On August 13, Nevada Copper Corp. (TSX: NCU) announced their second quarter financial results. The company did not provide any financial information in the news release but noted that they mined 9,500 tons of 1.5% copper and that they are going ahead with the installation and commissioning of underground fans. The company ended up losing $14.1 million this quarter, which is several times larger than their second quarter 2020 $2.5 million losses.

The company has 4 analysts covering the name, with 1 analyst having a buy rating and the other 3 having hold ratings. The consensus sits at $0.27, a 135% upside. The street high target currently sits at $0.50 while the lowest comes in at $0.15.

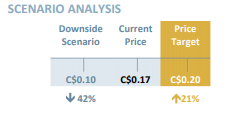

Haywood lowered their 12-month price target on Nevada Copper to C$0.20 from $0.30 and reiterated their hold rating as the company announced more delays and another CEO resignation. Mike Ciricillo is the fourth CEO to leave since May 8th, 2020. Mike is staying on as an interim CEO and President.

Haywood says that the 9,500 tonnes mined, which was coneducted at 1.5% copper, represented slow progress at the mine. They add that the ramp-up is progressing slower than anticipated due to the COVID-19 headwind and a water-bearing dyke that requires additional support.

They add that the 2 new fans installed, resolution of the main shaft commissioning items, ongoing installation of incremental underground power, and ventilation upgrades should help improve the company mining and development rates in the second half of the year.

In connection with the delays, the firm lowered its production and financial estimates for Nevada Copper. Haywood now anticipated production of 23 million pounds of copper in 2021, which is then to more than double to 50 million pounds in 2022. Estimates are down from the prior 29 million and 65 million pounds estimated for the time periods, respectively.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.