Elon Musk’s first day at the Twitter helm involved firing top executives, including CEO Parag Agrawal, CFO Ned Segal, and Vijaya Gadde, head of legal policy, trust, and safety. But, it seems the new “chief Twit” would get himself out of paying their severance packages as they were reportedly terminated “for cause.”

If the top executives, including Agrawal, were fired, they would be entitled to compensation ranging from US$20 million to US$60 million under the merger agreement.

The termination provides the executives a “golden parachute” clause equivalent to US$204 million in compensation and stock awards according to a US Securities and Exchange Commission filing. Agrawal, Segal, and Gadde will receive a year’s salary and health benefits. As with all the company’s stockholders, they will also be compensated for their stake in the company. The said three executives will receive a payout of about US$65 million, equivalent to 1.2 million shares total, with US$34.8 million belonging to Gadde.

However, Musk reportedly fired the executives “for cause,” which means he did it because he claimed he had justification, which may nullify the agreement, according to two individuals familiar with the situation.

The executives, which also include former general counsel Sean Edgett, are also reportedly considering their next actions.

More job cuts

According to four sources with knowledge of the situation, Musk planned to start laying off workers at Twitter as soon as Saturday, with certain managers being ordered to create lists of personnel to lay off.

The layoffs at Twitter would occur before the Nov. 1 deadline for employees to obtain stock awards as part of their compensation. Musk may avoid paying the grants by laying off staff before that date, though the merger deal requires him to pay the employees cash in lieu of shares.

The scale of the job cuts couldn’t be determined as of the moment. However, Gerber Kawasaki CEO Ross Gerber said that Jared Birchall, the head of Musk’s family office, relayed to him that layoffs at Twitter are imminent.

“I was told to expect somewhere around 50 percent of people will be laid off,” he said. Currently, the firm has around 7,500 employees.

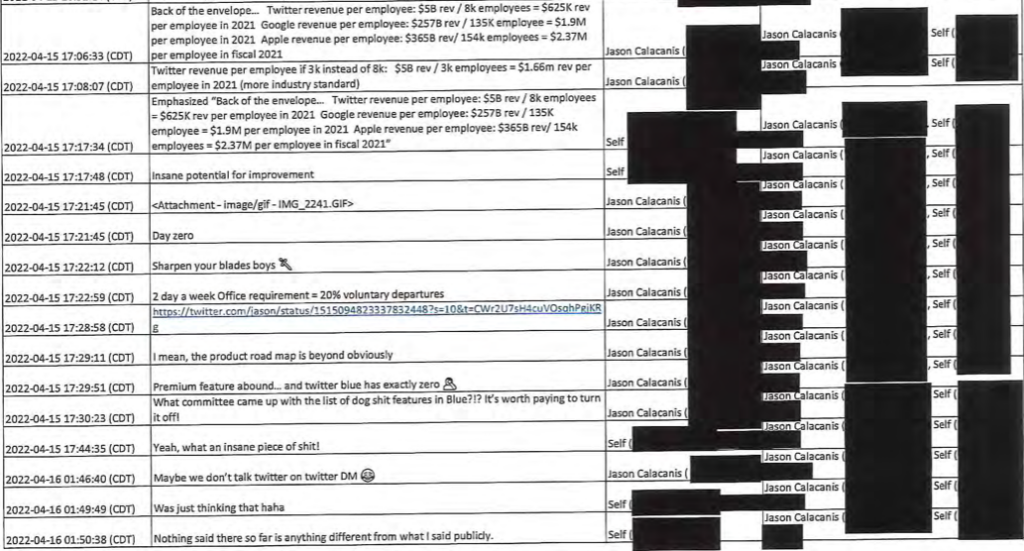

In one of the revealed text conversations during the legal battle between the Tesla chief and the Twitter board, self-proclaimed Musk fan Jason Calacanis made the math for the billionaire showing how the platform would be more cost-efficient and aligned with “industry standard” if it had around 3,000 employees only.

Musk: Twitter board deliberately hid evidence

While the deal has already closed, Musk recently accused Twitter’s former board of directors and their lawyers of “deliberately” obstructing court proceedings.

In a screenshot he shared on the platform, Musk highlighted Twitter’s Global Head of Safety & Integrity Yoel Roth’s message implying that a Twitter employee called Amir used “fraudulent metrics” to report objectives and critical results (OKRs).

“Literally doing what Elon is accusing of us doing,” added the executive.

Wachtell & Twitter board deliberately hid this evidence from the court. Stay tuned, more to come … pic.twitter.com/CifaNvtRtt

— Elon Musk (@elonmusk) October 31, 2022

Roth made the remarks in a May 17 communication, around the time Musk accused Twitter of being “extremely suspicious” about its reporting of spam bots. The fake accounts and the platform’s metrics in estimating its size have been one of Musk’s main contention regarding the acquisition, reneging twice on the deal because of the matter.

However, Roth is still within the company in the same capacity even after Musk has taken over. In a follow up tweet, the Tesla chief defended the safety & integrity head saying, “he has high integrity, and we are all entitled to our political beliefs.”

We’ve all made some questionable tweets, me more than most, but I want to be clear that I support Yoel. My sense is that he has high integrity, and we are all entitled to our political beliefs.

— Elon Musk (@elonmusk) October 31, 2022

Information for this briefing was found via The New York Times, Fox News, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.