Organigram Holdings (TSXV: OGI) (NASDAQ: OGI) reported its third quarter results early this morning, posting net revenues of $24.75 million, down from $26.93 million in the previous quarter. The firm also posted a net loss for the first time in several quarters, with a loss of $10.18 million, which is largely a result of fair value change in biological assets.

Expenses also climbed during the quarter, with General and Administrative costs ballooning from $2.6 million to that of $4.6 million, and Sales and Marketing expenses climbing from $3.1 million to $4.4 million.

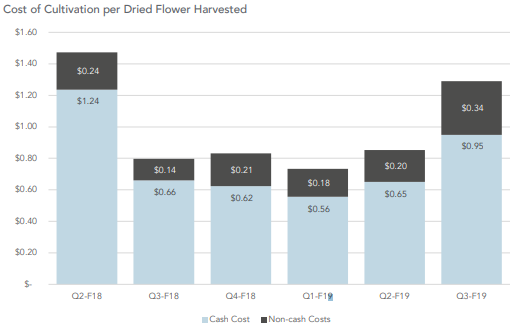

On a per gram basis, revenue per gram decreased marginally quarter over quarter, from $5.40 per gram to $5.36. Notably however, the price to produce each gram of cannabis increased significantly, from $0.85 to $1.29. The company states that this is related to a failed attempt to change its growing process, which it seemingly hasn’t been able to perfect over the five years its been in operation.

While we saw a temporary reduction in yield per plant in Q3 due to temporary changes in growing protocols, not only have our yields returned to historical levels, but we have seen a meaningful increase in average cannabinoid levels in harvests to date in Q4.

Greg Engel, Chief Executive Officer

Overall, kilograms harvested decreased 27% over the quarter, from 8,315 KG to that of 6,052 KG. Kilogram equivalents sold during the quarter saw a decrease of 7% as well, with the firm selling 4,615 KG of cannabis during the quarter. The company articulated within the corresponding press release this morning that the reduction in sales was due to the poor roll-out of retail locations across Canada, effectively transferring blame to that of provincial regulatory bodies.

However, the firm identified that orders have not been consistent from provincial distributors themselves, stating “Q3 net revenue reflected significant sales growth from Alberta and Atlantic Canada offset by the timing of shipments to Quebec that occurred subsequent to quarter-end, a large pipeline fill in Q2 2019 for Ontario in advance of opening retail stores that was not fully matched by reorders in Q3 and fewer reorders from British Columbia in Q3 (as demand for legal products remains generally under indexed in that province).”

While Organigram identified that they expected a large pipeline order yet again from Ontario as a result of fifty more stores coming online this fall, there was no mention of the recent actions by the OCS to remove cap limits on several Organigram products as a result of very slow moving product. Organigram may be able to benefit from large pipeline fill orders as new retail locations come online, but this reliance on new stores coming online identifies the major issue of consumers moving away from their product, as was demonstrated by the decrease in sales quarter over quarter.

With the decrease in product sold on a quarter over quarter basis, the firm focused heavily on the oncoming “Rec 2.0” within its news release, identifying that a significant portion of the $94 million worth of product sitting in inventory was slated for extraction for this purpose. Organigram also reaffirmed that it sees Canada as the best near term growth opportunity, despite its recently declining sales. The firm pointed to the ongoing regulation changes and more retail store openings as the reasoning for this bullishness.

Organigram Holdings is currently trading at $7.68, up $0.08 or 1.05% on the day.

Information for this briefing was found via Sedar and Organigram Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.