On Thursday, Canaccord Genuity became the 12th investment bank to initiate coverage on Nuvei Corporation (TSX: NVEI). Their analyst Joseph Vafi initiated coverage with a buy rating and U$105 price target. This puts Canaccord’s price target slightly below the street high of U$116 by Cowen and Company.

The mean 12-month price target sits at U$91.62, while the lowest comes in at U$74. Out of all 12 analysts, three have strong buy ratings, eight have buy ratings, and a single analyst has a hold rating.

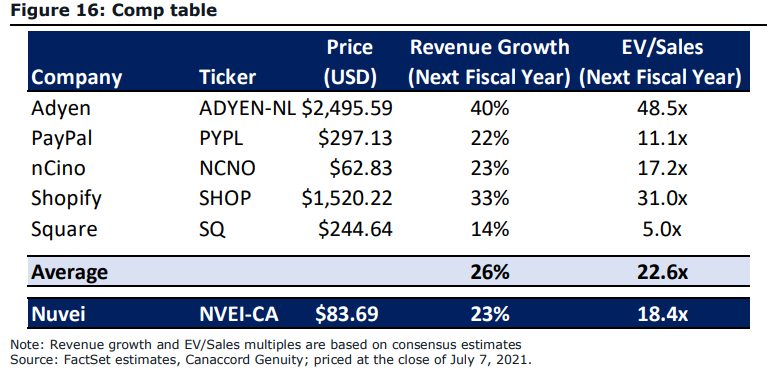

Vafi says that when you zoom out and look at the greater payment space, Nuvei makes itself out to be a company that is specifically built for “better-than-average growth.” This comes in many forms, such as their unique payment platform or their “majority exposure to fast-growth e-commerce, impressive global footprint.” Nuvei has operations in North America, Europe, and Latin America. They say that due to Nuvei’s payment volume mainly coming from ecommerce, its peers should be PayPal and Adyen.

One of the best features Nuvei has, according to Vafi, is their “À la carte service,” in which they have a full suite of offerings, including FX, global payment in gaming, fraud, and crypto payments. These are all a way for Nuvei to build customers into their suite of offerings and help Nuvei have high customer retention and strong organic growth.

Vafi says, “we have been impressed with the Nuvei M&A strategy,” and believes due to its relatively smaller size, it can continue to target M&A opportunities in the payment sector that the larger players don’t even know about. They call Nuvei’s acquisition of SafeCharge, “a true game-changer for Nuvei.”

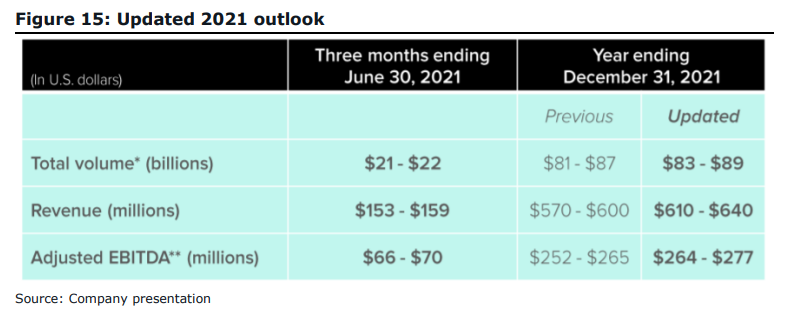

Canaccord believes that the first-quarter growth will continue into the rest of the year, with revenues increasing by 80% in the first quarter and 29% sequentially. Pro-forma revenue growth was up 44%, which makes Canaccord believe that they are gaining market share. They add, “we think Nuvei is well positioned to deliver outsized growth over the next couple of years.”

Below you can see Canaccord’s second quarter and full year estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.