Organigram Holdings (TSX: OGI) saw a decline in its share price as the firm reported its Q4 and fiscal 2023 financials.

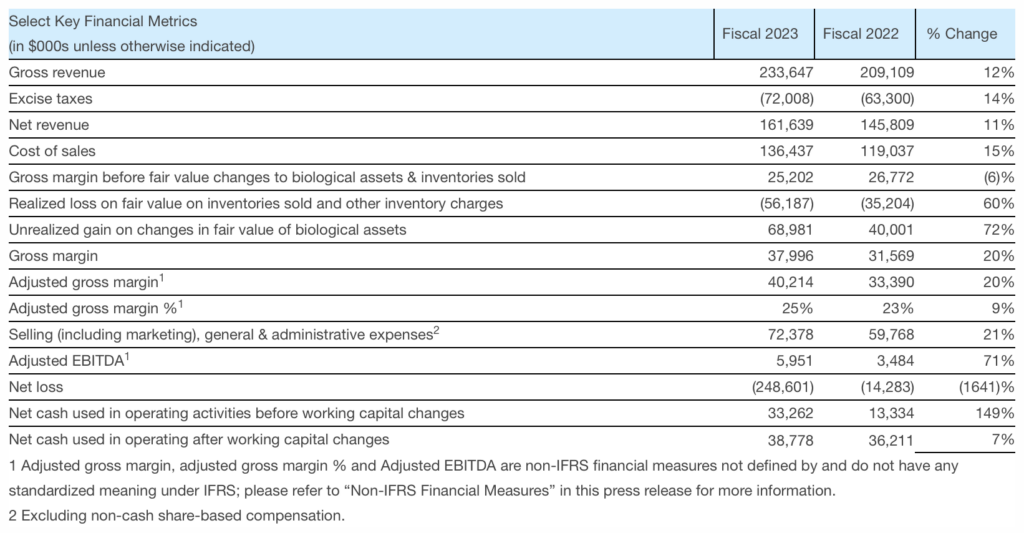

Fiscal 2023 marked a notable year-over-year net revenue increase of 11%, reaching $161.6 million. This surge was attributed to enhanced recreational and international revenue, along with an extended reporting period.

However, a dip in medical sales partially offset the overall positive trend. Despite the revenue boost, the company faced challenges reflected in a net loss of $248.6 million, compared to $14.3 million in fiscal 2022. This substantial loss was chiefly driven by impairments on property, plant, and equipment (PP&E), intangibles, and goodwill.

Adjusted EBITDA for fiscal 2023 exhibited growth however, reaching $6.0 million, an increase from $3.5 million in the previous fiscal year. Paolo De Luca, Interim Chief Financial Officer and Chief Strategy Officer, expressed satisfaction, stating, “We are pleased with our year-over-year Adjusted EBITDA growth of 71% and remain optimistic about our growth potential on the back of many successfully completed initiatives in Fiscal 2023.”

As of September 30, 2023, Organigram reported a cash and short-term investments balance of $51.8 million, down from $125.4 million in August 2022. This decrease was primarily attributed to cash utilized in operating activities amounting to $38.8 million, capital expenditures of $29.1 million, and investments of $10.5 million (including transaction costs) in Greentank and Phylos.

In November 2023, the company announced a significant follow-on investment from BAT, totaling $124.6 million. Out of this, $83.1 million is earmarked for the creation of “Jupiter,” a strategic investment pool intended to expand Organigram’s geographic footprint and capitalize on emerging international growth opportunities. The remaining $41.5 million is designated for general corporate purposes, pending shareholder approval.

Breaking down the quarterly performance, Q4 2023 also saw a 1% increase in net revenue to $46.0 million, compared to $45.5 million in the same period last year.

However, net losses also expanded to $33.0 million from $6.1 million in the previous year. Factors contributing to this increase included impairments on PP&E and goodwill, heightened cost of sales, and increased operating expenses. Adjusted EBITDA for Q4 2023 was reported at $(2.4) million, down from $3.2 million in the same quarter of the previous fiscal year.

Looking ahead to 2024, Beena Goldenberg, Chief Executive Officer, anticipates improved margins. Goldenberg stated, “In Fiscal 2024, we expect improved margins from efficiencies tied to our completed facility upgrades and growth in higher margin categories such as craft flower and vapes, while the $124.6 million financial commitment from BAT expedites our plans for international growth.” Positive free cash flow is now expected to be delayed until the second half of fiscal 2024, which is a delay from a prior forecast of being achievable in calendar 2023.

Organigram Holdings last traded at $1.75 on the TSX.

Information for this briefing was found via Sedar and Organigram Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.