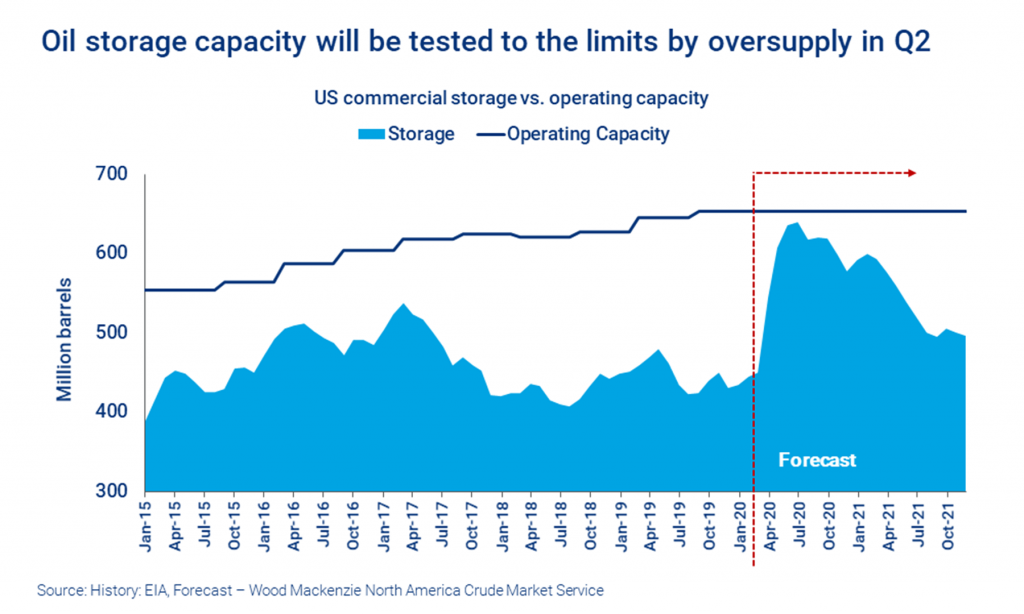

As previously reported, it is anticipated that US oil storage will reach maximum capacity by mid-May: now that prediction is becoming even more realistic, with Goldman’s chief commodity strategist foreseeing the global oil storage facilities becoming full within the next 3 to 4 weeks.

According to Jeffrey Currie, the chief commodity strategist at Goldman Sachs, there will soon be no more room to store excess oil supply given the current market conditions. As a response to economic shutdowns around the globe, the demand for fossil fuels has drastically decreased, and thus caused prices to plummet to historic levels. Even though a deal with reached with OPEC and its affiliates, it was still not enough to merely keep prices from dropping. Just last week, oil futures were trading at negative prices, meaning that sellers had to pay buyers in order to get the contracts off their hands!

Although Jeffrey notes that the worst may have passed, there is still a significant displacement between a supply and demand equilibrium. It may be another 4 to 8 weeks before we see re-balancing in the oil market again. Furthermore, it is worth noting that although equities have a much simpler rebound path to forthcoming growth, commodities such as oil do not.

Information for this briefing was found via Bloomberg, EIA, and Oil Price. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

There will be epic stories about this. We haven’t seen the end of negative oil futures. Fortunes will be lost here.