billion buyback program.

The company is currently down almost 8% in early morning trading as they missed on subscriber growth. The company added 4 million subscribers, which is lower than the forecasted 6 million subscribers. The Chairman and Co-CEO commented on this lack of growth by stating, “It’s just a little wobbly right now.”

Netflix currently has 44 analysts covering the company with a weighted 12-month price target of $613.50. This is slightly down from the average before the results, which was $622.74. 14 analysts have strong buys while another 20 have buy ratings. 6 analysts have hold ratings, 3 analysts have sell ratings and one analyst has a strong sell rating. The street high comes from Elazar Advisors with an $840 price target, while Societe Generale has the lowest target at $340.

Below you can see the most recent analyst changes:

- Evercore ISI cuts price target to $655 from $665

- Piper Sandler cuts target price to $600 from $605

- Pivotal Research Group cuts target price to $720 from $750

- JP Morgan cuts target price to $600 from $685

- Morgan Stanley cuts price target to $650 from $700

- Benchmark cuts target price to $448 from $472

- Wedbush raises target price to $342 from $340

- Guggenheim cuts target price to $600 from $625

- Moffettnathanson cuts target price to $460

- Truist Securities cuts target price to $600 from $630

- Stifel raises to buy from hold

- Stifel raises price target to $560 from $550

- Cowen and Company cuts target price to $650 from $675

- UBS cuts target price to $600 from $650

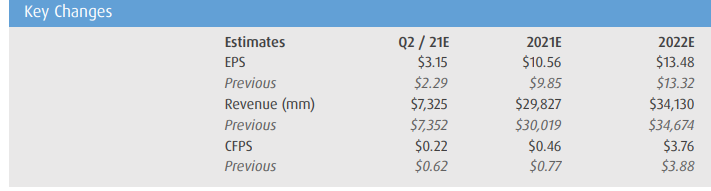

BMO Capital Markets analyst Daniel Salmon says that the bar was set too high but remains optimistic on Netflix. He writes, “we continue to recommend shares as NFLX is now passing its primary 2021 Bear point, making this a particularly attractive buying opportunity relative to typical quarterly sub misses.” He adds that the second quarter subscriber gain is additionally weak. The company is forecasting for a net of 1 million new customers in the second quarter versus BMO’s prior 5.38 million estimates, which is now revised down to 1.1 million in the second quarter.

Salmon gives their buy-back assumptions of $500 million in the second quarter, $1.9 billion total in 2021, and $3.5 billion in 2022. He adds, “We also assume the buyback to continue consistently through 2030, growing it at 10% per year to start.”

Below you can see BMO’s updated estimates to reflect management’s guidance as well as factoring in this quarter.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.