On February 5th, Nuvei Corp (TSX: NVEI) announced preliminary fourth-quarter numbers. They announced total revenue to be between $114 – $118 million, EBITDA between $50 – $52 million, and an operating profit between $16.5 – $19.5 million.

Nuvei currently has 13 analysts covering the company with a weighted 12-month price target of $65. This is up from the average at the end of January, which was $54.87. Only one analyst has a strong buy rating, while eight have buy ratings, and the last four analysts have hold ratings.

Below are the analyst changes since the news release:

- Scotiabank raises target price to C$83 from C$71

- CIBC raises target price to C$90 from C$76

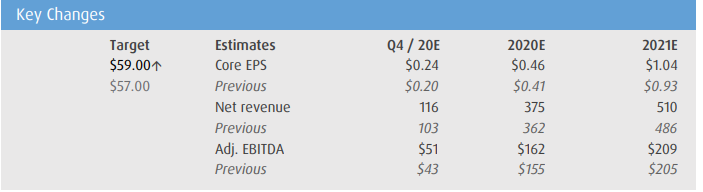

On the 5th, BMO Capital Markets analyst James Fotheringham raised their 12-month price target to C$59 from C$57 and reiterated their market perform rating. He writes, “Following NVEI’s 4Q20 positive pre-announcement, we raise our estimates by up to 13% due to higher expected revenues (from faster volume growth and mix shift to more e-commerce business).” He adds that Nuvei is exceptionally positioned for the e-commerce growth that has been accelerated by the pandemic but worries that with the stock being up 120% from IPO, about “the vulnerability of its valuation multiple.”

Nuvei’s implied core earnings per share are $0.24, which is 20% above BMO’s estimate, while revenue and EBITDA are coming in much higher and Fotheringham writes, “revenues appear driven by faster volume growth (partly offset by a lower take rate).” He adds that the fourth quarter volume growth is 50% year over year, while e-commerce accounts for 80% of total volume. He writes, “We expect e-commerce volume growth to remain elevated throughout 1H21E, then moderate in 2H21E as activity normalizes.”

Below you can see BMO’s key changes to full-year 2020 and 2021 estimates. Fotheringham comments, “We raise our NVEI core EPS estimates by 11% in 2020E (to $0.46 from $0.41), 13% in 2021E (to $1.05 from $0.93), and 11% in 2022E (to $1.20 from $1.08); higher than previously-modeled revenues more than offset higher expected operating costs.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.