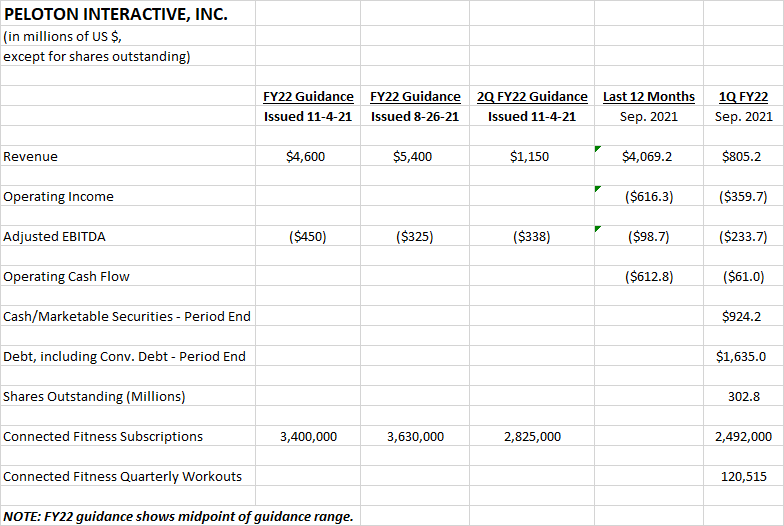

On November 4, Peloton Interactive, Inc. (NASDAQ: PTON), a leading seller of fitness equipment and one of the most popular stay-at-home stock plays during the COVID-19 pandemic, reported 1Q FY2022 (quarter ended September 30, 2021) earnings. At the same time, the firm slashed its guidance for the fiscal year ending June 30, 2022.

The company now expects full year FY 2022 revenue of US$4.4 to US$4.8 billion, down markedly from the US$5.4 billion forecast it endorsed just over two months ago. In tandem, the company increased its FY 2022 EBITDA loss projection to $425-$475 million from US$325 million.

In a nutshell, the company is acknowledging that people are venturing out as the pandemic is receding and not simply staying home. During pandemic-required isolation, working out with Peloton was perhaps a very welcome diversion. Now people have more options, including more fitness options, for how to spend their time.

Peloton’s own statistics seem to demonstrate this: the number of Peloton Connected Fitness quarterly workouts fell nearly 20% to 120,515 in the quarter ended September 30, 2021 from the period ended March 31, 2021.

In addition, Peloton faces increasing competition from fitness centers which seem safer to attend, as well as a variety of exercise equipment manufacturers. To name just as few, Bowflex, NordicTrack, SoulCycle, and Echelon manufacture high-quality equipment and have well-known brand names.

Peloton stock is trading down around 35% to US$55.70 from its US$86 close on November 4. At its current price, Peloton’s enterprise value (EV) is around US$19 billion. With its “luster” now dimmed, determining the company’s fair value is challenging.

For example, Peloton’s EV equates to about 4x its projected FY 2022 revenues. During prior periods, and before the November 4 guidance cut, that multiple would seem attractive. However, if the company were to meet the US$4.6 billion midpoint of its full year FY 2022 revenue, that would imply only 13% revenue growth from the US$4.069 billion revenue realized over the 12 months ended September 30, 2021. Attaching a 4x revenue multiple to such a diminished growth rate may be too high of a figure.

Equally difficult is predicting how the stock market will value (tolerate?) the company’s projected cash flow deficits now that growth is slowing. Peloton’s adjusted EBITDA loss is US$98.7 million for the twelve months ended September 30, 2021. This shortfall is now expected to be 4.5 times this figure in the twelve-month period ending June 30, 2022.

It is of course possible that investors will in time decide that Peloton’s growth slowdown will be short term in nature and that the company deserves to trade nearer to prior, more buoyant valuation multiples. Also, about 12% of the company’s float was shorted as of October 15, 2021 (according to Yahoo Finance). It is possible that the Reddit-inspired investors could decide that Peloton is a meme stock.

Peloton’s sharp revenue and EBITDA guidance resets could mark a transition in how the company is valued — from a high-growth name where losses are largely ignored, to a situation where more conventional measures are employed to value the stock. If such a transition has indeed occurred, Peloton shares could have more downside risk.

Peloton Interactive, Inc. last traded at US$55.70 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.