On February 14, the U.S. and Australia-based coal mining company, Peabody Energy Corporation (NYSE: BTU), reported robust fourth quarter 2022 earnings. The company reported 4Q 2022 revenue and EPS from continuing operations of US$1.63 billion and US$3.89, up from US$1.34 billion and US$2.34, respectively, in 3Q 2022.

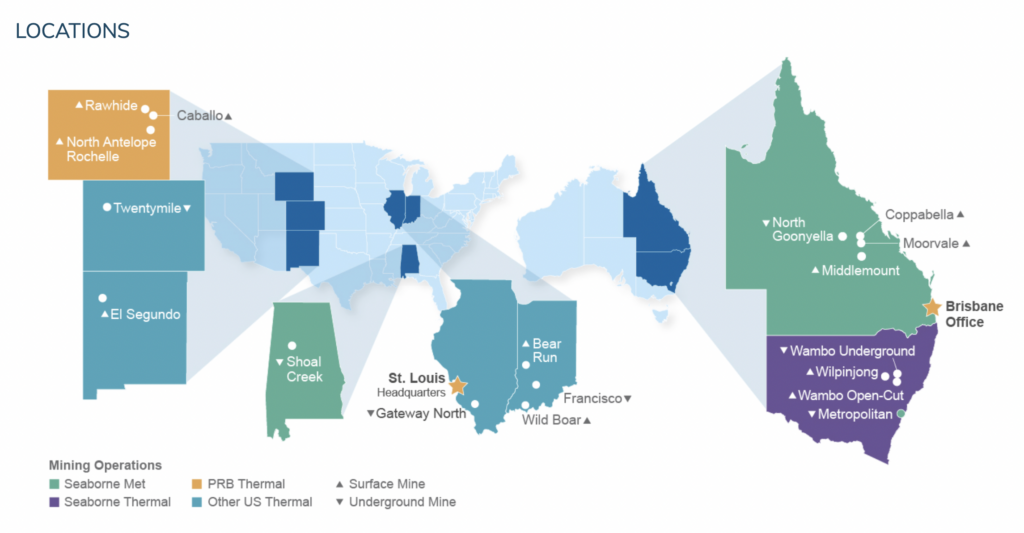

Peabody’s principal business is exporting: 1) thermal coal it mines in southeastern eastern Australia; and 2) metallurgical, or steelmaking, coal it mines in northeastern Australia and in the U.S. state of Alabama. As such, it benefitted in 2022 from European countries’ turning toward thermal coal to produce electric power to replace Russian natural gas.

Seaborne metallurgical coal pricing was strong throughout 2022 (average revenue per ton of US$244 versus US$132 in 2021). Met coal pricing is linked closely to the strength of the global economy so if a soft landing can be achieved, and if China’s economy does successfully reopen in 2023, metallurgical coal prices could remain high this year.

Investors as a group seem to anticipate that coal utilization in Europe will decrease quite significantly in 2023 and 2024 and that the global economy will stumble. As a result, Peabody stock trades at an extremely sharp discount to the overall market on almost all metrics.

More specifically, the company generated about US$500 million in adjusted EBITDA in 4Q 2022 and US$1.85 billion in the full-year 2022. Peabody’s enterprise value (EV) is around US$3.7 billion after factoring in its net cash position of nearly US$1 billion. Peabody therefore trades at an EV-to-2022 adjusted EBITDA ratio of only around 2x. Many stocks trade at 8x-10x EBITDA ratios.

PEABODY ENERGY CORPORATION

| (in millions, except per share data) | Full-Year 2022 | 4Q 2022 | 3Q 2022 | 2Q 2022 | 1Q 2022 |

| Revenue | $4,982 | $1,626 | $1,343 | $1,322 | $691 |

| Net Income – Continuing Operations | $1,317 | $642 | $384 | $411 | ($120) |

| Adjusted EBITDA | $1,845 | $501 | $439 | $578 | $328 |

| Operating Cash Flow | $1,174 | $670 | $495 | $281 | ($274) |

| Free Cash Flow | $1,145 | $580 | $461 | $342 | ($239) |

| Cash – Period End | $1,307 | $1,307 | $1,355 | $1,121 | $823 |

| Debt – Period End | $345 | $345 | $883 | $1,071 | $1,123 |

| EPS – Continuing Operations | $8.29 | $3.89 | $2.34 | $2.55 | ($0.87) |

| Weighted Average Shares Outstanding (Millions) | 157.2 | 161.9 | 161.9 | 161.9 | 136.2 |

Valuing Peabody on a P/E multiple approach leads to a similar conclusion. If one annualizes 4Q 2022 EPS from continuing operations of US$3.89, the company’s implied P/E multiple is less than 2x, a ~90% discount to the P/E ratio of the S&P 500 Index.

Clearly, given the heavy cyclical nature of Peabody’s business, the stock deserves to trade at a marked discount to the typical stock, but the degree of the current differential appears too large. Furthermore, Peabody noted in its 4Q 2022 earnings release that it is “actively addressing the remaining requirements to implement a shareholder return program,” so a dividend and/or share buyback program may be initiated soon.

As we mentioned at Investor Day, any shareholder return program that we’re looking at is certainly going to be proportional to free cash flow and it’s going to be flexible to return cash to shareholders through both buybacks and dividends.

CFO Mark Spurbeck on the 4Q earnings call

Given all this, investors who believe the global economy will land softly this year (or not experience a downturn at all) may consider the shares of Peabody. The stock is down about 10% from its late November 2022 highs, but up around 12% so far in 2023.

Peabody Energy Corporation last traded at US$28.21 on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.