PharmaTher Holdings (CSE: PHRM) had its first initiation report that came out on June 28th. Maxim Group initiated coverage on PharmaTher with a U$1.50 price target and a buy rating. Their analyst Jason McCarthy says that the company is “A multi-pronged approach to targeting the psychedelics space.”

PharmaTher is a company that is trying to use ketamine to treat different mental health and neurodegenerative disorders. Additionally, they are combining ketamine with another substance, Betaine, as a specific treatment for depression. McCarthy says ketamine has the potential to be repurposed for Parkinson’s disease. In preclinical and human case studies, ketamine played a dual therapeutic role by treating depression, which occurs in 50% of patients.”

Below you can see PharmaTher’s pipeline.

The company has a few catalysts coming in the next 9 months. The company will start its Phase 2 study to see how ketamine affects Parkinson’s Disease in the third quarter. That will be followed by the readout in the fourth quarter of this year.

During the fourth quarter, the company will also start its Phase 2 study to see how KETABET affects Depression. McCarthy expects the interim data readout will happen during the same quarter. The last catalyst they believe will come is the topline readout of the KETABET study, which is expected to happen in the first quarter of 2022.

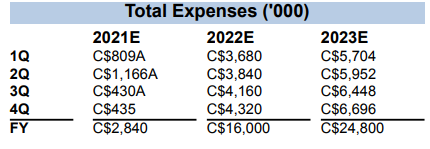

Below you can see PharmaTher expected expenses for 2021 to 2023. McCarthy believes that the expenses will grow due to them initiating Phase 2 studies. He writes that PharmaTher “will likely need multiple equity financings over time to support operations.”

McCarthy concludes the note by state that the company has de-risked its pipeline as a result of targeting the psychedelics space from multiple angles. He comments that future catalysts exist as well, as the firm has two compounds entering phase two studies, with further studies on a microneedle tech platform slated to occur as well.

FULL DISCLOSURE: Pharmather is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Pharmather on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.