On the 31st, PopReach Corporation (TSXV: POPR) reported its first-quarter financial results. The company had revenue of $4 million, which was basically flat quarter over quarter and down on a year over year basis. Gross margins of 62% were reported, which were basically flat quarter over quarter. The company reported a positive net income of $2.16 million and an adjusted EBITDA of $0.9 million.

Surprisingly, the company has 4 analysts who cover the name with a weighted 12-month price target of $1.61, or an ~121 upside. Two analysts have strong buy ratings while the other two have buy ratings. The street high comes from Echelon Wealth with a $2 price target while the lowest price target sits at $1.20.

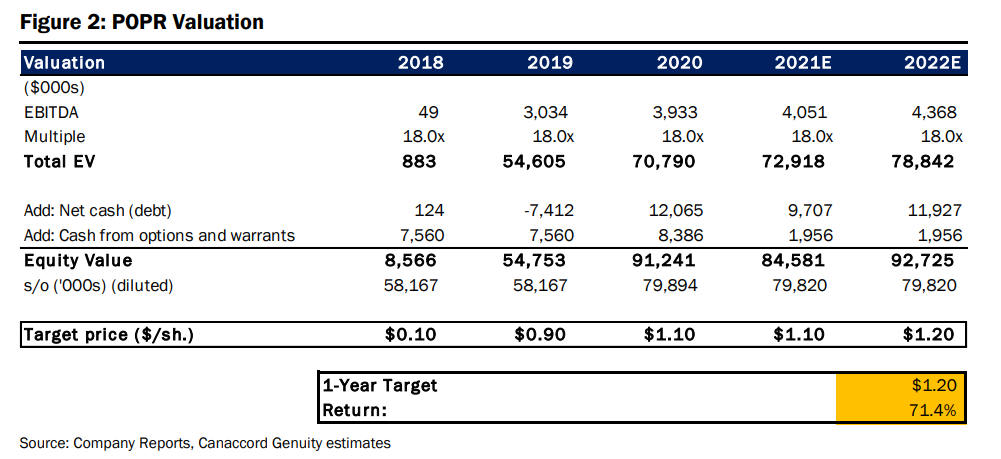

Canaccord reiterated their buy rating but slightly lowered their 12-month price target to $1.20, their analyst Aravinda Galappatthige says that the first-quarter results were a bit lighter than expected. He says that the first-quarter results were mainly impacted by the transition on the Facebook platform. Flash, a very popular way to make browser games, stopped being supported by Adobe, which is an industry-wide issue and not specifically a PopReach issue.

Canaccord’s top-line estimate was $4.4 million and their adjusted EBITDA estimate was $0.07 million. Galappatthige adds that many of the company’s metrics were down, most importantly In-App purchases were down 11.5% year over year. He writes, “we note that PopReach mainly focuses on the Apple, Google, and Amazon platforms for its growth, with the FB exposure arising largely due to a prior acquisition in late 2018.” They believe that PopReach will continue its M&A spree as it currently has $14.7 million in cash.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.