The economic restrictions imposed during the height of the second world war make today’s pandemic-induced controls on indoor dining and mandatory face coverings appear soft. In America, the government rationed nearly everything— gasoline, milk, shoes— even prohibited the production of bicycles and fridges. In fact, the economic restrictions at the time were so stringent, that there were only a total of 139 vehicles sold in the US in 1943. However, that all soon reversed once the war ended, allowing the historic consumer-boom to ensue. Americans were able to put what was left of their savings into their economy, and by 1950, American carmakers were able to produce over 8 million new vehicles each year.

Fast-forward to today, as lockdowns are being slowly lifted and the ongoing vaccine rollout is reducing Covid-19 hospitalization rates, attention is being increasingly turned to the unfolding of the economic recovery. The main question being asked is whether or not major economies— such as America’s and Canada’s— will be able to replicate a similar post-war scenario, with household savings fuelling an accelerated comeback.

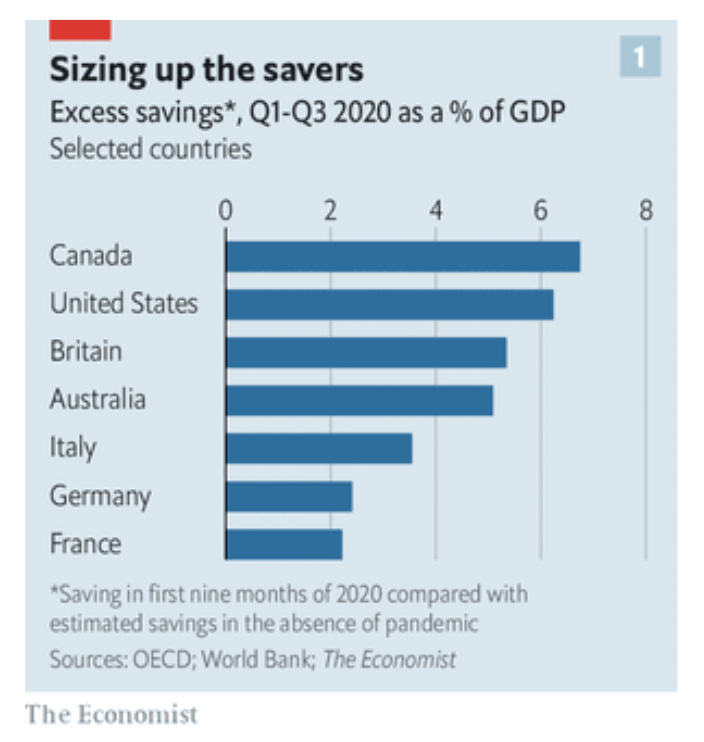

Indeed, households across major economies have accumulated an extensive amount of cash. The Economist compiled data across 21 developed countries on personal savings (the difference between post-tax income and consumption), and found that in the first nine months of 2020, Canadian and US households stashed away over $6 trillion in savings. If the pandemic had not happened, that figure would likely have stood at half that amount, or around $3 trillion. In the US, surplus savings could potentially top 10% of GDP, especially once Joe Biden’s $1.9 trillion stimulus is unleashed into the economy.

Interestingly, consumers typically do not save at such a high intensity during normal recessions. In fact, incomes usually tend to fall during times of economic hardship, largely due to pay cuts and job losses. However, governments in developed nations have allocated approximately 5% of their combined GDP towards various unemployment benefits, direct stimulus cheques, and numerous other furlough programs. This has caused household incomes to increase over the past year, while Covid-19 lockdowns have simultaneously reduced opportunities for spending.

So, this begs the question: what are households going to do with all of their excess cash? In the event that economies completely lifted all restrictions and consumers spent all of their savings in one go, GDP growth of developed countries would presumably exceed 10% in 2021, significantly outpacing the post-war recovery (whilst also creating a surge in inflation). On the other end of the spectrum though, households could also refrain from spending any of their pent-up savings, perhaps if they expect their taxes to increase in order to eventually pay for the unprecedented government stimulus spending.

According to research by JPMorgan, the most likely scenario will probably land somewhere between the two extremes. The US bank expects consumption to soon reach pre-pandemic levels, especially amid a strong global recovery. Similarly, Goldman Sachs calculates that Americans’ spending of additional savings will increase GDP growth by around 2 percentage points in the first full year following an economic reopening. Such scenarios point to an adequately swift recovery in both GDP output and employment. In fact, the OECD recently updated its GDP growth outlook for G20 countries to 6.2% this year, under the presumption that household savings (with more on the way following Joe Biden’s $1.9 trillion stimulus) characterized pent-up demand.

However, such forecasts remain fairly ambiguous, because there are several paradigms that set apart the current economic scenario and the one witnessed after the second world war. For one, the most important aspect that is likely being overlooked is how the accumulated excess cash is distributed across the income categories, followed by whether households indentify the excess cash as wealth or income.

First of all, a growing body of evidence shows that in rich economies, wealthier households have accumulated a large portion of the excess cash. Those individuals have been the least likely to lose their job, and a large share of their consumption is discretionary, such as restaurant dining and holiday trips (it is also these types of services that have been shut down as a result of the pandemic). However, a significant proportion of savings in the hands of wealthy consumers diminishes the likelihood of a post-lockdown spending frenzy, because, as research suggests, they have a lower propensity to spend.

However, an anomaly still persists, especially in the US. The federal government’s fiscal stimulus has been remarkably generous, with a third round of direct cheques— this time to the tune of $1,400— soon being sent out to qualifying Americans. In the meantime, unemployment benefit top-ups have allowed some American workers to earn more from the government than they did at their previous jobs. This leaves those that fall under the low-income category in a position of even more savings than their wealthier counterparts, relative to their incomes.

The Economist brings attention to a recent JPMorgan study, which found that by the end of 2020, some of the poorest of Americans had 40% higher bank balances than the prior year, compared to the richest— which only saw their balances increase by 25% during the same period. Moreover, the poorest half of consumers have witnessed their liquid assets increase by 11% in value over the past year, which is almost twice the increase for the top 1%. It is also those that fall into low and moderate income categories that are more likely to spend their excess savings once restrictions are lifted, propelling the economic recovery.

The second component of the economic recovery, however, is more uncertain: if consumers distinguish their cash build-up as wealth or income. This is not an easily logical distinction, because, according to numerous studies, individuals are more inclined to increase spending if their is a similar boost to their income level (such as a pay raise), than they are if there is an increase in their wealth (such as an increase in the value of their home).

It is also worth noting that households in different countries have accumulated surplus savings in different ways. As the Economist points out, households in Britain and the euro zone have done so by reducing their consumption, meaning they are less likely to categorize it as additional income. In comparison, consumers in the US have built up excess savings as a result of generous stimulus payments, rather than spending reductions. In such a scenario, additional savings can be interpreted as additional income, which households may be more obliged to spend.

In conclusion, all of this points to a compelling disparity between the post-war boom, and today. Although during the 1950s America’s economic recovery was monumental, Europe’s was even more so; GDP growth boomed 50% faster throughout the same decade. This time however, the situation is very different. As the pandemic slowly subsides across the US and even more stimulus payments are en route to households which are more inclined to spend it, it may just be that America’s recovery will be one for the history books. Or, alternately, the excess savings will fuel the retail trading craze even further— either scenario is plausible.

Information for this briefing was found via the Economist, JP Morgan, Goldman Sachs, and OECD. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.