Audio engineers over here at The Deep Dive‘s West Coast Headquarters are having trouble with a persistent grinding sound on the track. It appears to be caused by a growing number of people grinding their teeth over the sudden, explosive success of crypto-based NFTs. So, it’s high time we broke it down.

Non Fungible Tokens: What are they?

They’re tokens. Something that represents something else, the way a bouquet of flowers might be a token of someone’s affection, or the shrapnel a kid feeds into a skee-ball machine at Chuck-E-Cheese are tokens of the money that his dad forked over at the counter.

Are they fungible?

Glad you asked. They are NOT fungible.

Fungibility, of course, is an economic term for ease of substitution. Lend your car to a friend with a full tank of gas, you don’t care if the gas in the tank when he returns the car is the exact same gas that was in there when he took it, because it all burns the same. Gas is fungible. So are bitcoins and US dollars. But if the friend comes back with a different car all together, you aren’t going to care how much gas is in the tank, because what the hell happened to my car!? Cars aren’t fungible!

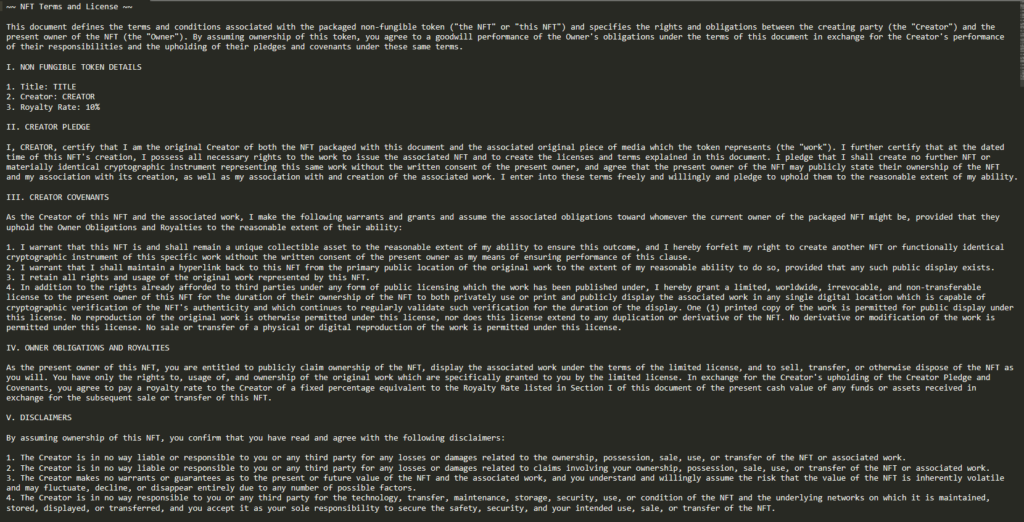

And neither are non-fungible tokens. That’s why they call them that. Each of them is a link to a media file, coupled to a blockchain-based smart contract that governs the movement of the token, under a set of conditions set by the creator of the token. The NFTs that are traded the most frequently are associated with images, but could also be used to represent original music, videos, a story, a component of a video game, etc. The terms of the token are set when a token is minted and sold.

Does the token come with the rights to the art?

Probably not, and that’s the rub.

To those who understand the potential value that exists in the rights to intellectual property, NFTs seem, at first blush, like an incredible opportunity. Media rights have been aggregated into collections and re-distributed in clever and profitable business applications both before and after the world went digital.

Record companies are enterprises set up to buy the rights to music before it’s even created, then pimp it out, previously by selling it on physical media, but these days by licensing it to streaming services or for use in movies. Getty Images pays photographers for the rights to photographs of things that are newsworthy, then charges publishers to re-print those photographs, either as a part of a subscription service or as a one-off, presumably for a lot of money. It’s one of the best grifts in media, possibly best understood through this great story by Defector’s Dave Davis about the rights to the definitive photo of Diego Maradonna’s “Hand of God” goal.

But it doesn’t work like that. Ultimately, licensing and royalty relationships could be handled with smart contracts, but the tech isn’t there yet. People who trade in media rights seriously are still using the regular kinds of contracts, and the dawn of NFTs hasn’t given them a reason to change.

What’s the difference between a Smart Contract and a smart contract?

Unfortunately for those of us who wanted to use these NFTs to become media barons, blockchain-based “smart contracts” aren’t the same thing as the legal contract that one might need to transfer the rights to a piece of media. They’re a set of rules kept by software that govern what the blockchain can do with the original token associated with the art.

Ultimately, all the smart contract can do is allow or prevent the transfer of the token in question, according to whether the conditions are met or not. Some of those smart contracts automatically transfer royalties to the original creator through the blockchain every time the token is sold, but the smart contracts can’t govern the licensing of that media for commercial purposes, and it can’t charge people to view the media, because that isn’t how the internet works.

Why would I buy an NFT when I can just see the image for free?

Why indeed?

Copyright changed when the world went digital, because copying things is what computers (especially networked computers) do. The text and images that make up The Deep Dive on our readers’ screens are copies that their machines have made of the copies on our servers. There is no “original” the way there is an original of the Mona Lisa, because one digital copy is as good as the next one. It’s the token that isn’t fungible. The media file, well…

If everyone who wanted to read The Dive had to buy an NFT, nobody would read it. And if the only way to see the art associated with an NFT was to buy the NFT, then nobody would ever buy an NFT. So they make the art free to view, and people buy the NFTs. Often for a lot of money. Business Insider puts the total size of the NFT market at $7 billion. The whole TSX Venture Exchange is worth $76 billion.

What gives?

How and why are tokens representing free “art,” that afford the buyer no licensing rights or any anything else, creating 1,000%+ gains? What does the buyer get that The Dive’s readers aren’t getting when they look at this screenshot?

The ability to sell it again, that’s what. The notion that the issuer of a junk bond would ever make the coupon payments, or that a micro-cap software equity would ever have practical value to anyone was always a fairy tale. All that ever mattered to a buyer of any negotiable product was that there might be another buyer.

Contracts for rights to images and music existed before there even was a blockchain to track them on, and will still exist after someone uses a quantum computer to smash the blockchain and everything on it to smithereens. There was no known gap in the process that had to be plugged by a new technology. NFTs are a solution looking for a problem, and it’s never long before solutions like that are swallowed up by the largest and most pervasive problem: capitalism.

How do I get in on this?

One of the larger entities of the NFT gold rush, so far, has been OpenSea, a platform that allows users to create, sell and trade NFTs. It’s got a friendly demeanor and plays itself more like a modern art gallery than an unregulated stock market. Enterprising individuals can use it to buy or trade NFTs or create their own. It isn’t the only game in town, but it’s the one with the highest profile, and profile might be the most important part of speculative assets.

What can I make them out of?

According to the OpenSea terms of service, any user that makes and sells an NFT must first own the right to the art they’re using to make the NFT, but there isn’t anything stopping anyone from just creating NFTs out of art that they don’t own. OpenSea has a process by which it entertains take-down requests from creators whose art is being offered up as an NFT without their permission, but OpenSea is just a platform.

Once the token has been created, the smart-contract exists, and can be bought and sold whether OpenSea allows it on the platform or not, and whether the artist wants that to happen or not. Unsurprisingly, the rights situation that blockchain smart contracts were presumably meant to solve has just been wrapped up in the larger problem, and NFTs have effectively become another way creators can be ripped off.

Why must I feel like that? Why must I chase the cat?

It’s nothin’ but the dog in me, hoser.

Yours truly put together a Bob and Doug Mackenzie / George Clinton mashup called “Ralph the Atomic Dog,” complete with an NFT, as part of our reporting for this story. It isn’t for sale, because we certainly don’t own the rights to either of the tracks in this mix, but also because we don’t want to go through the embarrassment of it not selling.

Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Wow. I’ve been dabbling in it, doing ‘ if it doubles take out half,’ and I may leave it at that. Sounds like taking out loans to buy stock, like the big crash of 1930’s? Great article.

Thanks for reading.