Yesterday, Organigram Holdings (TSX: OGI) (NASDAQ: OGI) reported their fourth quarter financials. The company announced net revenues of $20.4 million, up 25% year over year, with a $38.6 million net loss. In the year ago period, Organigram had revenues of $86.8 million for the year with a net loss of $136.1 million.

Organigram currently has 15 analysts covering the company with a weighted 12-month price target of C$2.82. This is down from the average at the start of the month, which was C$3.51. Four analysts have strong buys. Another four have buy ratings, and the majority, seven analysts, have hold ratings.

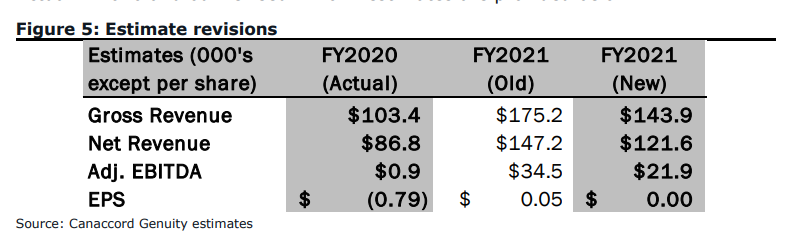

Matt Bottomley, Canaccord’s cannabis analyst, lowered their 12-month price target to C$2.50 from C$3, saying, “We reiterate our SPECULATIVE BUY recommendation. OGI trades at 2.6x our revised CY2021E EV/Revenue, compared to its LP peer group at 2.3x.”

He says that Organigram’s fourth-quarter earnings were generally in line with their expectations, “but saw little movement on the top line as the company is still in the process of revamping its future product offerings as the Canadian sector continues to expand.” Their $20.4 million in revenue was a, “modest bump but was consistent with management’s guidance.” Bottomley states that the increase was driven by the higher international/wholesale contribution for the period. At the same time, Organigram’s Canadian adult-use sales remained flat.

Bottomley says that Organigram reported another negative gross margin due to an $11.1 million inventory write-down, which he says “follows the trend from the prior quarter, which also included ~C$19M of unsaleable inventory provisions as the company looks to better right-size its operational structure.”

Bottomley believes that Organigram, “has been revitalizing its cannabis product platform during the second half of CY20,” with the company putting out 40 new SKU’s since July.

He also makes a list of other things that Organigram has done recently to get additional market penetration. The first thing is that Organigram has the lowest price per gram product with its SHRED line. They also introduced another value offering, their Buds line, a single-strain dried flower offering. Secondly, in August, they announced three new high THC flower products, with management saying that they believe there is a largely untapped high THC flower market. He lastly points out that Organigram has released multiple SKU’s in both the beverage and edibles category.

With the price target downgrade, Canaccord has updated its full-year 2021 estimates, which you can find below. Bottomley comments on this by stating, “we have lowered our near-to-medium term revenue ramp as the company looks to better optimize its offerings.”

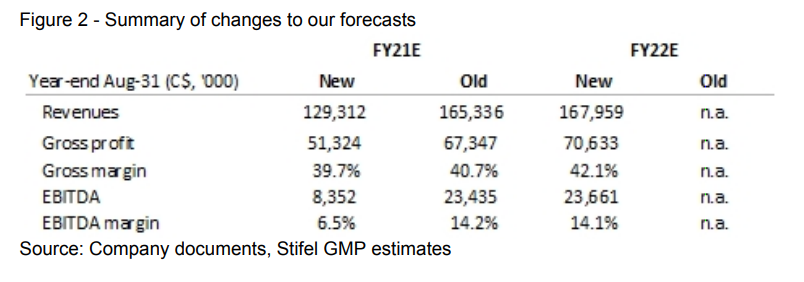

Next is Andrew Partheniou, Stifel GMP’s cannabis analyst, who has a C$1.75 price target and a hold rating. He headlines, “Early signs of refresh success; focus turns to operations,” and reiterates what Bottomley had to say about Organigram’s earnings and them being in line with expectations.

Just like Bottomley, Partheniou focuses on the 40 new SKU’s saying, “it

seems OGI’s product portfolio revamp has had some early success,” which has translated over to the recreational provincial wholesale channel.

He says that Organigrams’ “operating profile has room for improvement,” as the company is still right-sizing their operations to meet demand and are facing inefficiencies in 2.0 product manufacturing, “as well as price erosion on its vape products (~75% of Q4FY20 write-offs).”

Below you can find Andrew’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.