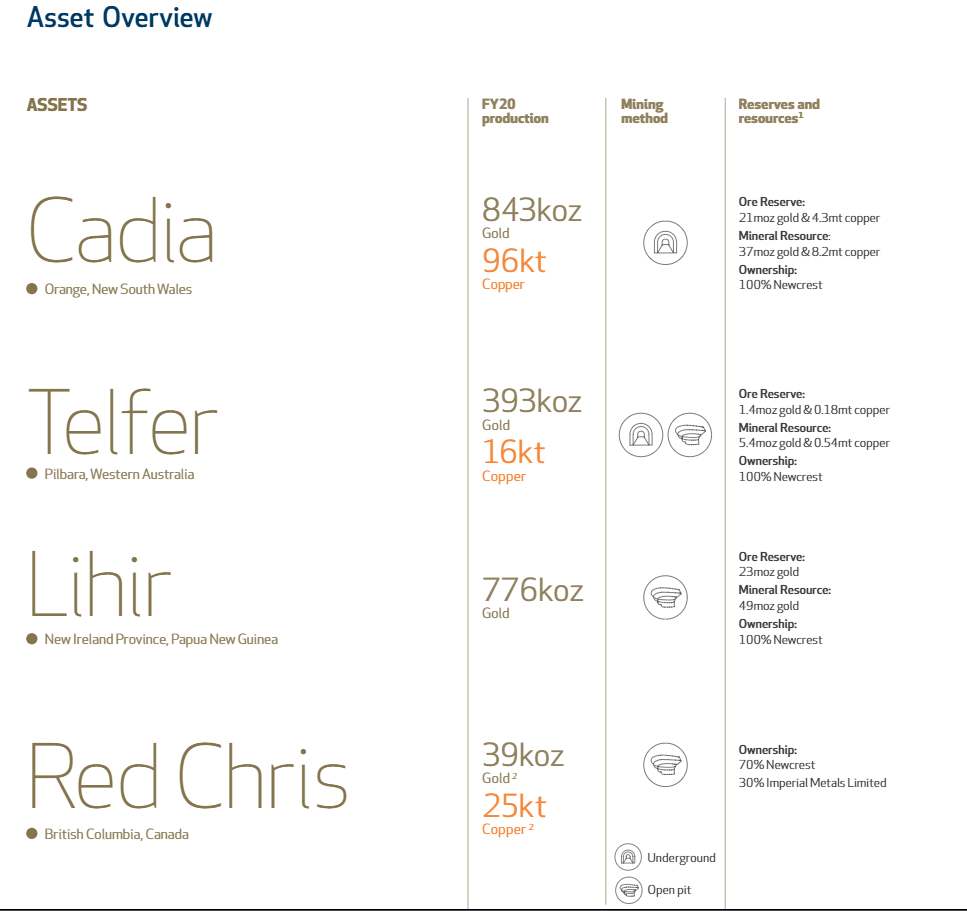

On October 5th, Newcrest Mining (ASX: NCM) received conditional approval to list on the Toronto Stock Exchange. It is anticipated that they will start trading on October 13th, 2020. Newcrest is a A$25.3 billion company. On the 4th, the company released their 2020 annual report, outlining the four major production locations and one advanced project they currently hold.

Notably, the firm was founded in 1966 as a subsidiary of Newmont Corporation (TSX: NGT). At the time, the primary objective was to capitalize on mineral assets located within Australia, however the company has since heavily expanded outside of this initial footprint. This expansion began in the early 1990’s, with the company at the time electing to expand overseas to different jurisdictions in a bid to diversify its operations. Presently, it is the largest gold producer listed on the Australia Securities Exchange, and one of the largest producers globally.

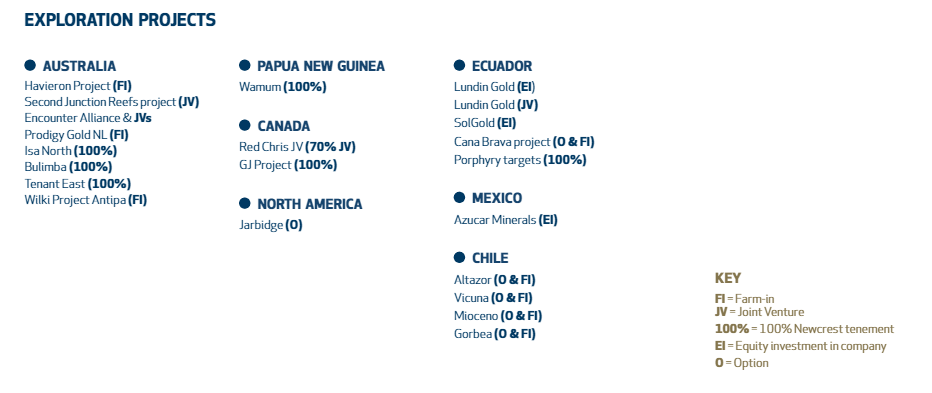

Given the size of the firm, Newcrest also has 22 exploration projects between Canada, Australia, Papua New Guinea, North America, Ecuador, Mexico, and Chile. Six of these properties are currently held via options, while they own a 100% stake in six of the projects. The remainder are owned via joint ventures, farm-ins and equity investments with various partners.

Newcrest Managing Director and Chief Executive Officer, Sandeep Biswas, commenting on the announcement, saying, “A North American listing is part of our strategy of pursuing growth in the Americas following our 70% acquisition of the Red Chris mine in Canada in 2019 and our investments in Ecuador.”

Newcrest identified that there will be no equity offering alongside this listing, and that they are simply looking to expand their exposure to markets. The company did not clarify what symbol it will be trading under.

Information for this briefing was found via Sedar and Newcrest Mining. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.