The Parliamentary Budget Officer’s new report pegs Build Canada Homes at $7.3 billion in accrual spending over 2025-26 to 2029-30, translating into about 25,713 units, while total federal planned spending on housing programs is set to fall 56% from $9.8 billion in 2025-26 to $4.3 billion in 2028-29.

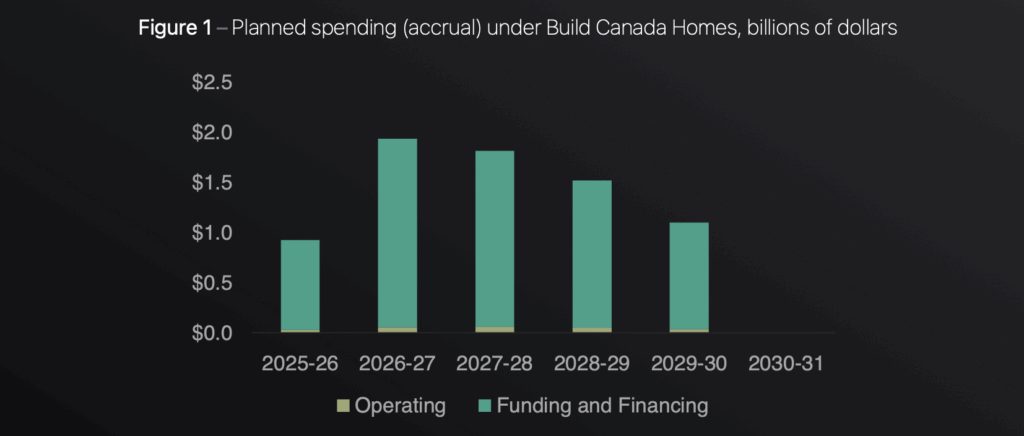

On an accrual basis, the $7.3 billion totals $6.7 billion in new spending and splits into $219 million of operating costs and $7.1 billion of “Funding and Financing.”

The report also describes the planned spending envelope over 2025-26 to 2030-31 in one section while consistently analyzing the five-year 2025-26 to 2029-30 window for unit outcomes, a framing mismatch worth noting because the unit estimate is explicitly five-year.

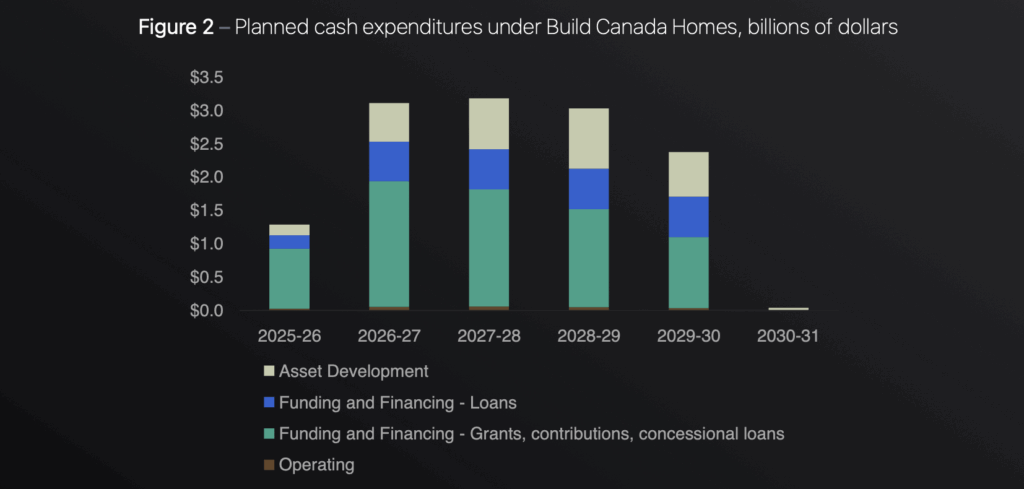

On a cash basis, the planned expenditures rise to $13.0 billion, including $2.6 billion in loans and $3.1 billion for asset development, with $11.6 billion characterized as new cash expenditures. The PBO also flags that the spending profile may not capture forgone revenues from diverting surplus federal properties from sale or interest costs tied to acquiring and developing federal properties.

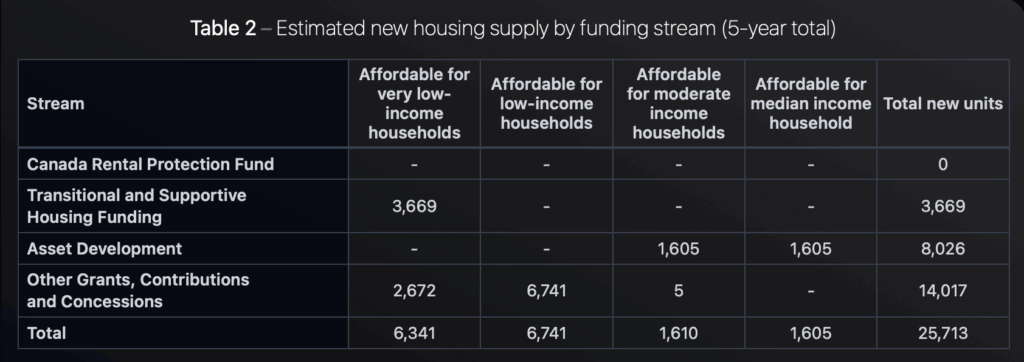

Within “Funding and Financing,” the program includes $625 million for the Canada Rental Protection Fund, $1.0 billion for transitional and supportive housing, and $5.4 billion in other grants, contributions, and loan concessions for affordable housing supply. The PBO is explicit that CRPF is not intended to increase supply.

Beyond the program, the PBO highlights scheduled expiries across CMHC responsibilities and additional CMHC Housing Programs cuts of $2.4 billion across 2026-27 to 2029-30 plus $860 million per year thereafter.

For supply, the PBO estimates this will add approximately 26,000 units over five years, or a 2.1% lift in housing completions versus its August 2025 baseline forecast, addressing 3.7% of its estimated 2035 housing gap of 690,000 units.

It also estimates Build Canada Homes has sufficient funding to create about 13,000 units affordable for low-income households.

By affordability tier, this allocates 6,341 units affordable for very low-income households, 6,741 for low-income households, 1,610 for moderate-income households, and 1,605 for median-income households.

For transitional and supportive housing, the PBO uses CMHC Rapid Housing Initiative Phase 2 as a cost anchor at $272,579 per unit, implying $1.0 billion would fund the 3,669-unit estimate.

For asset development, the report underscores that despite public references to a $13 billion “capitalization,” only the $3.1 billion allocated for asset development creates federally owned capital assets; loans create a corresponding debt owed to the Government of Canada, and any investment return depends on rental revenues versus expenses at those properties.

New PBO report out today, that finds that in the first 5 years of the Build Canada Homes program, it's will have $7.3 billion of spending on an accrual basis ($13 billion on a cash basis) and lead to fewer than 26,000 homes being built.

— Dr. Mike P. Moffatt 🇨🇦🏅🏅 (@MikePMoffatt) December 2, 2025

Read here: https://t.co/wlc14q0OYq pic.twitter.com/FE1HoDfPUH

BCH’s own direct development model is described as 60% of units at market rents, 20% at rents “affordable” for median household income, and 20% at rents “a little deeper,” operationalized as moderate-income affordability. The PBO’s illustrative application to a 2021 two-bedroom unit puts “median-income affordable” rent at $2,168 per month and “moderate-income affordable” rent at $1,626 versus a 2021 national median market rent of $1,100, or 97% and 48% higher, respectively.

Information for this story was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.