Power Nickel (TSXV: PNPN) is set to expand its drill program at its Nisk project following the closing of a financing earlier this week. The financing, which consisted of both flow through and non-flow through units, raised gross proceeds of $4.2 million for the company.

In terms of the drill program, the flow through offering will enable the company to expand its planned drill program from 5,000 metres in aggregate to between 7,500 and 10,000 metres.

“With the new financing we have expanded our drill program and now plan to keep drilling through mid-December and start up again in Mid January. We had planned to drill 5000 meters and will now add an additional 7500 to 10,000 meters as we continue to like what we see with our drilling program,” commented CEO Terry Lynch.

Assay results are expected to begin being released next week from the drill program, with further results to be released roughly every two weeks through to the end of February.

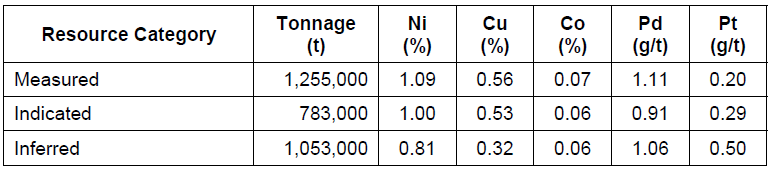

The drill results from the current program are expected to be combined with the drill program conducted in late 2021, an oncoming metallurgical study, and historical results to establish a resource estimate for the property, which is currently slated to be released in the second quarter of 2023. The project currently has a historical resource at the Nisk-1 deposit consisting of 1,255,000 tonnes in the measured category of 1.09% nickel, 0.56% copper, 0.07% cobalt, 1.11 g/t palladium and 0.20 g/t platinum. Indicated historical resources sit at 783,000 tonnes of 1.00% nickel, 0.53% copper, 0.06% cobalt, 0.91 g/t palladium and 0.29 g/t platinum, while inferred historical resources amounted to 1,053,000 tonnes of 0.81% nickel, 0.32% copper, 0.06% cobalt, 1.06 g/t palladium and 0.50 g/t platinum.

A total of 13.75 million flow through units were sold under the offering at a price of $0.20 per unit, with each unit containing one common share and one common share purchase warrant. Non flow through units meanwhile were sold at $0.10 per each, and contained one common share and one common share purchase warrant, with 14.4 million such warrants sold.

Warrants under the offering contain an exercise price of $0.20 per common share and are valid for a period of five years. Warrants also have an acceleration clause if the equity trades at or above $0.40 for ten consecutive days.

Proceeds from the flow through offering will be used for exploration, while proceeds from the non flow through offering will be used to settle an outstanding debt, as well as for general administrative and working capital purposes.

Power Nickel last traded at $0.17 on the TSX Venture.

FULL DISCLOSURE: Power Nickel is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Power Nickel on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.