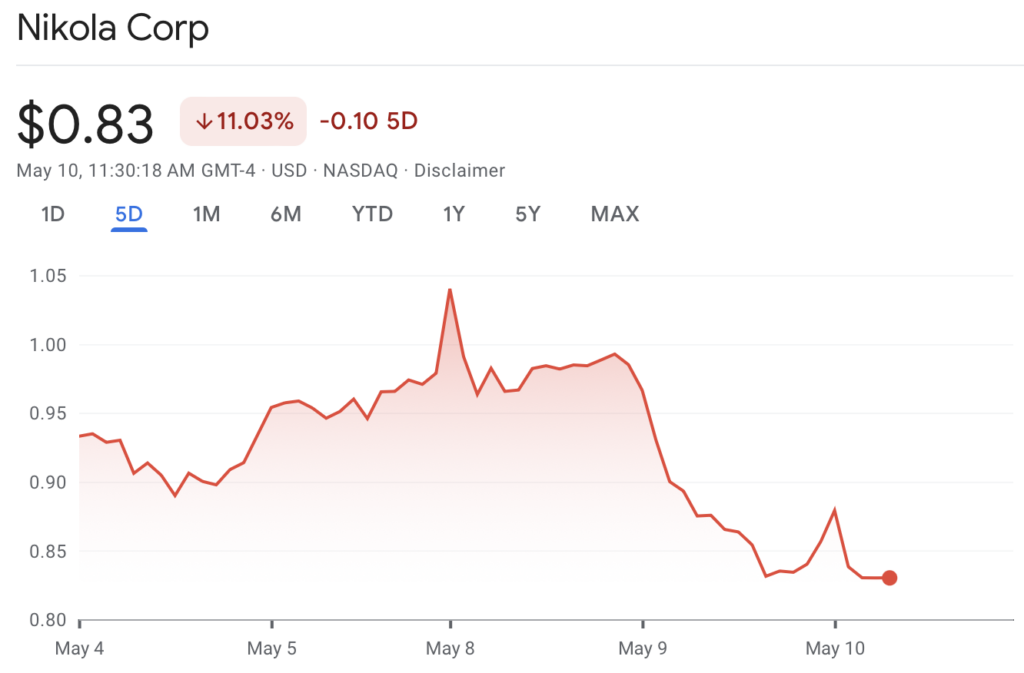

Nikola Corp (Nasdaq: NKLA) posted a larger quarterly loss on Tuesday and said it would halt production at its Coolidge, Arizona, factory to streamline the assembly line due to slow demand for its battery-powered trucks.

The company announced it would increase its cost-cutting efforts and will only produce battery electric trucks on demand, sending its stock down 13%.

Investors have focused on Nikola and other EV makers’ cash reserves, fearing that sluggish sales will force the businesses to sell more shares to obtain funding.

According to Nikola, cash burn in the first quarter was $240 million, compared to $200 million each quarter in 2022.

“This level of cash burn is not sustainable for our business, and we are looking at every option for reductions in spending,” the company’s finance chief, Stasy Pasterick, said on the earnings call.

“I am personally driving renewed focus on aggressive management of all three pillars of working capital: cost reductions, specifically payables, inventory procurement and management, and of course, cash collections,” she added.

The Coolidge production line will reopen in July and will accommodate both hydrogen fuel cell and battery electric trucks on the same line, according to Nikola, who added that the emphasis will be on building the former.

Nikola’s net loss increased to $169.09 million in the third quarter, or 31 cents per share, up from $152.94 million the previous year. The company lost 26 cents per share on an adjusted basis, barely meeting the expectations on the street.

Revenue increased from $1.9 million to $11.1 million, but this is still lower than the street estimate of $12.5 million.

Nikola announced plans to sell its 50% investment in a European joint venture with Italian truck manufacturer Iveco Group in order to focus on the North American market. The selloff is expected to equate to $35 million in cash and 20.6 million Nikola shares.

“Manufacturing and energy are capital intensive businesses, and we need to remain focused where we have competitive and first mover advantages,” Nikola said.

In the third quarter, Nikola produced 63 battery-electric trucks and supplied 31 to dealers. During that time, its dealers sold 33 trucks to end users. Nikola’s next model, a longer-range fuel-cell powered version of its semitruck, is set to enter production in July, as previously planned.

Nikola said that manufacturing of the battery-electric vehicle will be temporarily halted until the assembly line is reconfigured to construct both the battery-electric and fuel cell trucks. While it anticipates the fuel cell vehicle to be its major product, it will continue to construct battery-electric trucks to order once production of the fuel cell truck begins, according to the company.

“As we move forward, we will be focusing on the North American market, hydrogen fuel cell trucks, the HYLA hydrogen refueling business, and autonomous technologies,” CEO Michael Lohscheller said. “We have the right products at the right time.”

The company also stated that it was considering reorganizing its Romeo Power battery manufacturing unit, which might entail selling assets or declaring bankruptcy. Last year, Nikola paid $144 million for Romeo, one of its battery suppliers, in an effort to strengthen its supply chain.

Information for this briefing was found via Reuters, CNBC, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.