Yesterday, NG Energy (TSXV: GASX) announced that it had conducted two successful drillstem tests and a test “within three prospective zones in the Magico-1x well.” The tests produced 13.2 MMcf of gas, while at the same time demonstrating a flow rate of over 15 mmscf/d for the well within the Cienaga de Oro formation across 76 feet of net pay, with zero water produced.

Additionally, the company said that after all the analysis is completed, they will continue with the spudding of the Brujo exploration well.

In Beacon Securities’ note on the news release, they reiterate their buy rating and C$2.80 12-month price target, which represents an upside of 140%. On the news, Beacon says it’s positive as the company showcases that it can run successful exploration programs.

They write, “We have long stated that each well in the Phase 1 drilling program on that block has the potential to produce in the range of 20-35 mmcf/d,” adding that they believe that Magico-1x still has the potential to hit those rates and that at a rate of 15 mmcf/d, the company could see over C$11 million in annual EBITDA from the well.

Beacon adds that there are over 1,000 feet of vertical depth that has the potential to hold several CDO zones and that the next step for NG Energy is drilling at the Brujo well that is roughly 10km east of Magico.

Lastly, Beacon writes, “the market reaction to this well of a 16% dip this morning is too drastic,” while reminding investors that this is the company’s first natural gas exploration well at the SINU-9 Block.

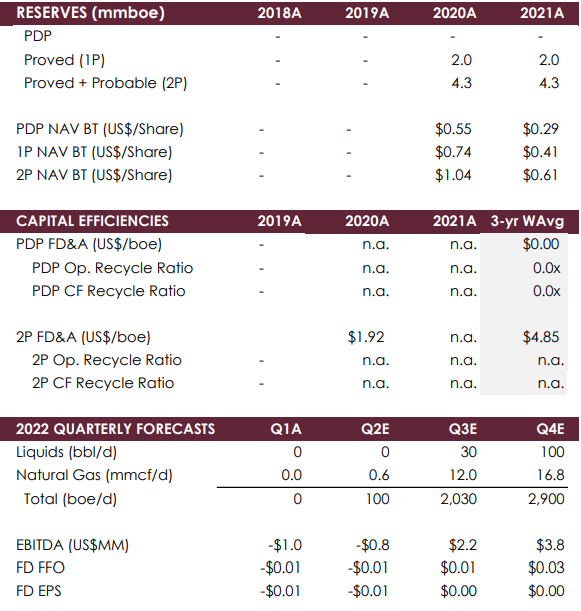

Below you can see some of Beacon’s estimates for the company.

FULL DISCLOSURE: Canacom Group, the parent company of The Deep Dive has been compensated to provide coverage on this company. The company has been compensated to cover this story on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.