Earlier this month PI Financial came out with their post-second-quarter U.S cannabis update, in which they say, “Second quarter earnings are now in the rear-view mirror we are able to reflect on themes and trends in the US cannabis sector.”

They say that generally, the sector showcased strong earnings and fundamentals during the second quarter relative to the first quarter results, but comment that even with the positive fundamentals, “cannabis stocks are out of favor which has led to all-time low valuations,” believing that these stocks will need “some legislative breakthroughs to fully realize the full gain.”

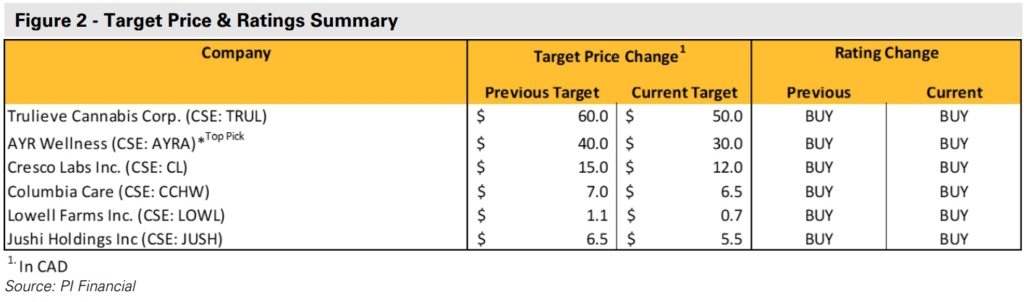

With all this in mind and the multiple compression that these stocks have seen over the past quarter, PI Financial has lowered every cannabis company price target that they cover. Though they believe that this is a good time to “accumulate positions in several US MSOs, particularly larger names with established operations, larger balance sheets with a strong presence in high-growth markets.”

Once again, PI Financial names Ayr Wellness (CSE: AYR.A) as their top U.S cannabis pick, saying that the company is well positioned in high-growth states “has industry-leading operating metrics,” and has recently finished its buildouts that are expected to help the company get their growth back on track.

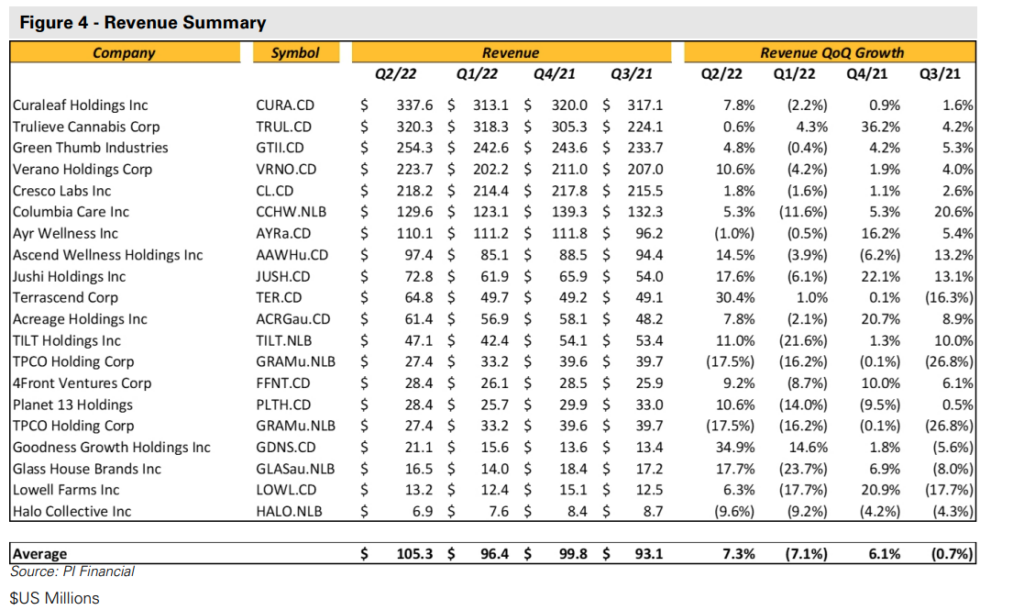

The average revenue growth was 7.3% this quarter, compared to a decline of 7.1% last quarter. PI Financial attributes the growth this quarter almost entirely to seasonality and “a strong uptick in performance in the retail segments of US MSOs.” They believe that the MSOs will be able to continue this trend into the second half of the year.

For gross margins, on average, the group saw a decline of 0.4% in margins, which is the complete opposite of last quarter, which saw margins expand by 6.5%. PI Financial attributes a lot of the decline to supply chain and inflationary issues alongside state-specific price compression. They say that eight companies saw an increase in gross margins while 11 companies saw a decrease in gross margins.

Another item PI Financial tracked was companies’ share-based compensation, both in dollar amounts and as a percent of revenue. They say that although the dollar amount of share-based compensation rose to US$4.6 million from US$4.4 million, the percentage of revenue decreased by 0.4% to 12.4%.

They say that as these companies are still in cash preservation mode, the usage of share-based compensation as a replacement for cash payments might start to rise, creating dilution concerns.

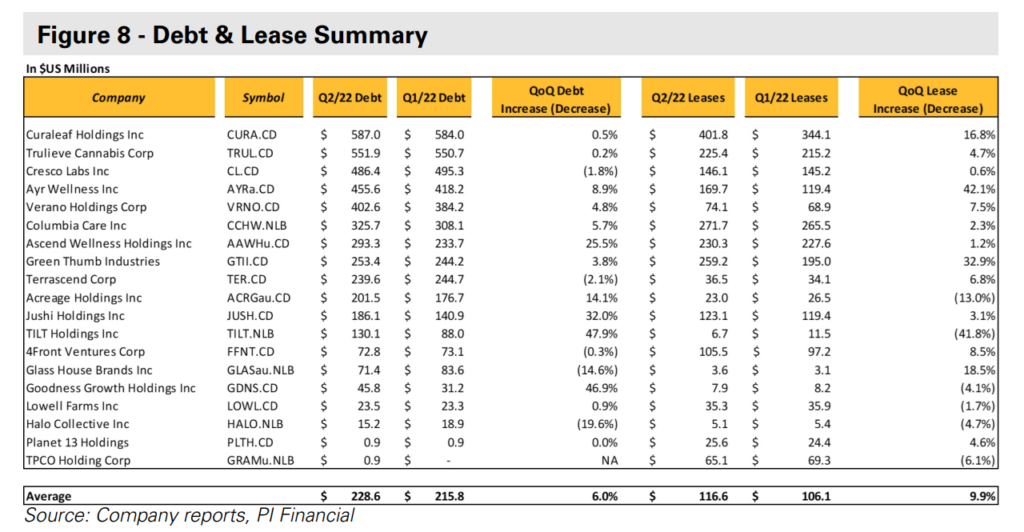

PI Financial has been keeping track of both debt levels and ratios. For total debt, companies on average, saw an increase of 6% sequentially, with Curaleaf continuing to be the company with the highest amount of debt on their balance sheet. PI adds that one of the biggest developments in the cannabis industry has been the increased access to capital with continually improved rates and longer maturity dates.

On the debt leverage ratios, which they use Debt to Trailing EBITDA, they note that five companies have negative ratios and ten have debt ratios below 5x.

Lastly, PI ends the note by saying that the sector is undervalued, with fundamentals improving. They believe that the U.S midterms could present “a catalyst to the legalization process but only if the Senate remains in the Democratic party’s control,” noting that the House of Representatives is likely to flip red, “which is not positive for a cannabis perspective.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.