Inflation and money supply concerns aside, the upcoming $1.9 trillion stimulus bill is expected to provide a major boost not only to the US economy, but also to the rest of the world.

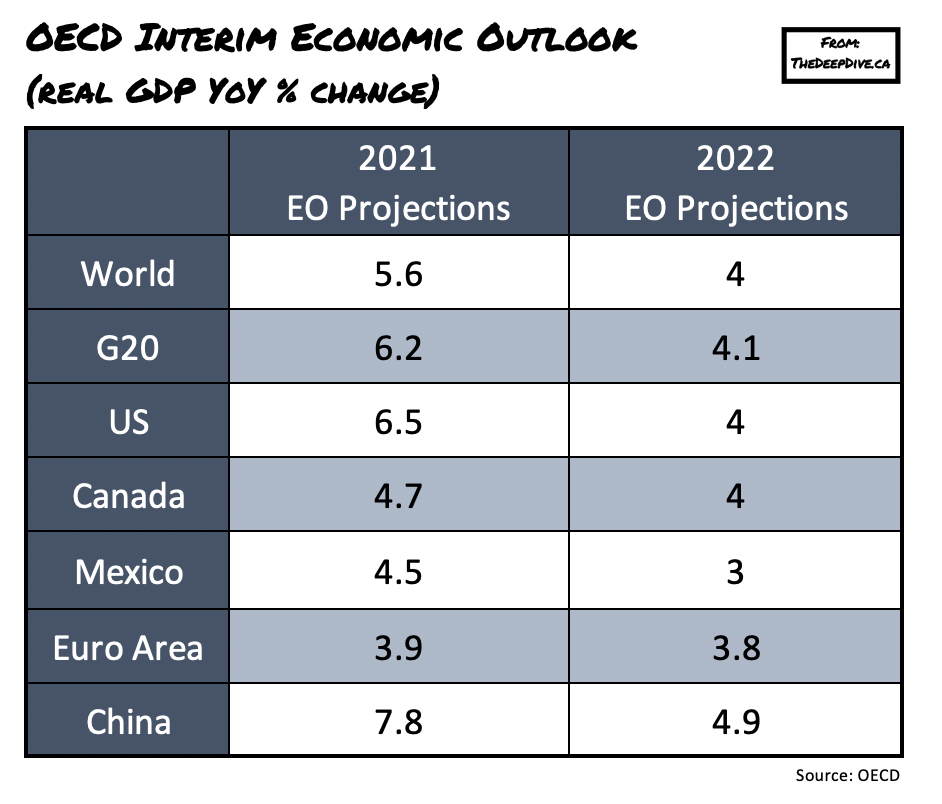

According to the latest OECD forecast, the extensive Covid-19 stimulus, coupled with the vaccine rollout, is expected to give the US economy a significant boost in 2021. In the updated outlook, the Paris-based economic organization now forecasts the US economy will expand by 6.5% this year, marking an significant increase from an earlier prediction of 3.2% growth. The report estimates that the latest round of stimulus will provide an immediate boost to US consumers, and raise America’s output by up to 4% in 2022.

“The significant fiscal stimulus in the United States, along with faster vaccination, could boost US GDP growth by over 3 percentage points this year, with welcome demand spillovers in key trading partners,” the report said. Indeed, the OECD also anticipates that Joe Biden’s $1.9 trillion bill will also have a broader impact on the world, as well. Standing to benefit from America’s latest round of spending is Canada, Mexico, the eurozone, as well as China, with the overall global economy expected to increase by 5.6% in 2021, up from a previous December forecast of 4.2%.

America’s stimulus package is expected to raise Canada’s and Mexico’s economic output by 1%, meanwhile the eurozone and Chinese economy stands to benefit by a 0.5% boost. On the other hand though, the OECD notes that the latest round of spending will also cause inflation to spike by around 0.75% annually in 2021 and 2022— which is likely a very conservative forecast given the surging level of M1 money supply that has already filled the economy.

Information for this briefing was found via OECD. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.