New Zealand’s mining sector, deeply rooted in the country’s history, is at a pivotal moment. With abundant mineral resources, including coal, silver, iron ore, limestone, and gold, mining has long been a cornerstone of New Zealand’s economy. Recent government initiatives aim to double mineral exports by 2035, signaling a renewed push towards mining.

The history of mining in New Zealand dates back to the pre-European Māori era, where rock such as argillite was quarried for tools and weapons. However, it was the latter half of the 19th century when mining truly expanded with the arrival of European settlers. Today, New Zealand boasts rich deposits of minerals, making mining a significant contributor to the national economy.

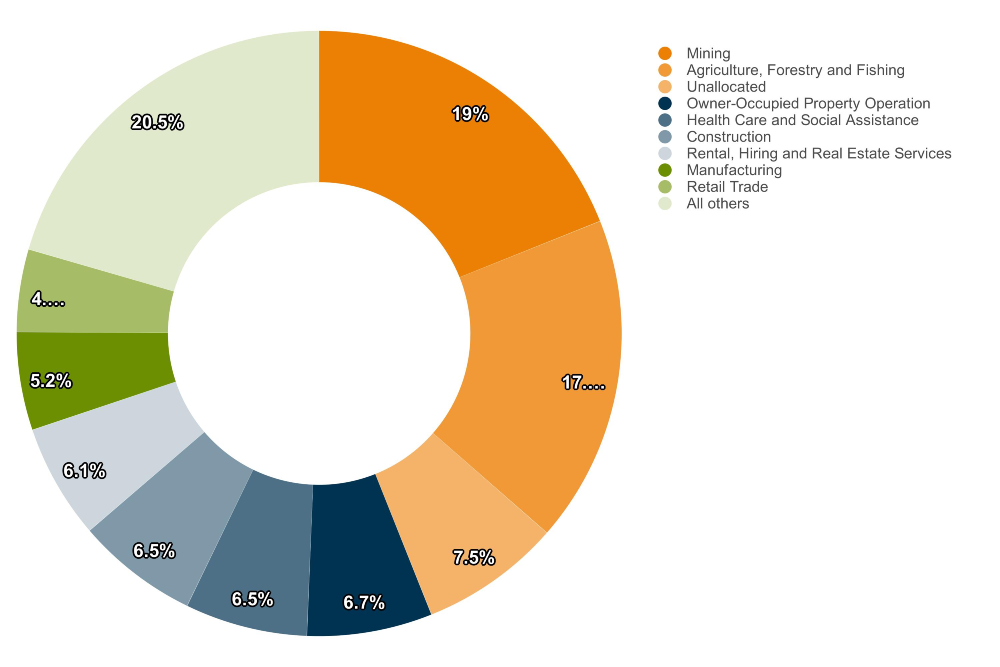

Mining is a major economic pillar in New Zealand. In 2006, the sector contributed $1.5 billion to the economy, excluding oil and gas. By 2017, this had grown to $3.1 billion, accounting for 1.3% of the GDP. The industry employs thousands directly and indirectly, providing high wages compared to the national average.

Despite a decline in the number of miners from 6,800 in 2009 to 5,300 in 2017, the sector remains highly productive. Recent data highlights that the mining industry delivers over $490,000 of GDP per filled job, with the Hauraki District, home to OceanaGold’s Waihi Operation, seeing even higher productivity at $640,000 per job.

Government’s push for mining

Under the current administration, there is a renewed push towards mining, particularly as the government rolls back some of the environmental policies from then-Prime Minister Jacinda Ardern’s era.

Resources Minister Shane Jones recently unveiled a plan to double mineral exports from NZ$1.03 billion to NZ$2 billion by 2035. Part of this strategy includes a proposed fast-track bill aimed at expediting approvals for significant mining projects, which the government argues is necessary to boost economic growth and attract investment.

Jones emphasized the importance of mining for clean energy technologies, stating that global demand for minerals used in electric vehicles and wind turbines is rapidly increasing. “New Zealand has a rich deposit of these critical resources, and the government will develop a plan for extracting them,” he said.

“The value of mineral exports in 2022 to New Zealand was $1.03 billion. This is about the same as the contribution made by fishing/aquaculture and seafood processing combined ($1.087b),” Jones explained. “Mining generated 8.4 per cent of the West Coast region’s GDP in 2023. This is the third highest sector on the coast behind only dairy farming (10 per cent) and electricity and gas supply (12.6 per cent).”

The government’s Fast Track Approvals Bill, currently before the parliament’s environment select committee, aims to streamline the approval process for significant infrastructure projects, including mining. While proponents argue it will spur economic development, critics fear it could bypass essential environmental protections.

The Barrytown Flats mine, approved by local councils with strict conditions, including night-time operational restrictions to protect the Westland petrel, is a case in point. The project by TiGa Minerals and Metals faced initial rejection due to environmental concerns but was eventually accepted with numerous conditions.

Leading the charge in the sustainable mining

Rua Gold (CSE: RUA) is a notable player in New Zealand’s mining sector, specializing in gold exploration and discovery. The company combines traditional prospecting practices with modern technologies to uncover and capitalize on valuable gold deposits. With a commitment to responsible and sustainable exploration, Rua Gold ensures minimal environmental impact through professional planning and execution.

The company boasts a highly skilled team of professionals with extensive expertise in geology, geochemistry, and geophysical exploration technology. Their operations focus on two primary gold districts: the Reefton Goldfield and the Hauraki Goldfield.

The Reefton Goldfield, located on New Zealand’s South Island, has a rich history of gold mining dating back to 1872. It produced 2 million ounces of gold from high-grade underground operations in orogenic quartz vein systems.

The company holds the Capleston permit, which hosts several promising prospects such as Capleston, Murray Creek, and Ajax Area.

Recent exploration has revealed the high-grade Pactolus quartz vein, with preliminary data suggesting the system extends south for 550 metres along strike. Ongoing drilling at the target has intersected 5.13 g/t over 2.0 metres, as well as 3.61 g/t gold over 2.0 metres. Further drilling under the current program is also set to target the Murray Creek districts, with further exploration also planned for the Crushington, Capleston and Caledonian districts.

The Hauraki Goldfield on the other hand, on the North Island, is another key area for Rua Gold. The region has produced over 15 million ounces of gold and 60 million ounces of silver since the 1860s.

The firm’s recent acquisition, the Glamorgan property, covers 4,644 hectares and includes the highly prospective Wires Ridge Prospect. The area shows significant signs of gold mineralization, with rock samples on surface up to 95g/t gold.

The property’s location is just 2.8 km from OceanGold’s Wharekirauponga, which recorded intercepts of 8.7 metres true width at 24.5 g/t gold & 32.0 g/t gold, and 22.8 g/t gold & 39.0 g/t gold over 48.9m.

Rua Gold recently announced the receipt of its drone concession from the Department of Conservation for its Glamorgan project, with surveys at the project now underway following the regulators approval. The exploration team has begun magnetic geophysical surveys, with plans for soil sampling, resistivity surveys, and geological mapping this year. This work is expected to enhance targeting for the drill program set to commence by the year’s end.

The project’s advancement is supported by the Fast Track Approvals Bill, providing a strategic framework for Rua Gold’s exploration efforts.

FULL DISCLOSURE: The information for this article was found via RUA Gold and the sources mentioned in the article. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.