An important gauge of investor perception of the EV industry is scheduled to play out over the next few weeks. On June 22, Gores Guggenheim, Inc. (NASDAQ: GGPI) shareholders are scheduled to vote on the SPAC sponsor’s proposed acquisition of the highly-regarded Swedish EV manufacturer Polestar. Presuming GGPI shareholders vote to approve the combination, the merger should close quickly and Polestar will likely begin trading on the NASDAQ before the end of the month.

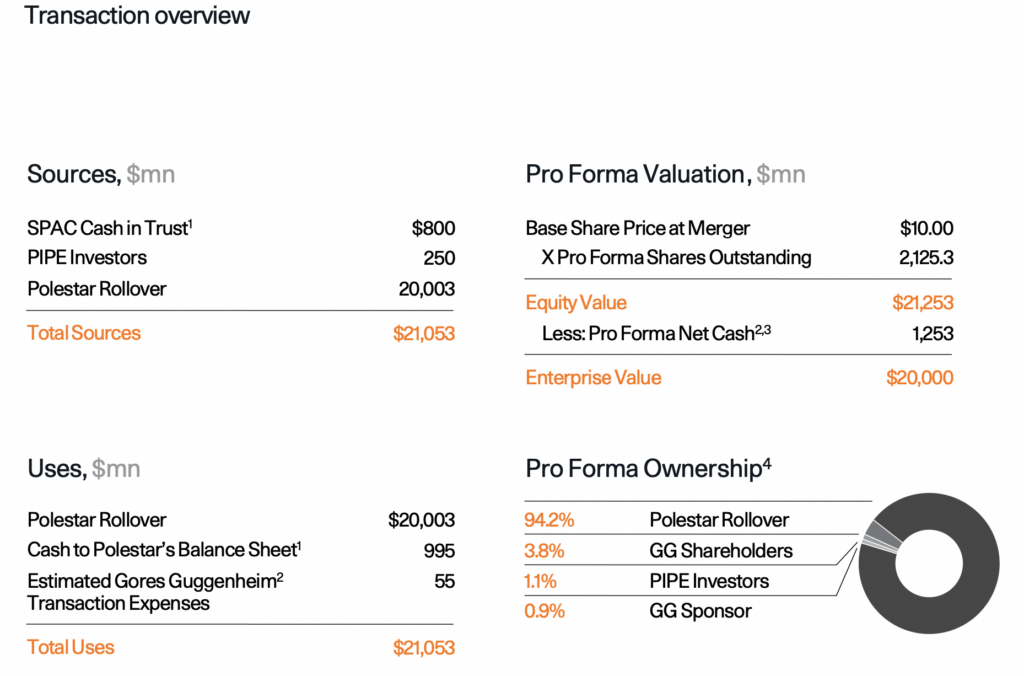

GGPI and Polestar announced they had entered into a definitive business combination in late September 2021 that would create an entity with an enterprise value of around US$20 billion.

If the new Polestar stock, which appears to be more inexpensively valued than Lucid Group, Inc. (NASDAQ: LCID), and more richly valued than Rivian Automotive, Inc. (NASDAQ: RIVN) based on GGPI’s current stock price and projected 2023 revenue, were to trade well, that could boost investor sentiment and confidence in Lucid and Rivian, and perhaps even in smaller start-up OEMs like Fisker Inc. (NYSE: FSR) and Canoo Inc. (NASDAQ: GOEV). Conversely, a less constructive early trading pattern for Polestar could suggest a continuation of a difficult trading environment for all EV stocks.

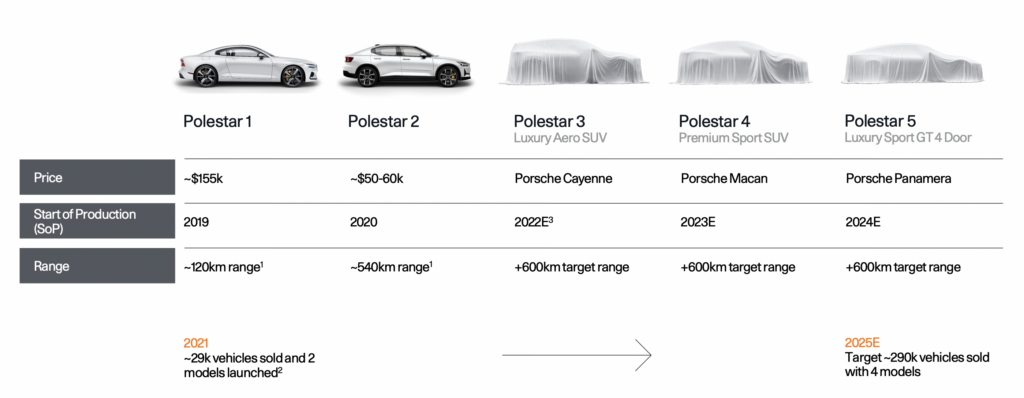

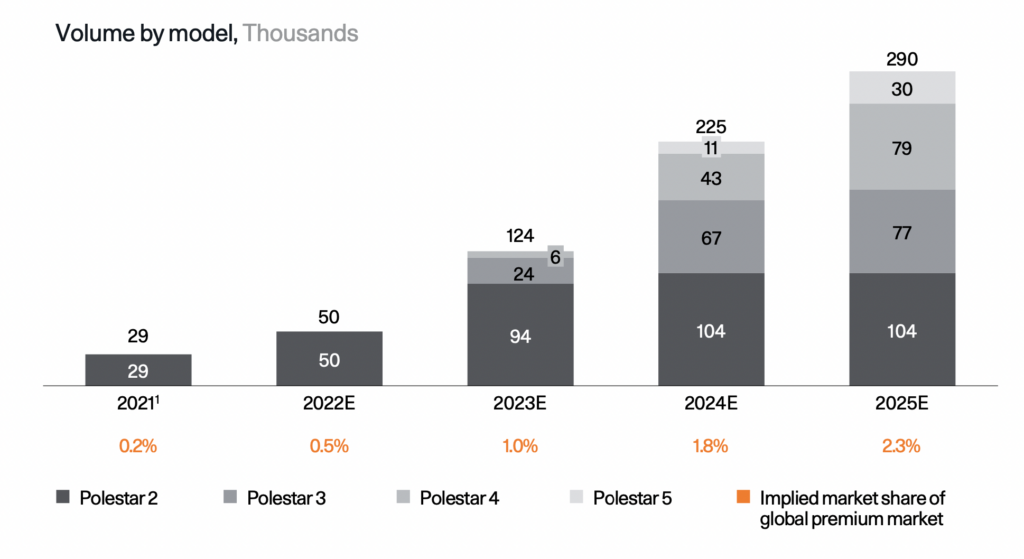

Polestar is a more advanced EV manufacturer than Lucid and Rivian were when they began trading publicly — or even are today. Polestar sold 29,000 and 10,000 units of its flagship Polestar 2 sedan in 2021 and 2020, respectively. Its high-priced Polestar 1 sports car is produced in limited quantities. To date, Lucid and Rivian have manufactured only around 485 and 5,000 vehicles, respectively.

In early April, Polestar reached an agreement with Hertz whereby the rental car company would purchase up to 65,000 Polestar 2 vehicles over a five-year period. No dollar amount of the contract was released, but at a sticker price of US$50,000-US$60,000 per vehicle, the deal could be valued at US$3.25-US$3.9 billion. In early June, Polestar began delivering the vehicles to Hertz. Hertz plans to make the cars available to European customers almost immediately, and to North American and Australian customers beginning in late 2022.

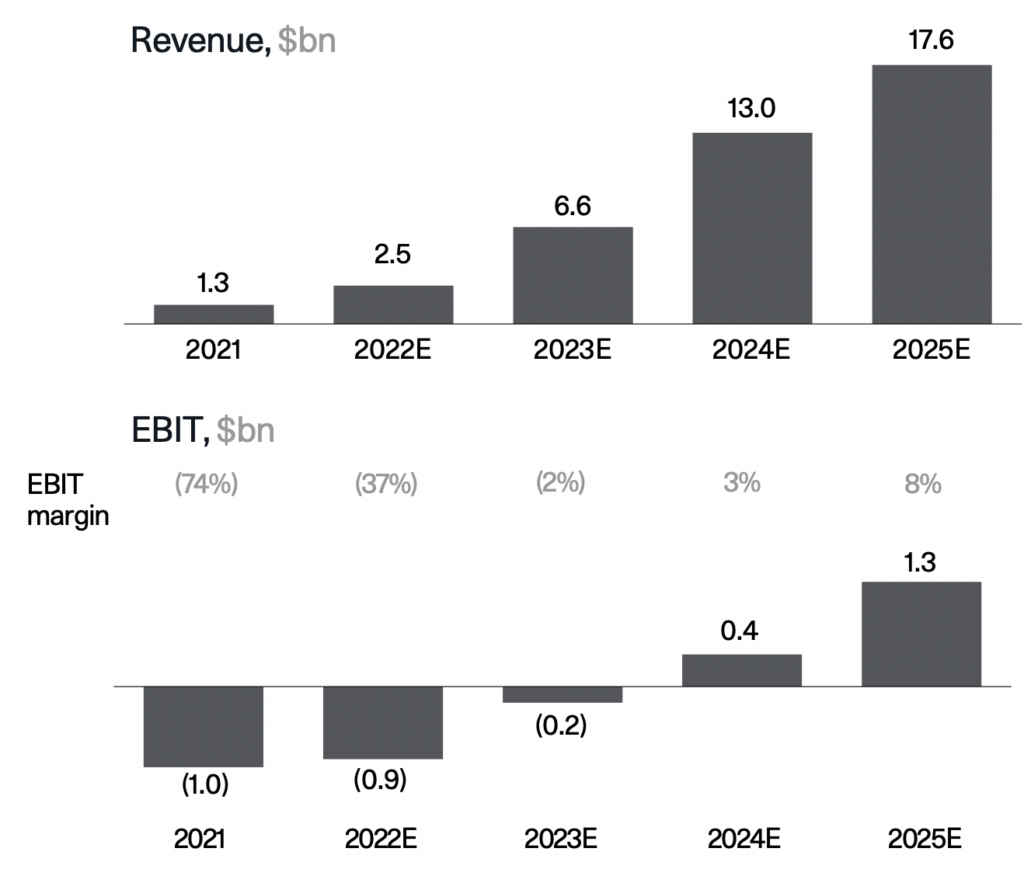

As was the case with virtually all prior EV SPAC transactions, Polestar expects substantial growth in vehicle sales and revenue over the next few years, as well as a rapid turn from EBIT losses to profits.

In particular, Polestar would trade at an enterprise value-to-projected 2023 revenue of just over 3x. (Note this revenue estimate reflects the company’s own projections.) According to analysts’ consensus 2023 estimates, Lucid and Rivian trade at revenue multiples of 7.0x and 1.3x, respectively.

The transaction with Polestar is currently expected to close on Thursday.

Gores Guggenheim, Inc. last traded at US$9.98 on the NASDAQ.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.