Osisko Development Corp (TSXV: ODV) has optimized a feasibility study initially released in January 2023 for their Cariboo Gold project in British Columbia.

The optimized study has seen the project increase its net present value to $943 million, while the IRR has moved to 22.1% on an after-tax basis, while the payback period has nearly halved to just 2.8 years, which is based on $2,400 gold and a 5% discount rate. That NPV is said to rise to $2.1 billion, while the IRR jumps to 38.0% and the payback period is cut to 1.6 years at $3,300 an ounce gold.

Under the prior model, which was conducted at $1,700 an ounce gold, the after-tax NPV was pegged at $502 million, with an IRR of 20.7% and a payback period 5.9 years.

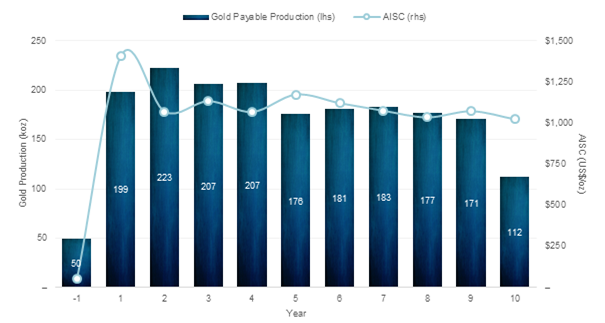

The optimized study is based on an underground mine plan that would see annual production of 190,000 ounce of gold over a ten year mine life, with Cariboo to average 202,000 ounces of production over the first years. The plan calls for a single phase of construction that would enable nameplate capacity of 4,900 tonnes per day.

Initial capital costs are estimated at $881 million, while sustaining capital is estimated at $525 million over the life of mine. Gold production under the study is estimated to have total cash costs of US$947 an ounce, with an all in sustaining cost of $1,157 an ounce, figures which would place the mine in the lower half of the global cost curve for gold mines.

Under the prior model, Cariboo was expected to average 163,695 ounces of production a year over a 12 year mine life, at cash costs of US$792 an ounce and all in sustaining costs of US$968 an ounce. Initial capital costs were estimated at $137.3 million for the first phase of construction, while phase two would require a further $451.1 million in capex. Sustaining capital meanwhile was pegged at $466.6 million over the life of mine.

The Cariboo Mine, under the revised feasibility study, is expected to take two years to construct, with first gold anticipated in the second half of 2027, provided Osisko is able to commence construction in the third quarter of this year. Osisko says that however is subject to ongoing project financing discussions.

“The results reaffirm our view that Cariboo is a high-quality asset with robust returns and significant upside potential within the existing mine plan. Our immediate focus remains on advancing project financing and further de-risking the project toward FID, but, we believe additional work could support potential future production increases within the planned mine footprint. Additionally, our extensive land position around the Project area offers numerous opportunities for new discoveries in this prolific gold belt,” commented Sean Roosen, CEO of Osisko Development Corp.

Osisko Development Corp last traded at $2.29 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.