The Deep Dive‘s NFT FAQ is a good primer on what Non Fungible Tokens are, in a technical sense, and as capital instruments. In a social sense, they’re basically a plague. Anyone who things otherwise ought to start talking about NFTs at a party and watch how fast the place clears out.

That isn’t unique to NFTs. People were ruining parties yacking about the stock market or real estate or their Herbal Life business before NFTs even existed. Eventually these crypto people will move on to some other annoyance, but for now they’re trying to work it into every conversation sideways, because markets need interest to operate; fires quit burning when they run out of fuel.

“It’s the perfect fit, except for the fact they hate your guts.”

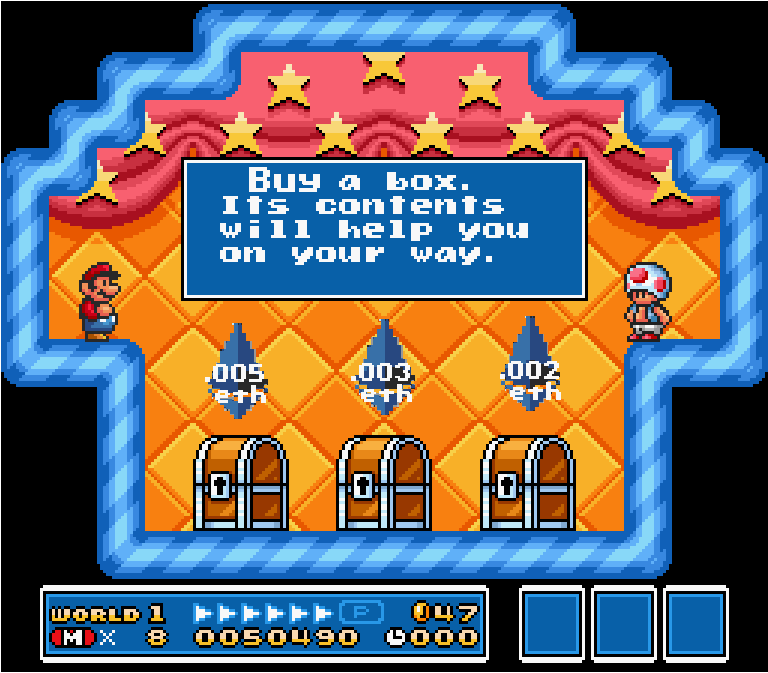

By our analysis, in 2022, the single rational shot that NFTs have at a practical, real-world use case is in the world of video games. An NFT can’t stop anyone from sharing or looking at whatever jpeg it’s associated with, but an on-chain game can easily restrict one-of-a-kind armors or weapons to their rightful owners, making blockchain-based NFTs a perfect fit to govern in-game marketplaces. But to hear the New York Times tell it, gamers are aggressively disinterested in in-game NFTs.

This past Saturday’s Times reports that large game companies have abruptly reversed course on NFT initiatives following widespread user backlash to what was perceived as just another cash grab by game companies. Gamers who had had quite enough of being charged for in-game items in popular titles they had already paid for weren’t in a mood to hear about the great potential in resale markets that tokenized items would bring. Presumably, they bought the game to play it, and not to be offered a once-in-a-lifetime opportunity to get rich flipping swords.

A turn of events like that is one anyone with the most basic of social skills could have seen coming, so it naturally blindsided video-game executives. The overwhelming distaste among the user-base makes it unlikely any popular titles will try again any time soon. And, without the potential for crypto-based assets to take hold in the one universe they make any useful sense, the highly-touted virtual reality “Metaverse” is facing an uphill climb.

“You go right ahead and get the party started without us. We’ll be along… um… eventually.”

Gadget nerds aren’t as consistently annoying as the cyrptocurrency / multi-level-marketing / stock market archetype. They’re just as obsessive, but at least they’ve got cool gear, and they usually aren’t trying to sell it to anyone. There was a disappointed emptiness among the compulsive early adopters last week when Apple Inc. (NASDAQ:APPL) pushed back the anticipated release of a VR / AR headset.

The ever popular “people familiar with the situation,” told Bloomberg that the headset would be pushed back until later in ’22 or possibly ’23, and cited problems getting the hardware to work. Gadget junkies who think we’re always on the precipice of a new and exciting future were disappointed by the non-launch, reasoning that Apple’s inaction at such a time that Meta (NASDAQ:FB) re-orients itself around VR and AR is effectively, “handing the future to Zuckerberg.”

If true Apple just handed Zuckerberg a big gift.

— Scoble (@Scobleizer) January 14, 2022

So disappointed. https://t.co/vFHHAKiAAb

NFTs are a major component of the Metaverse which, as near as we can tell, is presently an under-construction 3D internet, whose blocks are owned by nerds inclined to speculate that they will one day be able to charge people to use them. It may well be that Apple, the largest company in the world, and number one in consumer hardware and software publishing by a country mile, has determined that the Metaverse is a future they’re quite happy to let Zuckerberg have.

“We don’t expect it will fall apart until well after you’ve helped us inflate the price, Ms. Kardashian.”

If the growing cultural disinterest in blockchain constructs doesn’t reverse itself any time soon, promoters’ association with collapsed scams may eventually catch up to them. The Kim Kardashians of the world wouldn’t be much without their reputations, and promotions falling apart generate a lot more buzz than ones that hold together.

As we write this, twitter is having an extended laugh at Spice DAO, a cryptographic crowdfunding collective that bought a rare, unpublished Dune manuscript at auction for €2.66M, 100x its estimated value, this past November.

We won the auction for €2.66M. Now our mission is to:

— Spice DAO (🏜,🏜) (@TheSpiceDAO) January 15, 2022

1. Make the book public (to the extent permitted by law)

2. Produce an original animated limited series inspired by the book and sell it to a streaming service

3. Support derivative projects from the community pic.twitter.com/g4QnF6YZBp

Saturday, the Decentralized Autonomous Organization tweeted plans to create and distribute works of derivative media based on the manuscript, indicating that the DAO was under the impression that owning the book gave it the rights to the intellectual property which, of course, it does not. Today is the third straight day that the apparent embarrassment has been steadily lampooned, another blatant example of anti-crypto persecution, and a great indication that the public at large would rather laugh at these nerds than take them seriously.

The notion of independent films being financed by DAO isn’t far-fetched at all. It’s basically indiegogo on the blockchain, and members of a DAO that does own the rights to a piece of media at least own something. But decentralized structures aren’t known for film making, or the movie business, which are traditionally enterprises built around centralized hierarchies.

So, in 2022, the blockchain is still a solution in search of a problem. Blockchain units’ utility as instruments of speculation remain their only strength, and a decidedly mixed blessing. New blockchain tech either becomes another trade-able token, or repels would-be adopters who might have any reason to use it for anything else.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.