It appears that oil production cuts have finally been agreed upon, with OPEC+ members agreeing to cuts consisting of 9.7 million barrels per day in an effort to combat a reduction in oil demand. Despite the agreement, many are anticipating markets to open bearish, with the belief that much larger production cuts were already priced in.

The agreement, which was stated to be signed only minutes ago, had seen much deliberation over the past several days. Traders had anticipated a deal to arrive on Thursday following a virtual OPEC+ meeting that had been postponed from earlier in the week. However, Mexico is said to have walked out of those discussions, refusing to commit to a 400,000 barrel per day cut in production.

The next day, it was reported by several outlets that Trump had settled with Mexico, with the US said to take responsibility over a large portion of those cuts. Mexico instead only committed to a quarter of what was expected of them, at 100,000 bpd. The result, is that 9.7 million bpd in production cuts have been agreed upon, instead of the planned 10 million bpd. The initial agreement is for a period of two months.

We have a deal! Opec plus to cut 9.7 million bpd – sources #OOTT

— Amena Bakr (@Amena__Bakr) April 12, 2020

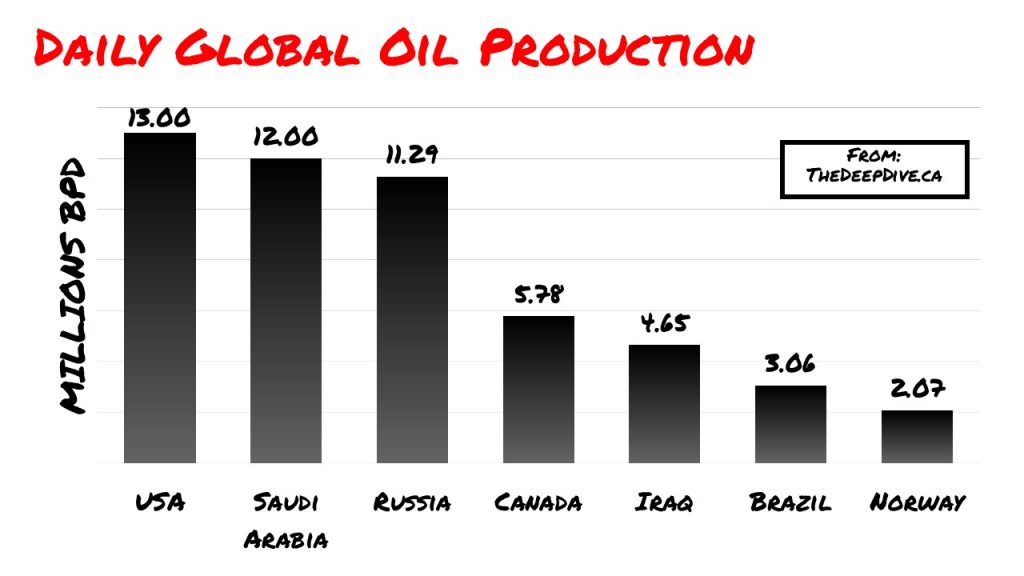

The US, who is not a member nation, is stated to be covering the remaining 300,000 in cuts Mexico was supposed to commit to. The struggle, however, is that production in the US is not run by a nationalized firm that the government can force production cuts on. Instead, it’s been reported that President Trump will “let market forces do their work,” which is starkly different than that of forced cuts.

#Kuwait's oil minister confirms the #Opec+ deal has been agreed and finalized:

— Nader Itayim | نادر ایتیّم (@ncitayim) April 12, 2020

"We now announce the completion of the historic agreement to reduce output by approx 10mn b/d from members of "Opec+" starting from May 1, 2020." #oott

The cuts are to be implemented as of May 1, leaving much time for producers to continue to over supply the current oil market. However, following a G20 meeting that occurred Friday, it has been rumoured that other nations have agreed to a combined 3.2 million bpd in production cuts to help prop up the price of oil. It is unclear however whom exactly will be performing these cuts.

West Texas Intermediate (WTI) closed Thursday’s session at a price of $23.17 after a wild session that saw heights of $28.32 and lows of $22.62. While production cuts are anticipated to be bullish for the market in general, with amounts far lower than initially expected – with rumours as high as 20 million barrels per day in cuts floating around late last week – it’s unclear whether or not the market will react positively or negatively to the news.

Rather, the market reaction may largely be predicated on how Saudi Aramco elects to price oil for the month of May. That announcement is expected to occur later today.

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.