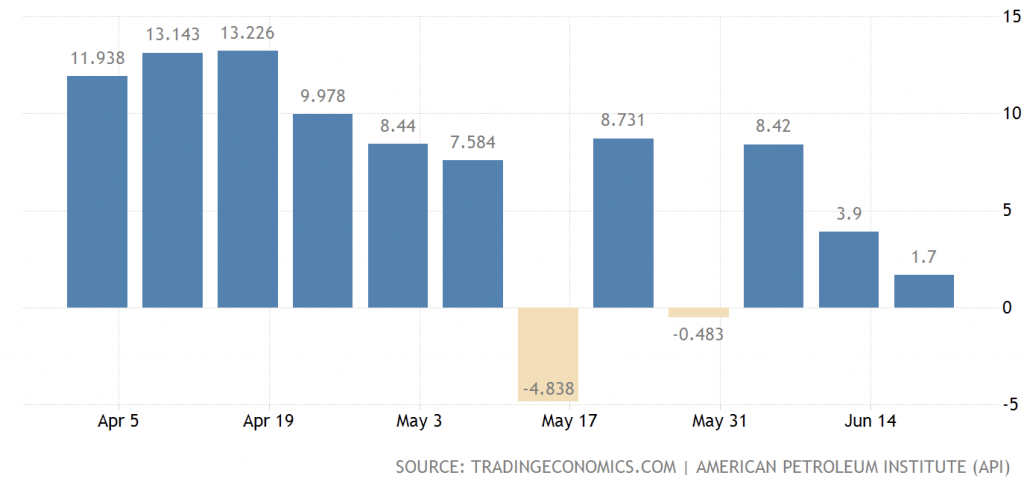

It appears that volatility in the oil industry has far from subsided amid the ongoing coronavirus pandemic. Oil prices spiralled once again, with WTI Crude falling as low as $37.10 on Wednesday. The oil price slide comes after the API released an update regarding a sudden increase in crude inventory builds. Analysts had previously projected an inventory of approximately 299,000 barrels for the week ending on June 19, but instead a total of 1.749 million barrels was reported.

Although US oil production has fallen substantially since the onset of the pandemic, with a decrease from 13.1 million barrels per day to 10.5 million barrels per day as of June 12, inventories are continuing to increase. The demand for oil continues to remain low, as some forms of lockdowns are still in place, and consumerism has not returned to pre-pandemic levels.

Furthermore, many market participants are fearful of yet another wave of coronavirus infections, given the current alarming daily infection rate increases across the US. The relaxing of restrictions across many states, as well as demonstrations have led to a sudden, nearly exponential increase in cases over the last couple of weeks, and as a result, a recovery in the demand for crude oil is less than likely in the near term.

Information for this briefing was found via OilPrice, API, and MarketWatch. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.