Netflix (Nasdaq: NFLX) reported its Q1 2023 financials, headlined by $8.16 billion in revenue. This is an increase from both Q4 2022’s $7.85 billion and Q1 2022’s $7.87 billion but a hairline below street estimate of $8.18 billion.

“In short, we’re off to a good start in 2023. As always, our focus remains pleasing our members and attracting great creators so that we can continue to build a wildly successful business,” the streaming service said in a letter to shareholders.

The paid membership base at the end of the quarter came in at 232.50 million subscribers, up from 230.75 million users from the previous quarter. The 1.75 million net additions is lower than the estimated 2.3 million new subscribers.

The APAC market took the lion share of this increase with 1.46 million new memberships but the EMEA market still is the firm’s largest and still overtakes the UCAN market.

Operating income for Q1 2023 also jumped to $1.71 billion from last quarter’s $549.9 million but dipped from last year’s $1.97 billion. However, this is said to still be above the firm’s guidance of $1.6 billion.

“The year over year decline in operating margin was primarily due to F/X – the appreciation of the US dollar accounted for roughly three percentage points of the year over year change in operating margin,” the company added.

Net income spurred to $1.31 billion, up from Q4 2022’s $55.3 million but down from Q1 2022’s $1.60 billion. The bottomline translates to $2.88 earnings per share, above the firm’s $2.82 per share forecast and street estimate of $2.86 per share.

The firm also said it was pushing back its broad rollout of its password-sharing crackdown originally slated for Q1 2023.

“While this means that some of the expected membership growth and revenue benefit will fall in Q3 rather than Q2, we believe this will result in a better outcome from both our members and our business,” the company added.

Relatedly, the firm is forecasting a quarter-on-quarter decline in operating margin and net income for Q2 2023, guiding to $1.57 billion and $1.28 billion, respectively. But, it expects a revenue bump, ending the subsequent quarter at $8.24 billion in revenue.

There’s a lot of pushback with Netflix’s plan to block password sharing for its subscribers. In February, a petition was created on Change.org in protest of the policy change, garnering at least 36,000 sign ups.

According to the corporation, subscriber growth has been impacted in overseas regions where such approaches have previously been implemented. Netflix issued password-sharing guidelines in four countries in February: New Zealand, Canada, Portugal, and Spain.

The firm estimates more than 100 million households, or roughly 43% of its global user base, have shared accounts. This has hampered its capacity to invest in new programming, said Netflix. The ad-supported alternative and the ban on password sharing are both intended to increase earnings.

Netflix also said goodbye to its original business model, DVD mailing, in which it would ship discs to subscribers in red envelopes. In a blog post, the company’s CEO, Ted Sarandos, stated that the DVD business would be phased out, as it “continues to shrink.”

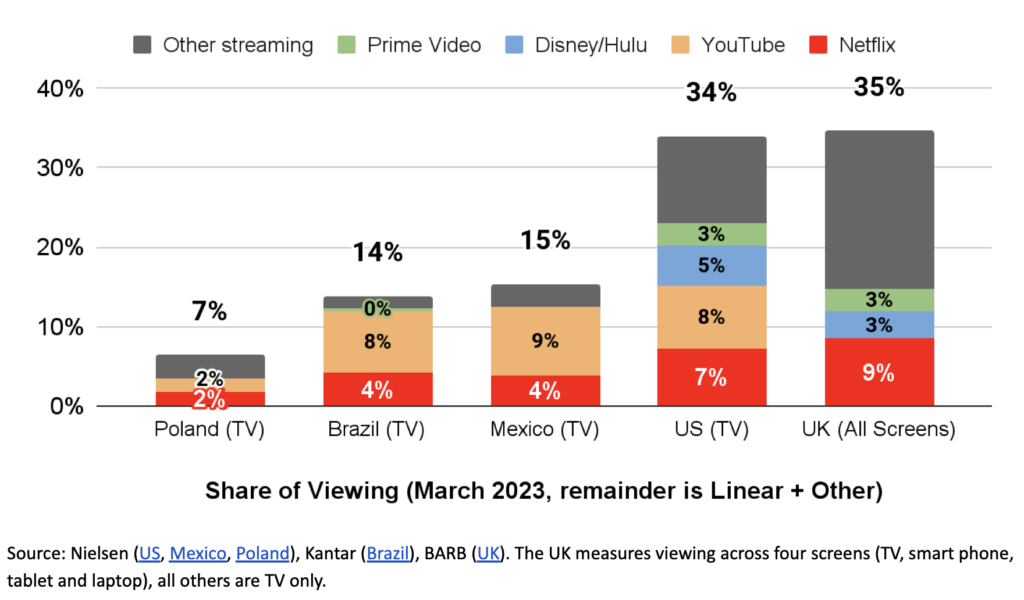

In the earnings release, the streaming giant also said “competition remains intense as we compete with so many forms of entertainment.” But, it remains “highly confident that streaming’s share of engagement will continue to grow at the expense of linear,” pointing to Netflix and YouTube’s dominance in share of viewing.

Data from Nielsen shows that Americans used streaming services more than cable TV for the first time in July 2022, and they haven’t looked back. Streaming closed December with a 38.1% viewer share, up almost 36% year over year. Cable fell further to 30.9%, down 17% from the same period last year and 2.92% from November.

However, the latter part of 2022 showed YouTube overtaking Netflix as the top streaming platform. The rise in streaming share gave Netflix a year-over-year viewer share increase of 17%, while YouTube’s jumped 50%. Runner-ups Hulu, Amazon Prime Video, Disney+, and HBO Max didn’t show significant changes in the year, while Peacock+ claimed 1% for the first time ever in December.

Information for this story was found via CNBC, Yahoo Finance, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.