Rumours have started swirling that online used-car seller Vroom has filed for an initial public offering hoping to start trading in June. This move will test the ice-cold tech IPO market which has seen a major decrease in activity over the last 2 months. According to the Wall Street Journal, Goldman Sachs will be leading the public offering and will be joined by other firms including Wells Fargo, Bank of America and Stifel.

Vroom will look to catch the tailwinds of rival Carvana whose shares have increased 7x since their 2017 IPO. Carvana’s share price declined 80% during the COVID market selloff in March, followed by a quick recovery to now trading at near all time highs. Despite the rough market conditions, Carvana announced they successfully raised $600M in early April.

Thanks to a general movement towards social-distancing measures we have a new environment where consumers are more likely to purchase cars from home. We are now seeing online car sellers likely to gain market share from traditional dealers. As profiled by CNBC recently, buyers are now opting for a digital solution, where online banking portal DealerTrack has seen an explosion in online activity.

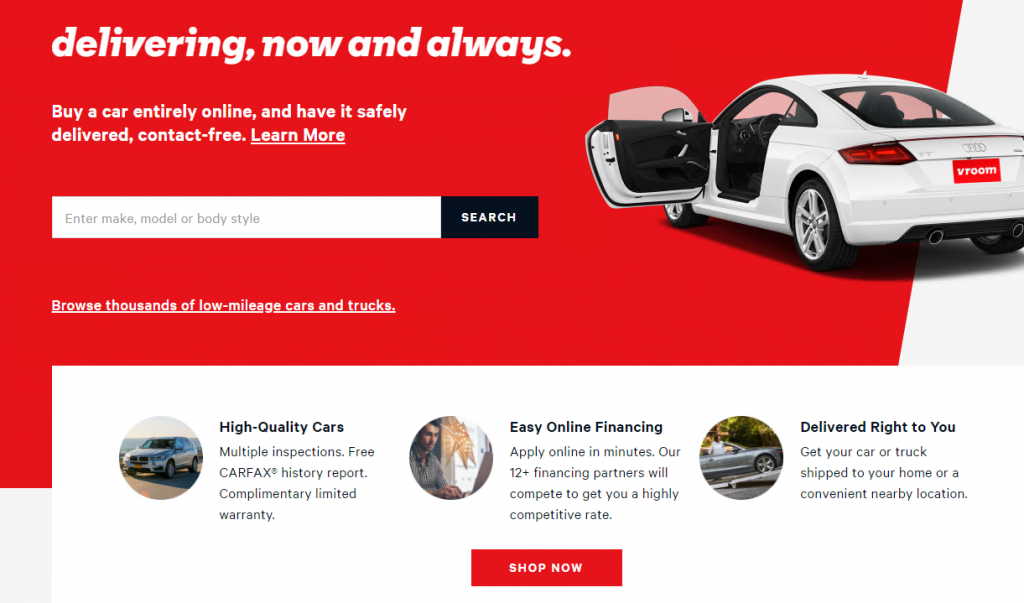

Vroom describes themselves as a full end-to-end solution, where you can find a car that meets your needs, sell your current one, do your financing; all without a trip to the dealership. They even allow for a 7 day return policy if the consumer is unhappy with their purchase.

Given current market volatility, the online retailer has surprised many with their decision to go public at this point in time. As of April 23rd, there was only 41 IPOs year to date, a 30.5% drop compared to the previous year.

Vroom’s IPO valuation hasn’t been stated publicly. However, in Q4 the Auto Fintech player raised $254 million in a private financing round at a valuation of $1.5 billion.

Information for this briefing was found via the Wall Street Journal, Y-Charts, and Sec.gov. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Great article! Will definitely recommend this to my friends.

Thank you.