On December 29, the Swedish battery maker Northvolt produced its first lithium-ion battery cell, making it the first electric vehicle (EV) battery company based in Europe. The company plans to begin supplying the EV power packs to car makers in 2022.

The firm already has a reported US$30 billion in contracts to supply such customers as BMW, Volvo and Volkswagen Volkswagen owns an approximate 20% stake in Northvolt and accounts for about half the company’s total orders.

Northvolt’s gigafactory has annual battery production capacity of 40 gigawatt-hours (Gwh) and is located in the far northern Swedish city of Skelleftea. One Gwh of capacity equates to battery production for about 10,000 EVs per year. Construction of the facility began in 2019.

Northvolt already plans to increase its production capacity to 60 Gwh and raised US$2.75 billion in June 2021 to fund the expansion. That funding round, which was led by Volkswagen and Swedish and Canadian pension funds, values Northvolt at nearly US$12 billion.

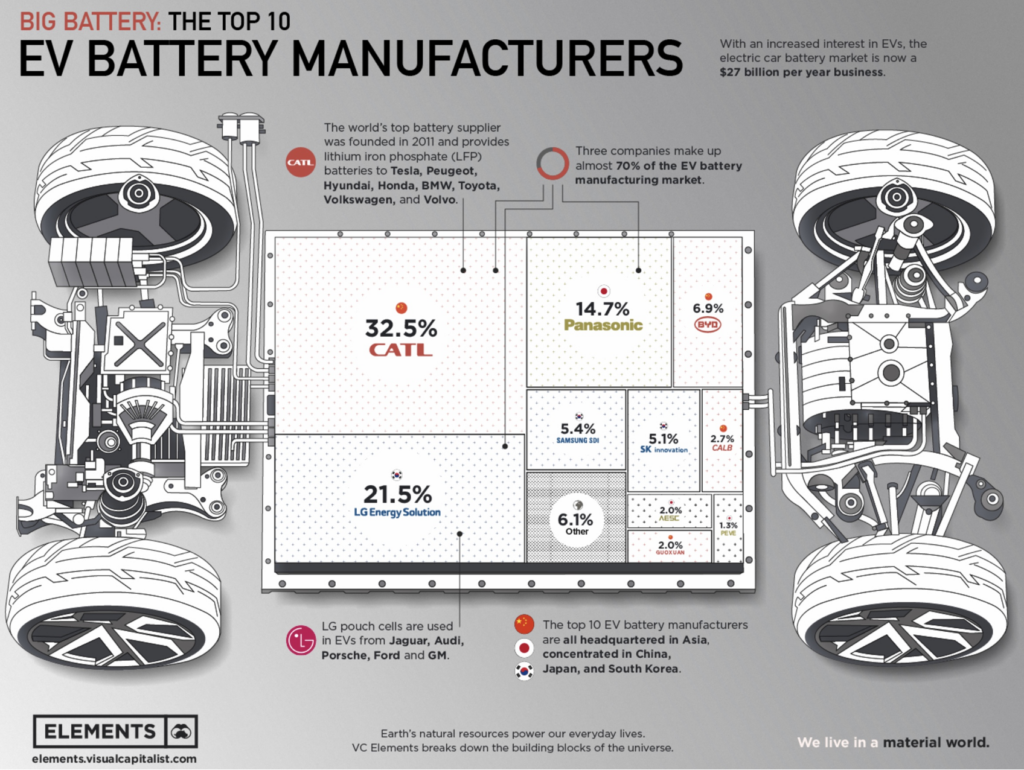

To put Northvolt’s activities into further perspective, China’s Contemporary Amperex Technology Co., Ltd. (CATL), the world’s largest battery manufacturer, has around 69 Gwh of capacity in operation and about 155 Gwh under construction. CATL’s stock market value is around US$216 billion, and it controls about a 32.5% share of the global EV battery market.

Moreover, there are at least 27 battery manufacturing facilities that have been announced in the U.S., according to the Center for Automotive Research. These include plants owned — or owned in joint ventures — by Tesla, General Motors and Ford.

The net effect of all this prospective battery production has been an extraordinary increase in lithium prices. Lithium is a key component of the cathode in most EV batteries. Lithium carbonate prices have more than quintupled in a year, and have tripled since just this summer.

Furthermore, prices may continue to rise in 2022. In mid-December, a spokesman for Abemarle Corporation (NYSE: ALB), the world’s largest lithium producer, told S&P Platts that the lithium market would “remain tight in 2022 as new industry supply comes close to keeping up with expected demand.” S&P Platts is one of the world’s most trusted commodities information sources.

To take advantage of the very constructive supply-demand characteristics of the lithium market, we continue to look at two smaller lithium developers; Lithium Americas Corp. (TSX: LAC) and Sigma Lithium Corporation (NASDAQ: SGML). The flagship lithium properties for both companies, located in Argentina and Brazil, respectively, are expected to commence production in 2022.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.