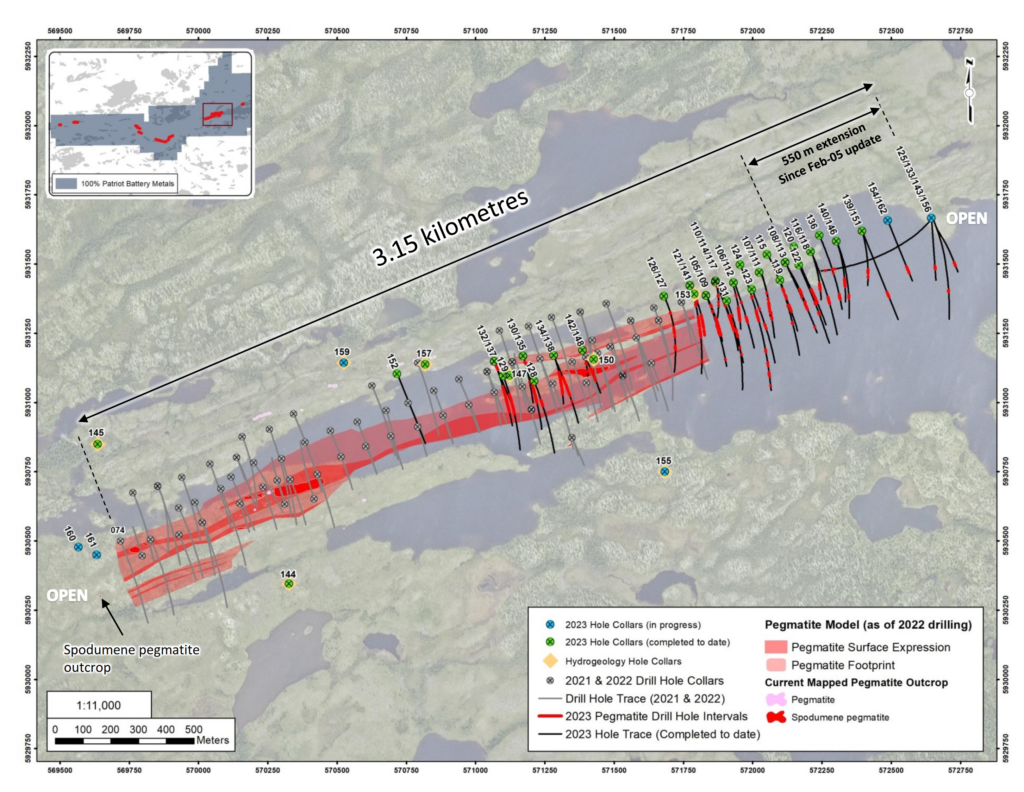

Patriot Battery Metals (TSXV: PMET) has again extended the strike length of the CV5 spodumene pegmatite following further exploration at its flagship Corvette property.

The pegmatite is said to now have been traced over a lateral distance of at least 3.15 kilometres, “drill hole to drill hole.” The target remains open along strike at both ends, as well as at depth. The length represents an increase of 550 metres since the firms last update.

To the east, the pegmatite is now just 1.5 kilometres from the CV4 pegmatite cluster, while drilling is now said to be focused on stepping out to the west towards CV13, which is 4.3 kilometres away currently. Six core drill rigs are said to currently be active at CV5 testing both ends of the pegmatite, while a seventh is presently focused on testing a potential infrastructure location, in support of a pre-feasibility study.

Ice-based drilling is also said to have recently begun, targeting the eastern extension of CV5.

The body of the pegmatite meanwhile is said to range from 25 metres to 120 metres in thickness, with ranges of “80+ metres at moderate depth.”

“There remains more than 20 km of geologically favourable trend to be explored for new pegmatite targets and three known spodumene pegmatite clusters yet to be drill tested. The ongoing advancement of the CV5 Pegmatite to an initial mineral resource estimate and subsequent Pre-Feasibility underway is expected to continue to de-risk the CV5 project area,” commented Blair Way, CEO of Patriot.

To date, 52 drill holes are said to have been completed with seven currently in progress, for an aggregate 21,780 metres. 37 holes are said to currently be awaiting assays.

Patriot Battery Metals last traded at $10.77 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.