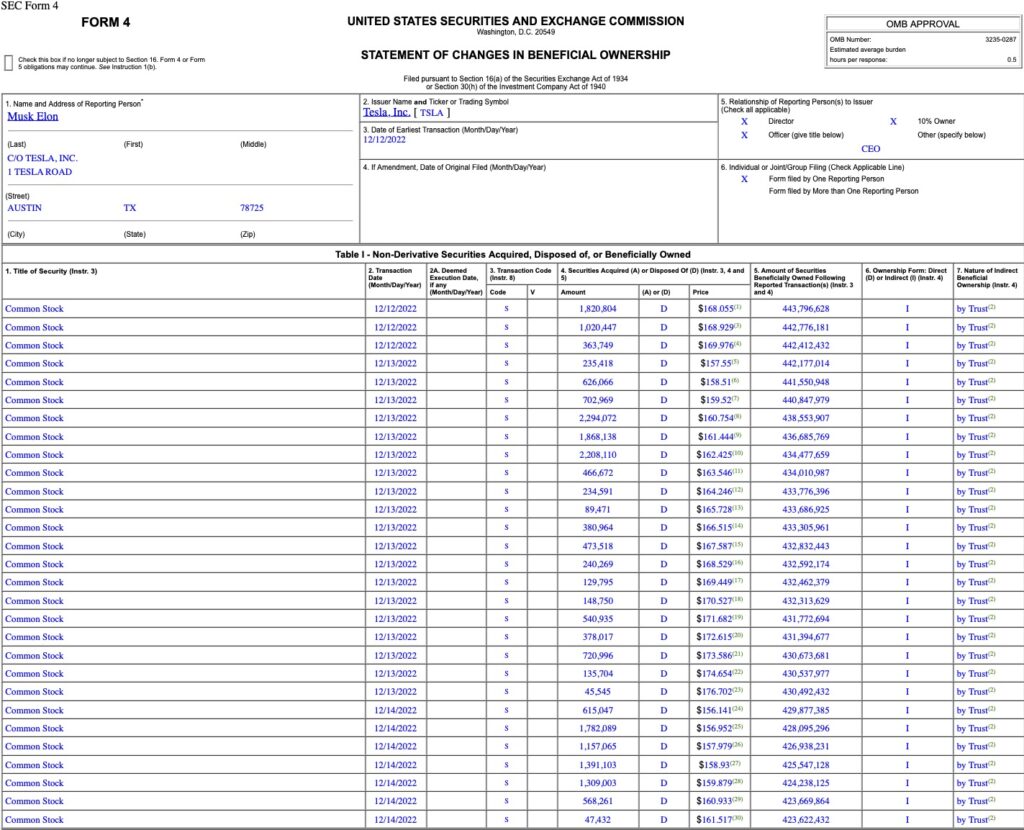

Tesla (Nasdaq: TSLA) Elon Musk sold a total of 22 million shares worth $3.58 billion in the electric-vehicle maker in the past three days, according to an SEC filing on Wednesday.

This follows the chief executive selling 19.5 million Tesla shares over the three market days in November, generating cumulative gross proceeds of $3.9 billion. This brings the billionaire’s total gross from selling Tesla shares since buying Twitter to around $7.4 billion.

Year-to-date, Musk has sold Tesla stocks to nearly $40 billion. He still remains the largest shareholder but his stake has come down to 13.4% of the company, according to Refinitiv data.

The Tesla share sales have been particularly noteworthy after Musk claimed before that no more “planned sales” will happen for the year.

— Stephen Geiger (@Stephen_Geiger) December 15, 2022

Forgot to say one thing at Tesla annual shareholders meeting: just as my money was the first in, it will be the last out.

— Elon Musk (@elonmusk) June 5, 2013

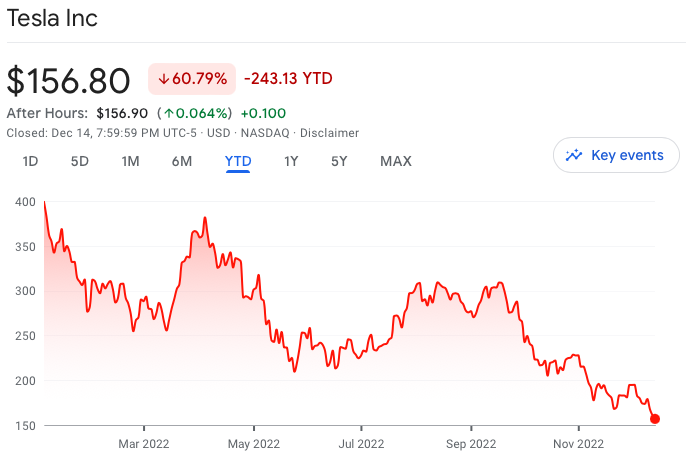

Musk lost his position as the world’s richest person this week due to a dramatic drop in the value of his Tesla shares this year. According to Forbes and Bloomberg, he was surpassed at the top by Bernard Arnault, CEO of luxury goods conglomerate LVMH.

Investor fears that Musk’s acquisition of Twitter will take his attention away from Tesla which saw its stock fall by more than 60% in 2022, making it one of the worst-performing stocks among major automakers and tech firms this year.

READ: Tesla Taking A Hit As Elon Musk Focuses On Twitter

In a recent tweet, Musk said it was “generally wise” to avoid using margin loans on any company when there are macroeconomic risks involved.

“When there are macroeconomic risks, it is generally wise to avoid using margin loans on any company, as stocks may move in ways that are decoupled from their long-term potential,” Musk tweeted.

The tweet comes after Musk’s bank lenders are reportedly considering replacing some of the high-interest debt he piled on Twitter with fresh margin loans backed by Tesla stock that he would be personally responsible for repaying.

Tesla continues to face production hurdles–specifically at its Texas gigafactory–due to recruitment hurdles and problematic employer image. When the Berlin gigafactory first launched in March, the goal was to build 5,000 vehicles per week by the end of the year–even stretching this out to construct half a million Teslas in Berlin in 2022, as Musk told a German media. However, it is far from meeting its objectives due to serious recruitment issues—the company has only hired 7,000 individuals out of a planned 12,000.

READ: Tesla Misses Berlin Gigafactory Production Target As Hiring Continues To Be A Problem

The carmaker is also reportedly planning to reduce output by at least 20% from its Shanghai facility’s full production, bringing capacity levels on par with October and November. The voluntary move comes amid a slump in China’s demand for Teslas, indicative of the company’s recent onslaught of incentives and price cuts. The EV maker has also drastically reduced its delivery times, also suggesting that supply is outpacing domestic demand.

Musk is currently in a legal battle to defend why he’s worth the massive $50-billion Tesla pay package that helped make him the world’s wealthiest person.

Tesla last traded at $156.80 on the Nasdaq.

Information for this briefing was found via Reuters, BBC, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.