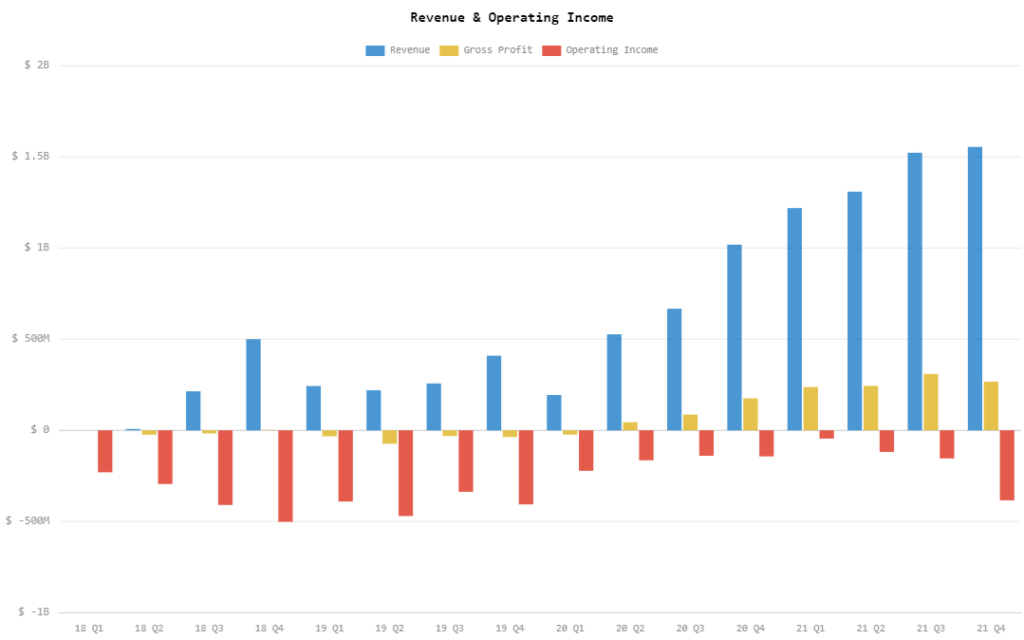

NIO Inc. (NYSE: NIO) reported on Thursday post-closing its financial results for Q4 and full-year 2021. The financials highlighted a quarterly revenue of US$1.55 billion, an increase from Q3 2021’s revenue of US$1.54 billion and Q4 2020’s revenue of US$1.04 Billion.

Down the line, the company incurred a quarterly net loss of US$336.4 million compared to a US$129.6 million net loss last quarter and US$217.9 million last year. This translates to US$0.21 loss per share.

For the full year, the automaker recorded US$5.67 million in revenue and US$630.3 million net loss compared to 2020’s US$2.55 million in revenue and US$832.3 million net loss.

In the Q4 2021 earnings call, CEO William Li said the firm aims to have its first profitable year in 2024.

“In terms of the overall strategic direction for the Company, our target is that we can achieve breakeven for a single quarter in the fourth quarter of 2023, and we can achieve breakeven or reach profitability in 2024 for the full year,” said Li.

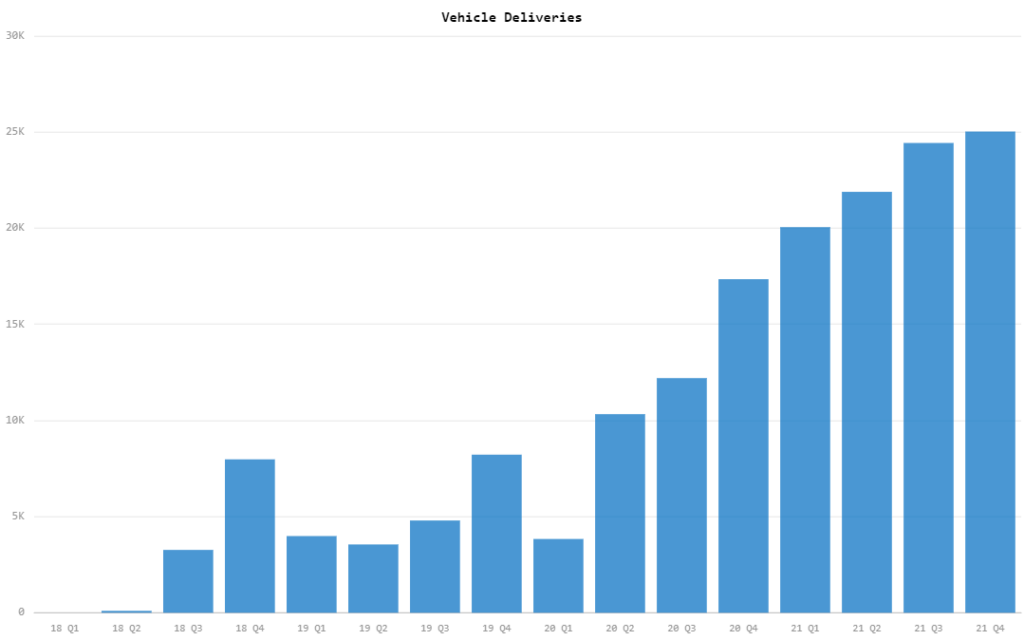

The company reported a total of 25,034 vehicle deliveries during the quarter, up from the 24,439 deliveries in the previous quarter and 17,353 deliveries in the year-ago period. This puts the annual vehicle deliveries for 2021 at 91,429, a 109.1% increase from 2020.

For Q1 2022, the firm expects to deliver 25,000 – 26,000 vehicles while quarterly revenue is anticipated to be between US$1.51 – US$1.57 billion. These are both increases from Q1 2021 actuals of 20,060 vehicle deliveries and US$1.22 billion in revenue.

The company ended the year with approximately US$2.41 billion in cash and cash equivalent, putting the balance of the current assets at US$9.99 billion while current liabilities came in at US$4.58 billion.

NIO Inc. last traded at US$21.98 on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.